Question

Company A announced an offer to buy Company B for $22/sh; $17/sh in cash, $5/sh in stock (Explain) Cash component is about $22 Bn Revenue

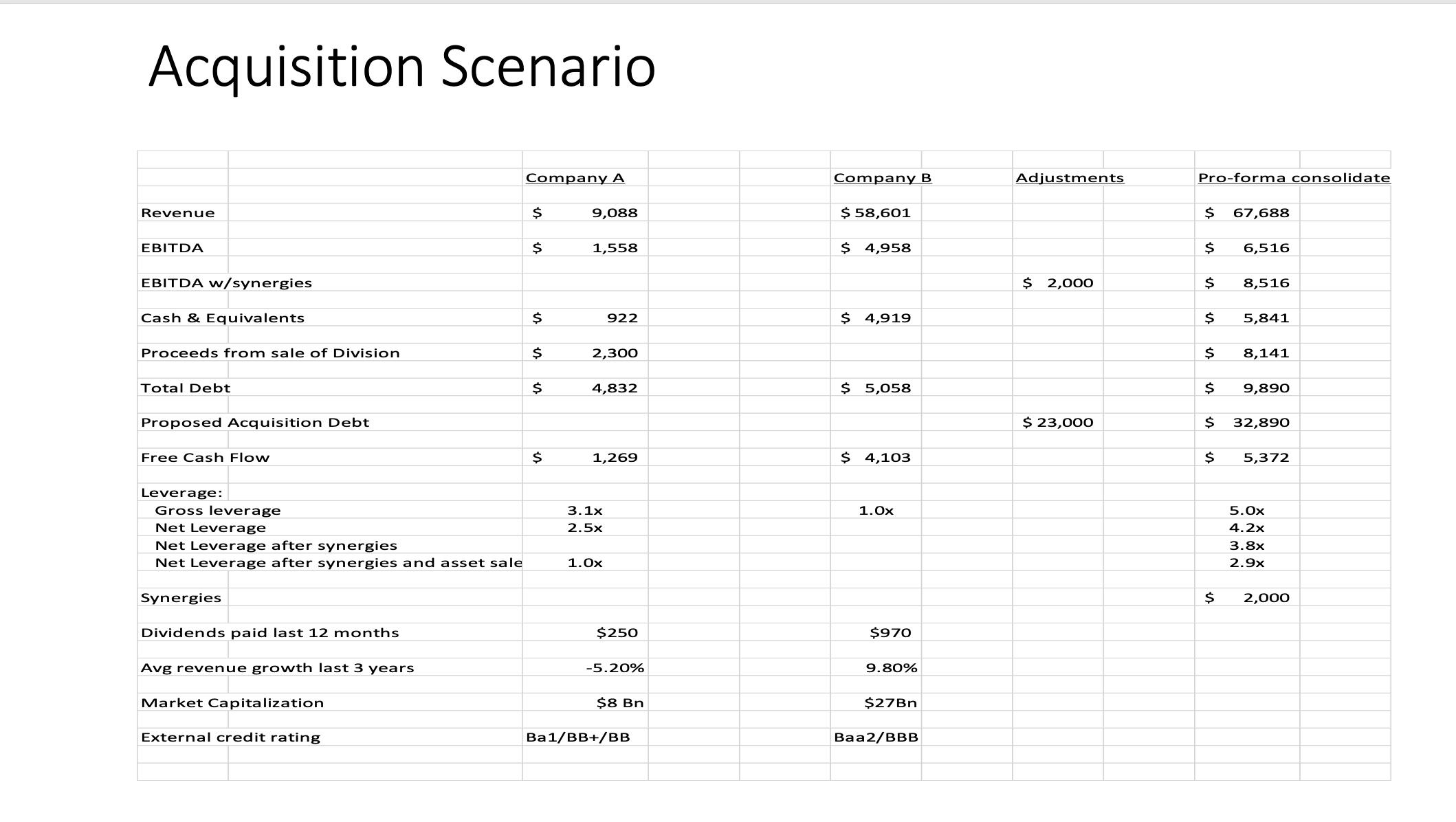

•Company A announced an offer to buy Company B for $22/sh; $17/sh in cash, $5/sh in stock (Explain)

•Cash component is about $22 Bn

•Revenue of target is 6.5x the acquiror

•Combined EBITDA is $6.5 Bn

•Free cash flow is $5.4 Bn

•Acquiror announced the sale of a sub/division for $2.3 Bn

•Acquiror is projecting $2 Bn in synergies

•Both companies paid dividends

•Pro Forma leverage is 5x

•Companies moving in different directions in terms of revenue growth•External ratings (Moodys/S&P) differ with the target much better rated

Questions:

1.At 5x leverage are you comfortable with the terms of the merger?

2.The target has 5X the revenue of the acquiror. Is this normal?

3.The acquiror is stating there are $2 Bn in synergies associated with the merger. Are they likely to attain these synergies?4.Is the cash portion of the offer financeable?

5.If you were CEO or CFO of the target would you entertain this offer?

6.Would the fact there is limited overlap between their two businesses effect your decision?

Acquisition Scenario Revenue EBITDA EBITDA w/synergies Cas & Equivalents Proceeds from sale of Division Total Debt Proposed Acquisition Debt Free Cash Flow Leverage: Gross leverage Net Leverage Net Leverage after synergies Net Leverage after synergies and asset sale Synergies Dividends paid last 12 months Avg revenue growth last 3 years Market Capitalization External credit rating Company A $ $ $ $ $ $ 9,088 1,558 2,300 922 4,832 1,269 3.1x 2.5x 1.0x $250 -5.20% $8 Bn Ba1/BB+/BB Company B $ 58,601 $ 4,958 $ 4,919 $ 5,058 $ 4,103 1.0x $970 9.80% $27Bn Baa2/BBB Adjustments $ 2,000 $ 23,000 Pro-forma consolidate $ 67,688 $ $ $ $ $ $ $ $ 6,516 8,516 5,841 8,141 9,890 32,890 5,372 5.0x 4.2x 3.8x 2.9x 2,000

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down each question 1 At 5x leverage are you comfortable with the terms of the merger The pro forma net leverage after synergies and asset sale is projected to be 10x This indicates a relati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started