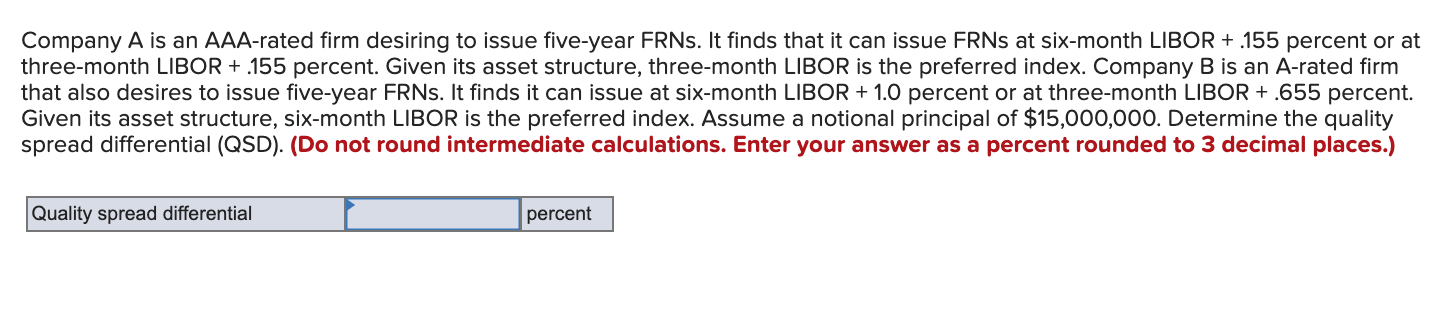

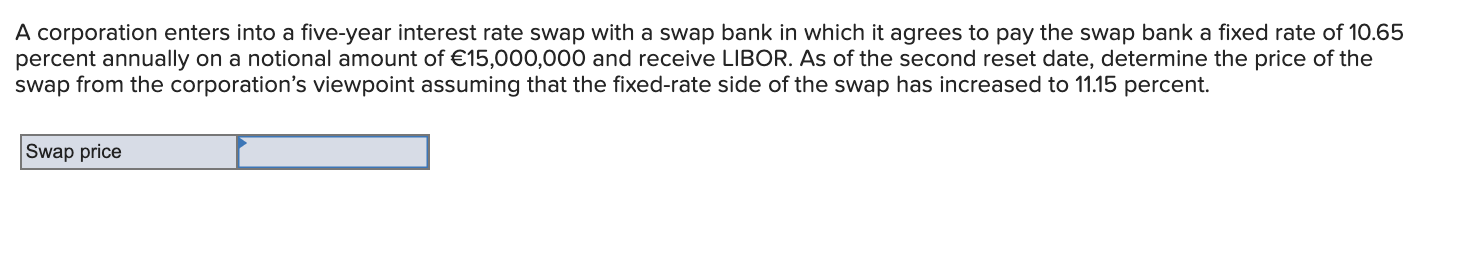

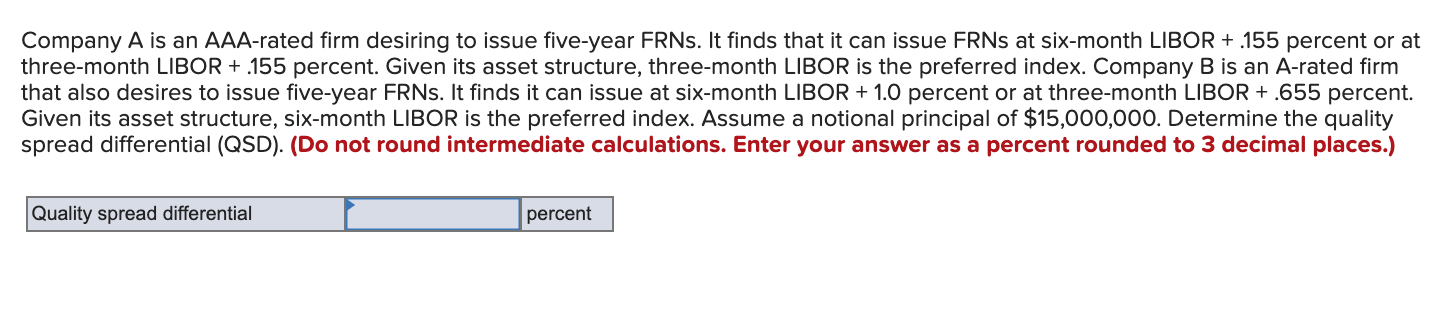

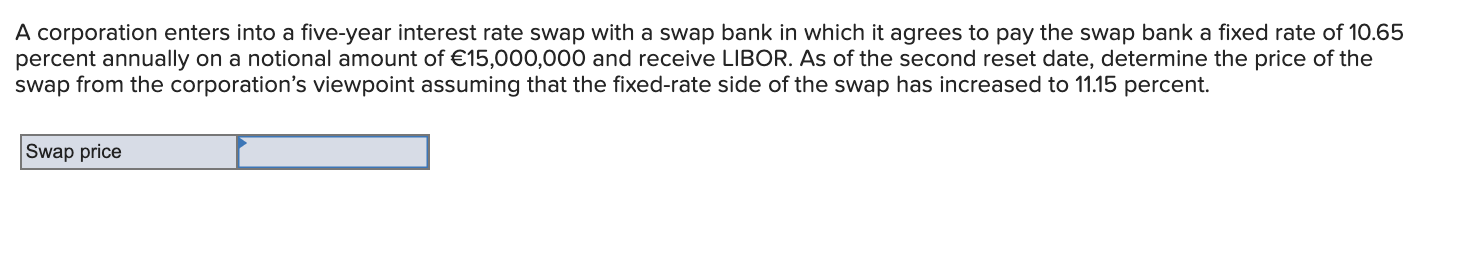

Company A is an AAA-rated firm desiring to issue five-year FRNs. It finds that it can issue FRNs at six-month LIBOR +.155 percent or at three-month LIBOR +.155 percent. Given its asset structure, three-month LIBOR is the preferred index. Company B is an A-rated firm that also desires to issue five-year FRNs. It finds it can issue at six-month LIBOR + 1.0 percent or at three-month LIBOR +.655 percent. Given its asset structure, six-month LIBOR is the preferred index. Assume a notional principal of $15,000,000. Determine the quality spread differential (QSD). (Do not round intermediate calculations. Enter your answer as a percent rounded to 3 decimal places.) Quality spread differential percent A corporation enters into a five-year interest rate swap with a swap bank in which it agrees to pay the swap bank a fixed rate of 10.65 percent annually on a notional amount of 15,000,000 and receive LIBOR. As of the second reset date, determine the price of the swap from the corporation's viewpoint assuming that the fixed-rate side of the swap has increased to 11.15 percent. Swap price Company A is an AAA-rated firm desiring to issue five-year FRNs. It finds that it can issue FRNs at six-month LIBOR +.155 percent or at three-month LIBOR +.155 percent. Given its asset structure, three-month LIBOR is the preferred index. Company B is an A-rated firm that also desires to issue five-year FRNs. It finds it can issue at six-month LIBOR + 1.0 percent or at three-month LIBOR +.655 percent. Given its asset structure, six-month LIBOR is the preferred index. Assume a notional principal of $15,000,000. Determine the quality spread differential (QSD). (Do not round intermediate calculations. Enter your answer as a percent rounded to 3 decimal places.) Quality spread differential percent A corporation enters into a five-year interest rate swap with a swap bank in which it agrees to pay the swap bank a fixed rate of 10.65 percent annually on a notional amount of 15,000,000 and receive LIBOR. As of the second reset date, determine the price of the swap from the corporation's viewpoint assuming that the fixed-rate side of the swap has increased to 11.15 percent. Swap price