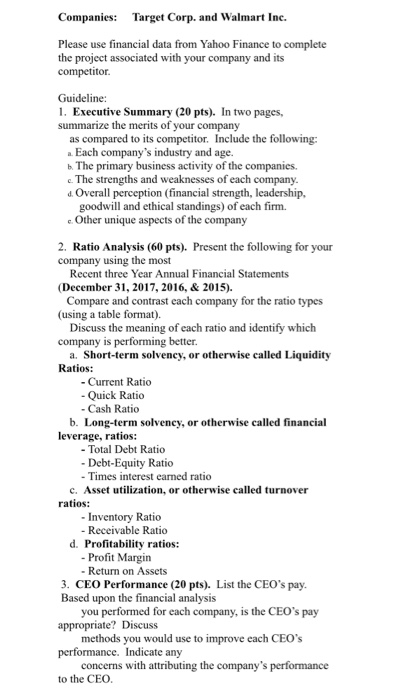

Companis Target Corp. and Walmart Inc. Please use financial data from Yahoo Finance to complete the project associated with your company and its competitor. Guideline: 1. Executive Summary (20 pts). In two pages summarize the merits of your company as compared to its competitor. Include the following: a Each company's industry and age. b. The primary business activity of the companies. c The strengths and weaknesses of each company d. Overall perception (financial strength, leadership, each firm. goodwill and ethical standings) of e. Other unique aspects of the company 2. Ratio Analysis (60 pts). Present the following for your company using the most Recent three Year Annual Financial Statements December 31, 2017, 2016, & 2015). Compare and contrast each company for the ratio types (using a table format). Discuss the meaning of each ratio and identify which company is performing better a. Short-term solveney, or otherwise called Liquidity Ratios: - Current Ratio -Quick Ratio Cash Ratio leverage. ratiom solvengy, or otherwise called financial leverage, ratios: - Total Debt Ratio - Debt-Equity Ratio - Times interest earned ratio c. Asset utilization, or otherwise called turnover ratios: Inventory Ratio - Receivable Ratio d. Profitability ratios: - Profit Margin Return on Assets 3. CEO Performance (20 pts). List the CEO's pay. Based upon the financial analysis you performed for each company, is the CEO's pay methods you would use to improve each CEO's concerns with attributing the company's performance appropriate? Discuss performance. Indicate any to the CEO Companis Target Corp. and Walmart Inc. Please use financial data from Yahoo Finance to complete the project associated with your company and its competitor. Guideline: 1. Executive Summary (20 pts). In two pages summarize the merits of your company as compared to its competitor. Include the following: a Each company's industry and age. b. The primary business activity of the companies. c The strengths and weaknesses of each company d. Overall perception (financial strength, leadership, each firm. goodwill and ethical standings) of e. Other unique aspects of the company 2. Ratio Analysis (60 pts). Present the following for your company using the most Recent three Year Annual Financial Statements December 31, 2017, 2016, & 2015). Compare and contrast each company for the ratio types (using a table format). Discuss the meaning of each ratio and identify which company is performing better a. Short-term solveney, or otherwise called Liquidity Ratios: - Current Ratio -Quick Ratio Cash Ratio leverage. ratiom solvengy, or otherwise called financial leverage, ratios: - Total Debt Ratio - Debt-Equity Ratio - Times interest earned ratio c. Asset utilization, or otherwise called turnover ratios: Inventory Ratio - Receivable Ratio d. Profitability ratios: - Profit Margin Return on Assets 3. CEO Performance (20 pts). List the CEO's pay. Based upon the financial analysis you performed for each company, is the CEO's pay methods you would use to improve each CEO's concerns with attributing the company's performance appropriate? Discuss performance. Indicate any to the CEO