Question

Company 10, a local road building contractor, had budgeted indirect costs for 2023 of $600,000. Budgeted labour hours for the year were 12,500 costing

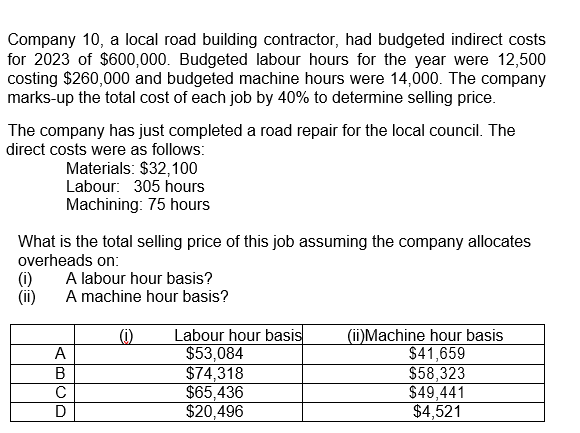

Company 10, a local road building contractor, had budgeted indirect costs for 2023 of $600,000. Budgeted labour hours for the year were 12,500 costing $260,000 and budgeted machine hours were 14,000. The company marks-up the total cost of each job by 40% to determine selling price. The company has just completed a road repair for the local council. The direct costs were as follows: Materials: $32,100 Labour: 305 hours Machining: 75 hours What is the total selling price of this job assuming the company allocates overheads on: (i) A labour hour basis? (ii) A machine hour basis? Labour hour basis (ii)Machine hour basis A $53,084 $41,659 B $74,318 $58,323 C $65,436 $49,441 D $20,496 $4,521

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Accounting A Managerial Emphasis

Authors: Horngren, Srikant Datar, George Foster, Madhav Rajan, Christ

6th Canadian edition

978-0132893534, 9780133389401, 132893533, 133389405, 978-0133392883

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App