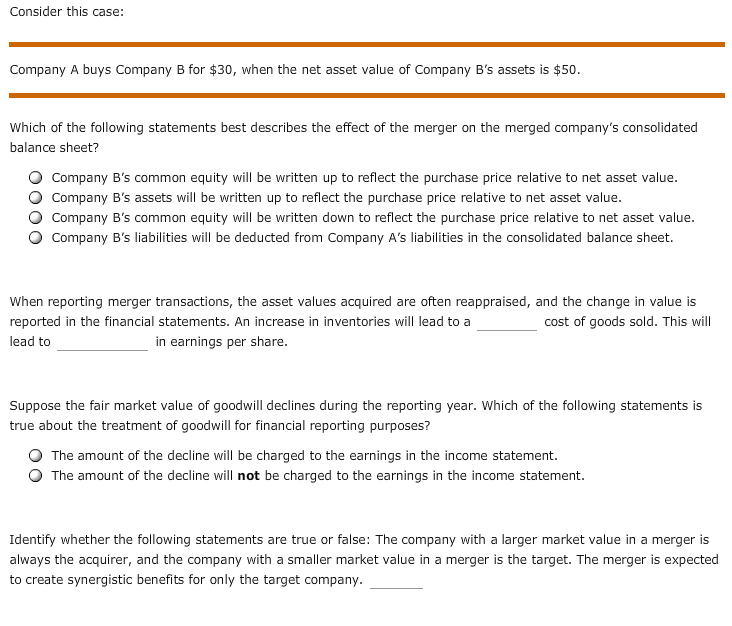

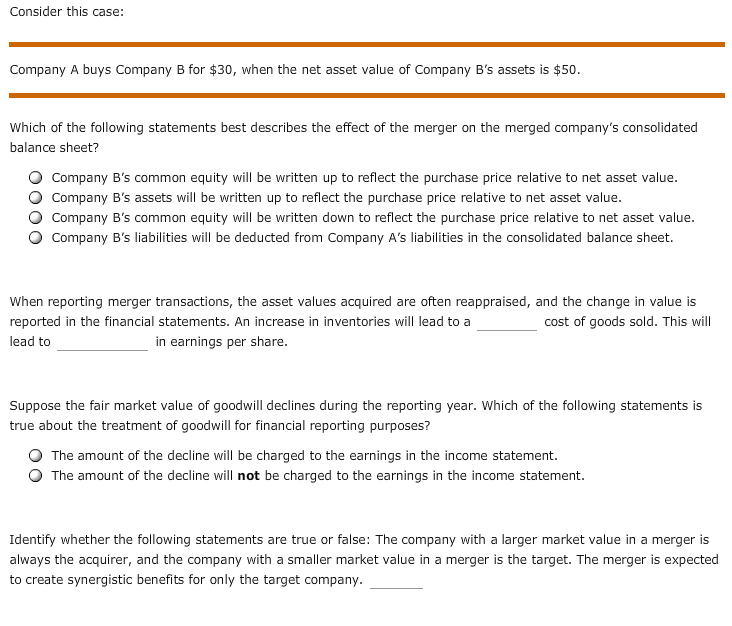

Company A buys Company B for $30, when the net asset value of Company B's assets is $50. Which of the following statements best describes the effect of the merger on the merged company's consolidated balance sheet? Company B's common equity will be written up to reflect the purchase price relative to net asset value. Company B's assets will be written up to reflect the purchase price relative to net asset value. Company B's common equity will be written down to reflect the purchase price relative to net asset value. Company B's liabilities will be deducted from Company A's liabilities in the consolidated balance sheet. When reporting merger transactions, the asset values acquired are often reappraised, and the change in value is reported in the financial statements. An increase in inventories will lead to a ____ cost of goods sold. This will lead to ____ in earnings per share. Suppose the fair market value of goodwill declines during the reporting year. Which of the following statements is true about the treatment of goodwill for financial reporting purposes? The amount of the decline will be charged to the earnings in the income statement. The amount of the decline will not be charged to the earnings in the income statement. Identify whether the following statements are true or false: The company with a larger market value in a merger is always the acquirer, and the company with a smaller market value in a merger is the target. The merger is expected to create synergistic benefits for only the target company. Company A buys Company B for $30, when the net asset value of Company B's assets is $50. Which of the following statements best describes the effect of the merger on the merged company's consolidated balance sheet? Company B's common equity will be written up to reflect the purchase price relative to net asset value. Company B's assets will be written up to reflect the purchase price relative to net asset value. Company B's common equity will be written down to reflect the purchase price relative to net asset value. Company B's liabilities will be deducted from Company A's liabilities in the consolidated balance sheet. When reporting merger transactions, the asset values acquired are often reappraised, and the change in value is reported in the financial statements. An increase in inventories will lead to a ____ cost of goods sold. This will lead to ____ in earnings per share. Suppose the fair market value of goodwill declines during the reporting year. Which of the following statements is true about the treatment of goodwill for financial reporting purposes? The amount of the decline will be charged to the earnings in the income statement. The amount of the decline will not be charged to the earnings in the income statement. Identify whether the following statements are true or false: The company with a larger market value in a merger is always the acquirer, and the company with a smaller market value in a merger is the target. The merger is expected to create synergistic benefits for only the target company