Question

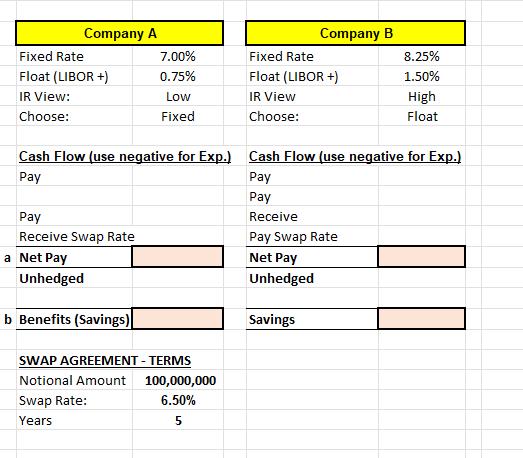

Company A Company B Fixed Rate 7.00% Fixed Rate 8.25% Float (LIBOR +) 0.75% Float (LIBOR +) 1.50% IR View: Low IR View High

Company A Company B Fixed Rate 7.00% Fixed Rate 8.25% Float (LIBOR +) 0.75% Float (LIBOR +) 1.50% IR View: Low IR View High Choose: Fixed Choose: Float Cash Flow (use negative for Exp.) Cash Flow (use negative for Exp.) Pay Pay Pay Pay Receive Receive Swap Rate Pay Swap Rate a Net Pay Net Pay Unhedged b Benefits (Savings) Unhedged Savings SWAP AGREEMENT - TERMS 100,000,000 Notional Amount Swap Rate: Years 6.50% 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the key details of the swap agreement Company A Fixed rate debt 700 IR view Low expect r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting And Analysis

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

8th Edition

1260247848, 978-1260247848

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App