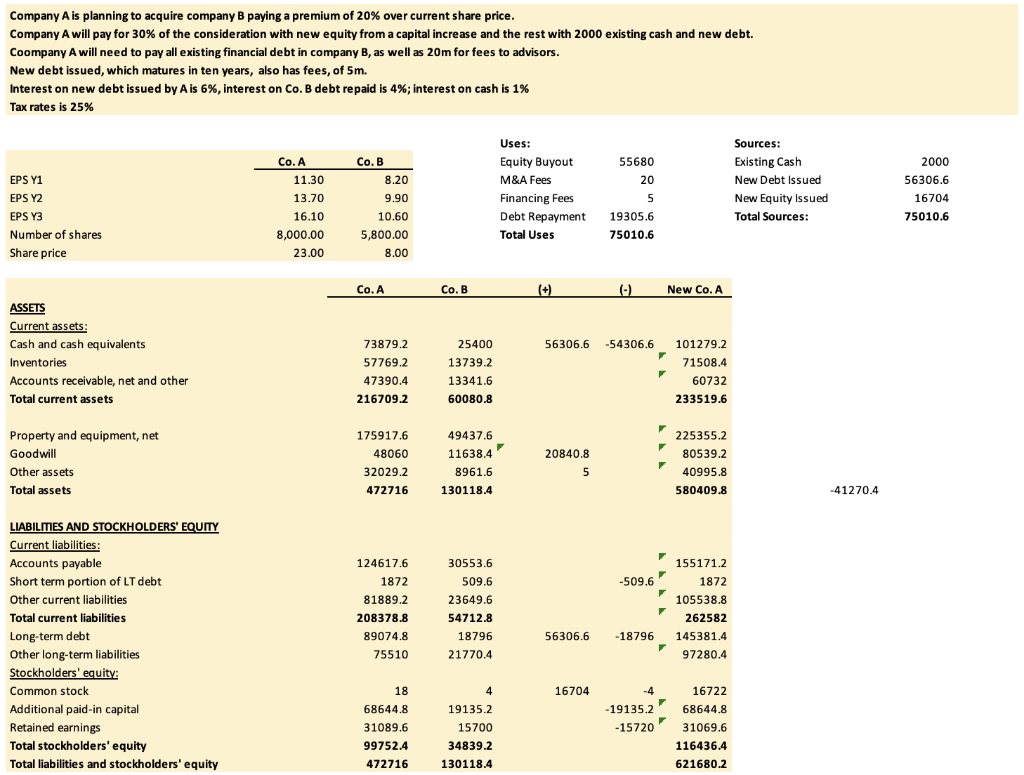

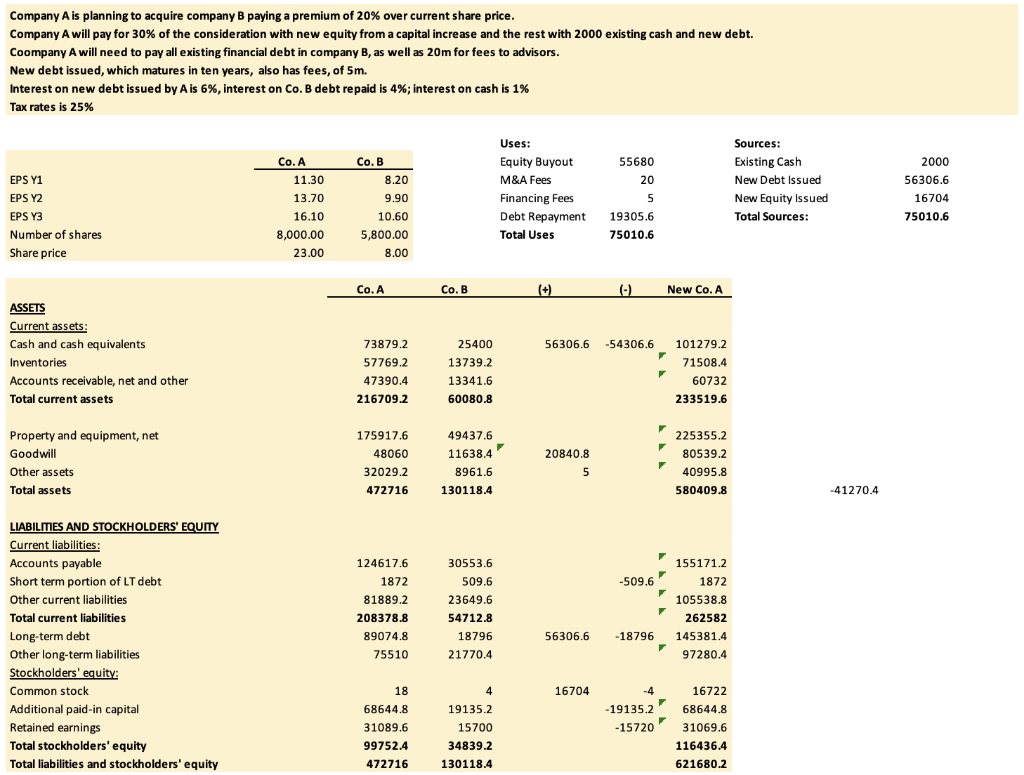

| Company A is planning to acquire company B paying a premium of 20% over current share price. |

| Company A will pay for 30% of the consideration with new equity from a capital increase and the rest with 2000 existing cash and new debt. |

| Coompany A will need to pay all existing financial debt in company B, as well as 20m for fees to advisors. |

| New debt issued, which matures in ten years, also has fees, of 5m. |

| Interest on new debt issued by A is 6%, interest on Co. B debt repaid is 4%; interest on cash is 1% |

| Tax rates is 25% |

PLEASE HELP :)

Company A is planning to acquire company B paying a premium of 20% over current share price. Company A will pay for 30% of the consideration with new equity from a capital increase and the rest with 2000 existing cash and new debt. Coompany A will need to pay all existing financial debt in company B, as well as 20m for fees to advisors. New debt issued, which matures in ten years, also has fees, of 5m. Interest on new debt issued by A is 6%, interest on Co. B debt repaid is 4%; interest on cash is 1% Tax rates is 25% Uses: Co.B 8.20 55680 20 EPS Y1 EPS Y2 EPS Y3 Number of shares Share price Co. A 11.30 13.70 16.10 8,000.00 23.00 Sources: Existing Cash New Debt Issued New Equity Issued Total Sources: Equity Buyout M&A Fees &A Financing Fees Debt Repayment Total Uses 5 2000 56306.6 16704 75010.6 9.90 10.60 5,800.00 