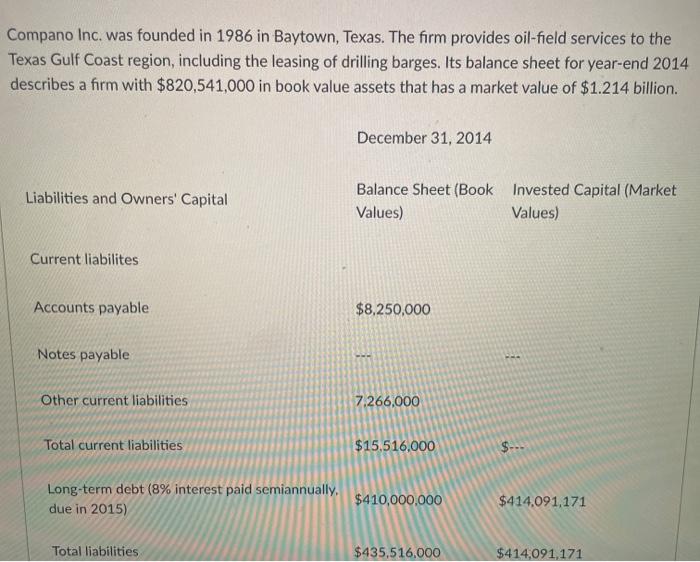

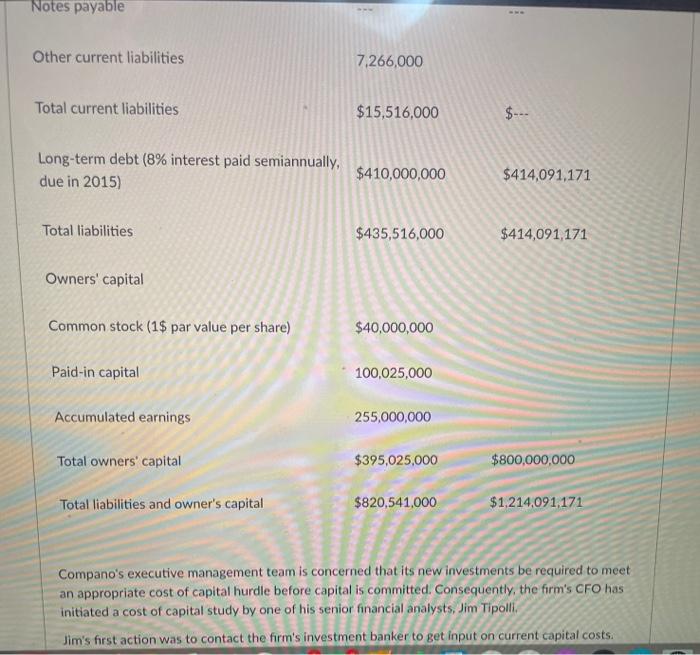

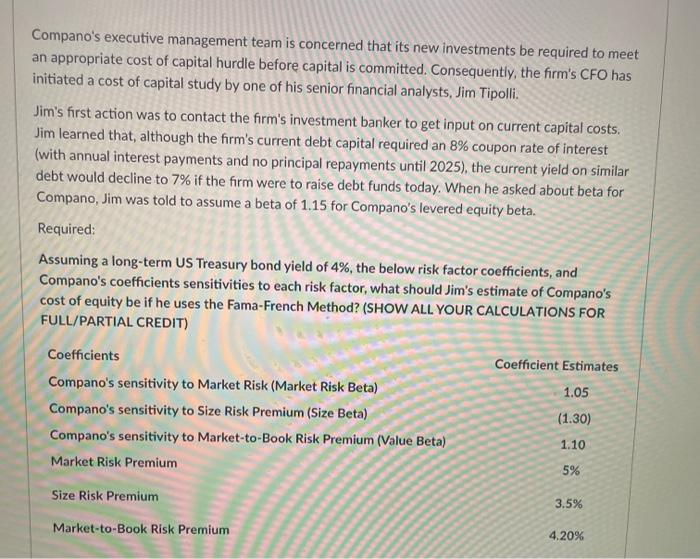

Compano Inc. was founded in 1986 in Baytown, Texas. The firm provides oil-field services to the Texas Gulf Coast region, including the leasing of drilling barges. Its balance sheet for year-end 2014 describes a firm with $820,541,000 in book value assets that has a market value of $1.214 billion. December 31, 2014 Liabilities and Owners' Capital Balance Sheet (Book Invested Capital (Market Values) Values) Current liabilites Accounts payable $8,250,000 Notes payable Other current liabilities 7.266,000 Total current liabilities $15,516,000 $-. Long-term debt (8% interest paid semiannually, due in 2015) $410,000,000 $414.091,171 Total liabilities $435,516,000 $414,091,171 Notes payable . Other current liabilities 7,266,000 Total current liabilities $15,516,000 $- Long-term debt (8% interest paid semiannually, due in 2015) $410,000,000 $414,091,171 Total liabilities $435,516,000 $414,091,171 Owners' capital Common stock (1$ par value per share) $40,000,000 Paid-in capital 100,025,000 Accumulated earnings 255,000,000 Total owners' capital $395,025,000 $800,000,000 Total liabilities and owner's capital $820,541,000 $1,214,091,171 Compano's executive management team is concerned that its new investments be required to meet an appropriate cost of capital hurdle before capital is committed. Consequently, the firm's CFO has initiated a cost of capital study by one of his senior financial analysts, Jim Tipolli. Jim's first action was to contact the firm's investment banker to get input on current capital costs. Compano's executive management team is concerned that its new investments be required to meet an appropriate cost of capital hurdle before capital is committed. Consequently, the firm's CFO has initiated a cost of capital study by one of his senior financial analysts, Jim Tipolli. Jim's first action was to contact the firm's investment banker to get input on current capital costs. Jim learned that, although the firm's current debt capital required an 8% coupon rate of interest (with annual interest payments and no principal repayments until 2025), the current yield on similar debt would decline to 7% if the firm were to raise debt funds today. When he asked about beta for Compano, Jim was told to assume a beta of 1.15 for Compano's levered equity beta. Required: Assuming a long-term US Treasury bond yield of 4%, the below risk factor coefficients, and Compano's coefficients sensitivities to each risk factor, what should Jim's estimate of Compano's cost of equity be if he uses the Fama-French Method? (SHOW ALL YOUR CALCULATIONS FOR FULL/PARTIAL CREDIT) Coefficients Coefficient Estimates Compano's sensitivity to Market Risk (Market Risk Beta) 1.05 Compano's sensitivity to Size Risk Premium (Size Beta) (1.30) Compano's sensitivity to Market-to-Book Risk Premium (Value Beta) 1.10 Market Risk Premium 5% Size Risk Premium 3.5% Market-to-Book Risk Premium 4.20%