Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company A from Sections 4 and 5 decides during year 2 of its existence to repurchase some of the 10 million shares it issued

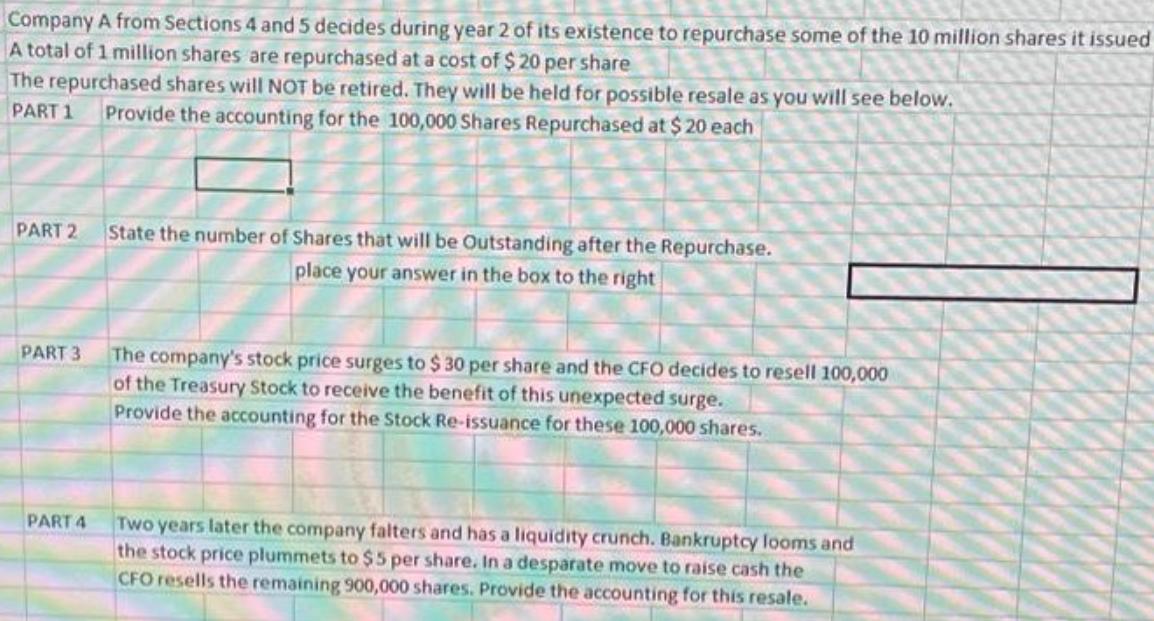

Company A from Sections 4 and 5 decides during year 2 of its existence to repurchase some of the 10 million shares it issued A total of 1 million shares are repurchased at a cost of $ 20 per share The repurchased shares will NOT be retired. They will be held for possible resale as you will see below. PART 1 Provide the accounting for the 100,000 Shares Repurchased at $ 20 each PART 2 State the number of Shares that will be Outstanding after the Repurchase. place your answer in the box to the right The company's stock price surges to $ 30 per share and the CFO decides to resell 100,000 of the Treasury Stock to receive the benefit of this unexpected surge. PART 3 Provide the accounting for the Stock Re-issuance for these 100,000 shares. Two years later the company falters and has a liquidity crunch. Bankruptcy looms and the stock price plummets to $5 per share. In a desparate move to raise cash the CFO resells the remaining 900,000 shares. Provide the accounting for this resale. PART 4

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Solution Accounts titles Debit Credit Part 1 Treasury Stock 1000000 shares ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started