Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company ( A B C ) is an international conglomerate. It is looking to establish a subsidiary selling unproven homeopathic remedies, having identified a current

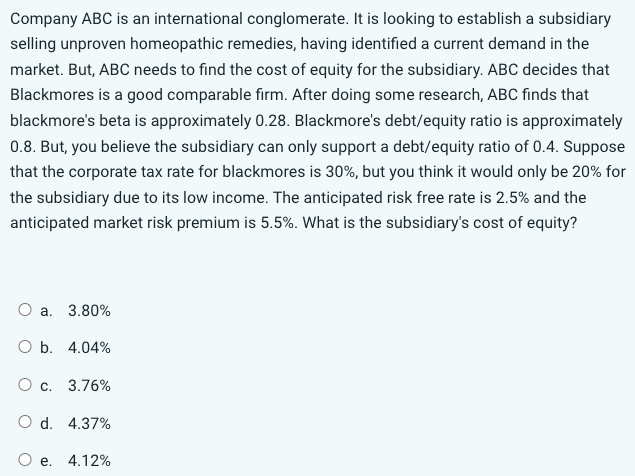

Company \\( A B C \\) is an international conglomerate. It is looking to establish a subsidiary selling unproven homeopathic remedies, having identified a current demand in the market. But, \\( A B C \\) needs to find the cost of equity for the subsidiary. \\( A B C \\) decides that Blackmores is a good comparable firm. After doing some research, ABC finds that blackmore's beta is approximately 0.28 . Blackmore's debt/equity ratio is approximately 0.8 . But, you believe the subsidiary can only support a debt/equity ratio of 0.4 . Suppose that the corporate tax rate for blackmores is \30, but you think it would only be \20 for the subsidiary due to its low income. The anticipated risk free rate is \2.5 and the anticipated market risk premium is \5.5. What is the subsidiary's cost of equity? a. \3.80 b. \4.04 c. \3.76 d. \4.37 e. \4.12

Company \\( A B C \\) is an international conglomerate. It is looking to establish a subsidiary selling unproven homeopathic remedies, having identified a current demand in the market. But, \\( A B C \\) needs to find the cost of equity for the subsidiary. \\( A B C \\) decides that Blackmores is a good comparable firm. After doing some research, ABC finds that blackmore's beta is approximately 0.28 . Blackmore's debt/equity ratio is approximately 0.8 . But, you believe the subsidiary can only support a debt/equity ratio of 0.4 . Suppose that the corporate tax rate for blackmores is \30, but you think it would only be \20 for the subsidiary due to its low income. The anticipated risk free rate is \2.5 and the anticipated market risk premium is \5.5. What is the subsidiary's cost of equity? a. \3.80 b. \4.04 c. \3.76 d. \4.37 e. \4.12 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started