Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company A enters into a contract on 1 January 2020 with Company B to use their sedan car for 4 years. The contract states

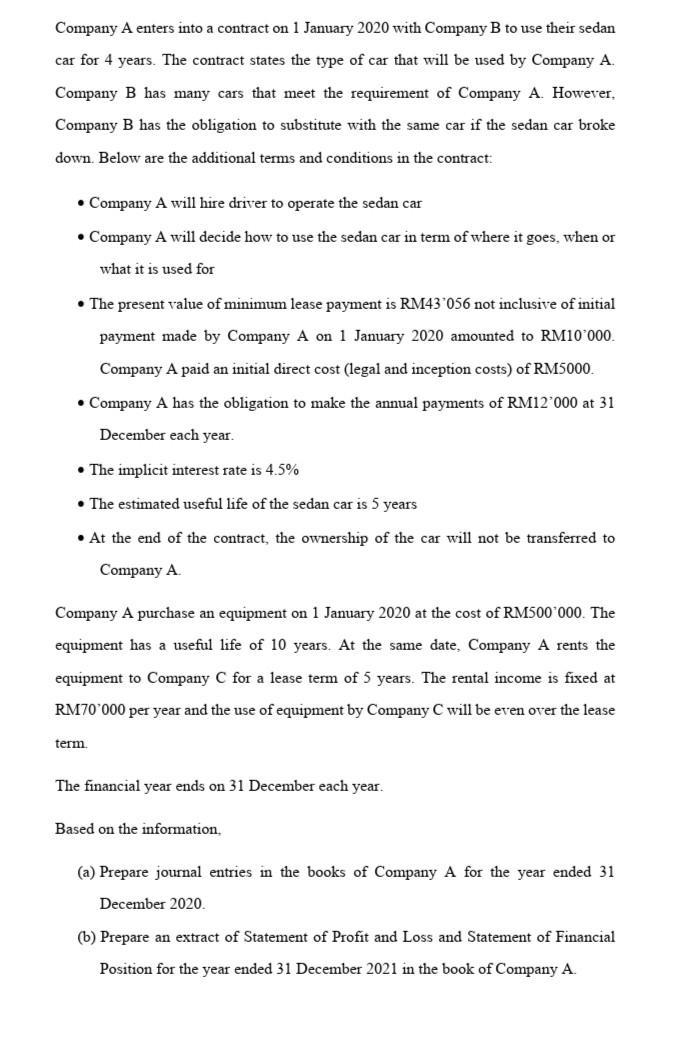

Company A enters into a contract on 1 January 2020 with Company B to use their sedan car for 4 years. The contract states the type of car that will be used by Company A. Company B has many cars that meet the requirement of Company A. However, Company B has the obligation to substitute with the same car if the sedan car broke down. Below are the additional terms and conditions in the contract: Company A will hire driver to operate the sedan car Company A will decide how to use the sedan car in term of where it goes, when or what it is used for The present value of minimum lease payment is RM43'056 not inclusive of initial payment made by Company A on 1 January 2020 amounted to RM10'000. Company A paid an initial direct cost (legal and inception costs) of RM5000. Company A has the obligation to make the annual payments of RM12'000 at 31 December each year. The implicit interest rate is 4.5% The estimated useful life of the sedan car is 5 years At the end of the contract, the ownership of the car will not be transferred to Company A. Company A purchase an equipment on 1 January 2020 at the cost of RM500'000. The equipment has a useful life of 10 years. At the same date, Company A rents the equipment to Company C for a lease term of 5 years. The rental income is fixed at RM70'000 per year and the use of equipment by Company C will be even over the lease term. The financial year ends on 31 December each year. Based on the information. (a) Prepare journal entries in the books of Company A for the year ended 31 December 2020. (b) Prepare an extract of Statement of Profit and Loss and Statement of Financial Position for the year ended 31 December 2021 in the book of Company A.

Step by Step Solution

★★★★★

3.49 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a Entries are as follow In the Books of Company A Lessee Particulars Date 01Jan ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started