Question

Company A has cost of equity of 10%, cost of debt of 5%, and a debt to equity of 0%. The tax rate is assumed

Company A has cost of equity of 10%, cost of debt of 5%, and a debt to equity of

0%. The tax rate is assumed to be 35%. For part (a), calculate the values for debt

to equity ratios of 25%, 50%, 100%, 150%, 200%, where the company adjusts the

ratio by issuing debt to repurchase shares or issue shares to repay debt.

Modigliani Miller propositions assumptions are applied.

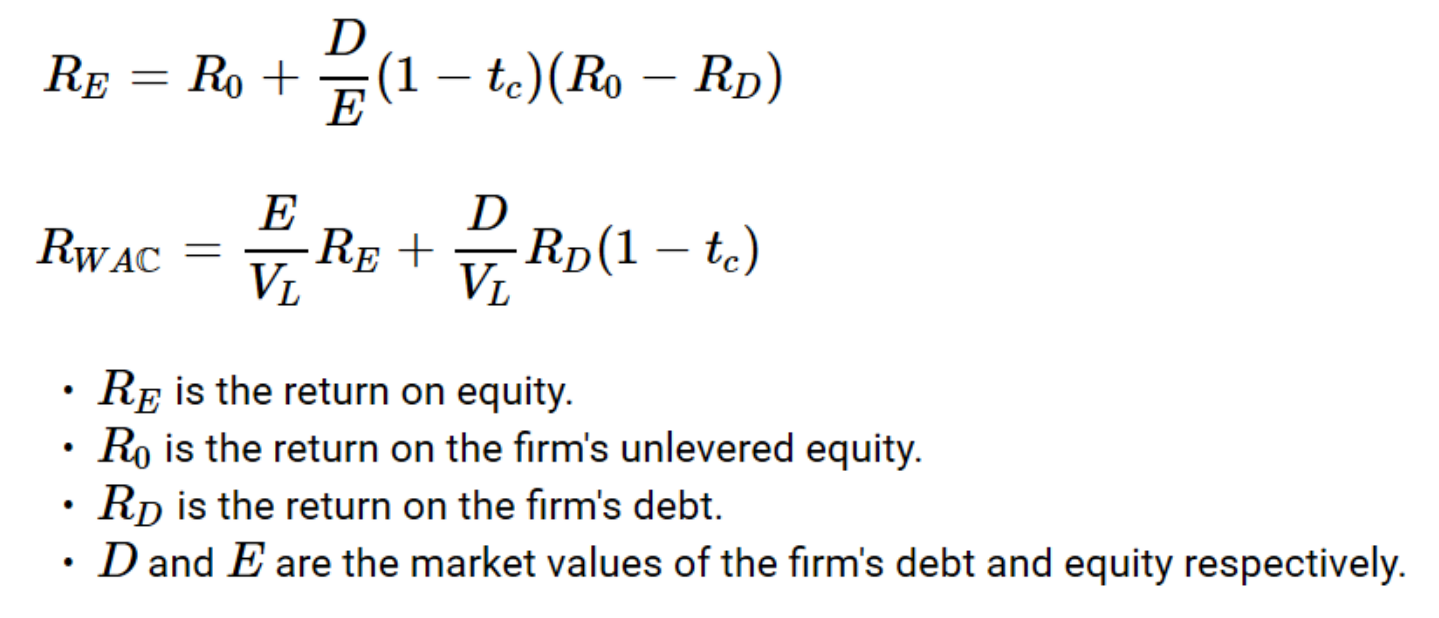

a) Calculate the cost of equity and wacc for each of the debt to equity ratios.

Use the formulas below. Assume cost of debt is constant.

b) For your results in part (a), plot the cost of equity and WACC vs the debt to

equity ratio

c) You are an investor that has your entire portfolio consisting of Company A

stocks. The company has recently unlevered to debt to equity ratio of 50%. You are unhappy with this decision, as the risk and yield are both lowered.

How can you change your portfolio to reverse this change?

d) Even at 0% tax, earnings per share increases as debt to equity ratio

increases, therefore the firm should borrow as much as possible to

maximize shareholder value. What is wrong with this statement?

RE=R0+ED(1tc)(R0RD)RWAC=VLERE+VLDRD(1tc) - RE is the return on equity. - R0 is the return on the firm's unlevered equity. - RD is the return on the firm's debt. - D and E are the market values of the firm's debt and equity respectively

RE=R0+ED(1tc)(R0RD)RWAC=VLERE+VLDRD(1tc) - RE is the return on equity. - R0 is the return on the firm's unlevered equity. - RD is the return on the firm's debt. - D and E are the market values of the firm's debt and equity respectively Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started