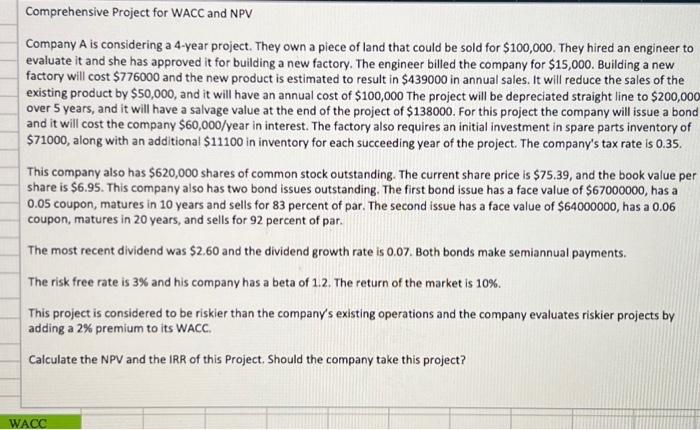

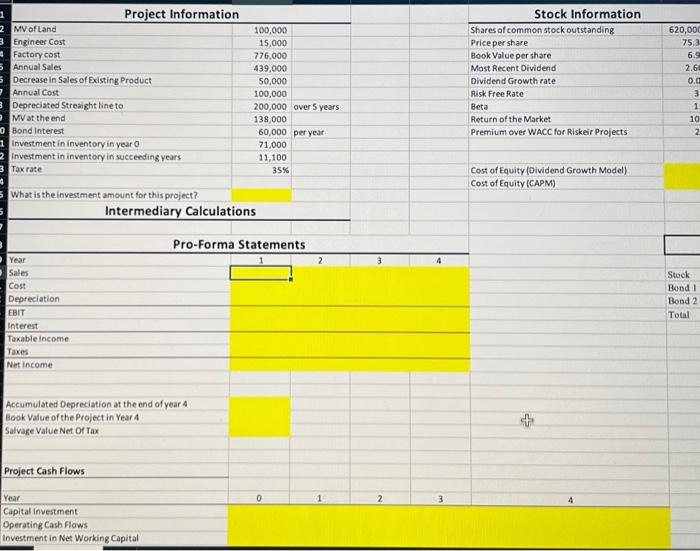

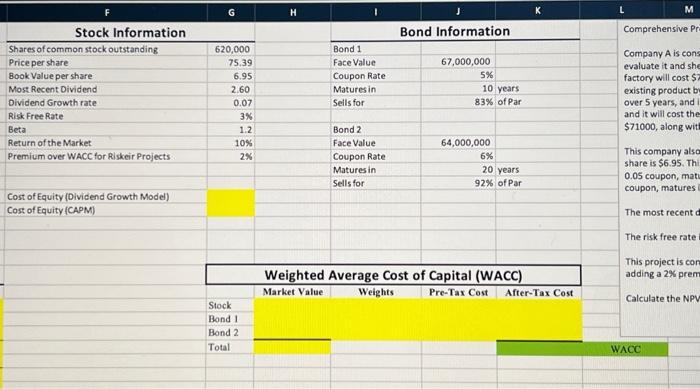

Company A is considering a 4-year project. They own a piece of land that could be sold for $100,000. They hired an engineer to evaluate it and she has approved it for building a new factory. The engineer billed the company for $15,000. Building a new factory will cost $776000 and the new product is estimated to result in $439000 in annual sales. It will reduce the sales of the existing product by $50,000, and it will have an annual cost of $100,000 The project will be depreciated straight line to $200,000 over 5 years, and it will have a salvage value at the end of the project of $138000. For this project the company will issue a bond and it will cost the company $60,000/ year in interest. The factory also requires an initial investment in spare parts inventory of $71000, along with an additional $11100 in inventory for each succeeding year of the project. The company's tax rate is 0.35 . This company also has $620,000 shares of common stock outstanding. The current share price is $75.39, and the book value per share is $6.95. This company also has two bond issues outstanding. The first bond issue has a face value of $67000000, has a 0.05 coupon, matures in 10 years and sells for 83 percent of par. The second issue has a face value of $64000000, has a 0.06 coupon, matures in 20 years, and sells for 92 percent of par. The most recent dividend was $2.60 and the dividend growth rate is 0.07 . Both bonds make semiannual payments. The risk free rate is 3% and his company has a beta of 1.2 . The return of the market is 10%. This project is considered to be riskier than the company's existing operations and the company evaluates riskier projects by adding a 2% premium to its WACC. Calculate the NPV and the IRR of this Project. Should the company take this project? \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{3}{|c|}{ Project Information } & & & \multicolumn{2}{|l|}{ Stock Information } \\ \hline MVoftand & 100,000 & & & & Shares of common stock outstanding & 620,000 \\ \hline Engineer Cost & 15,000 & & & & Price per share & 753 \\ \hline Factory cost & 776,000 & & & & Book Value per share & 6.9 \\ \hline Annual Sales & 439,000 & & & & Most Recent Dividend & 2.60 \\ \hline Decrease in Sales of Existing Product & 50,000 & & & & Dividend Growth rate & 0.0 \\ \hline Annual Cost & 100,000 & & & & Risk Free Rate & 3 \\ \hline Depreciated Streaight line to & 200,000 & over 5 years & & & Beta & 1 \\ \hline MV at the end & 138,000 & & & & Return of the Market & 10 \\ \hline Bond Interest & 60,000 & per year & & & Premium over WACC for Riskeir Projects & 2 \\ \hline Investment in inventory in vear 0 & 71,000 & & & & & \\ \hline Investment in inventory in succeeding vears & 11,100 & & & & & \\ \hline \multirow[t]{2}{*}{ Tax rate } & 35% & & & & Cost of Equity (Dividend Growth Model) & \\ \hline & & & & & Cost of Equity (CAPM) & \\ \hline \multicolumn{7}{|l|}{ What is the investment amount for this project? } \\ \hline \multicolumn{7}{|c|}{ Intermediary Calculations } \\ \hline \multicolumn{7}{|c|}{ Pro-Forma Statements } \\ \hline Year & 1 & 2 & 3 & 4 & & \\ \hline Sales & & & & & & Stock \\ \hline Cost & & & & & & Bond I \\ \hline Depreciation & & & & & & Bond 2 \\ \hline EBIT & & & & & & Total \\ \hline \multicolumn{7}{|l|}{ Interest } \\ \hline \multicolumn{7}{|l|}{ Taxable income } \\ \hline \multicolumn{7}{|l|}{ Taxes } \\ \hline \multicolumn{7}{|l|}{ Net income } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \multicolumn{7}{|l|}{ Accumulated Depreciation at the end of year 4} \\ \hline Book Value of the Project in Year 4 & & & & & & \\ \hline \multicolumn{7}{|l|}{ Salvage Value Net of Tax } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \multicolumn{7}{|l|}{ Project Cash Flows } \\ \hline & & & & & & \\ \hline Year & 0 & 1 & 2 & 3 & 4 & \\ \hline \multicolumn{7}{|l|}{ Capital Investment } \\ \hline \multirow{2}{*}{\multicolumn{7}{|c|}{\begin{tabular}{l} Operating Cash Flows \\ Investment in Net Working Capital \end{tabular}}} \\ \hline & & & & & & \\ \hline \end{tabular} hensive Pr wy A is con e it and she will cost $ iproduct b iears, and ill cost the , along wit mpany also i\$6.95. Th upon, mat: 4. matures ist recent cfree rate Dject is cor a 2% prem te the NPV