8.00 19305.6 75010.6 Co. A Co.B (+ (+) (-) New Co. A 56306.6 -54306.6 ASSETS Current assets: : Cash and cash equivalents Inventories Accounts receivable, net and other Total current assets 73879.2 57769.2 47390.4 216709.2 25400 13739.2 13341.6 60080.8 101279.2 71508.4 60732 233519.6 F Property and equipment, net Goodwill Other assets Total assets 175917.6 48060 32029.2 472716 49437.6 11638.4 8961.6 130118.4 20840.8 5 225355.2 80539.2 40995.8 580409.8 -41270.4 -509.6 124617.6 1872 81889.2 208378.8 89074.8 75510 30553.6 509.6 23649.6 54712.8 18796 21770.4 F LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Short term portion of LT debt Other current liabilities Total current liabilities Long-term debt Other long-term liabilities Stockholders' equity: Common stock Additional paid-in capital Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 155171.2 1872 105538.8 262582 145381.4 97280.4 56306.6 -18796 16704 18 68644.8 31089.6 99752.4 472716 4 19135.2 15700 34839.2 130118.4 -4 -19135.2 -15720 16722 68644.8 31069.6 116436.4 621680.2 Company A is planning to acquire company B paying a premium of 20% over current share price. Company A will pay for 30% of the consideration with new equity from a capital increase and the rest with 2000 existing cash and new debt. Coompany A will need to pay all existing financial debt in company B, as well as 20m for fees to advisors. New debt issued, which matures in ten years, also has fees, of 5m. Interest on new debt issued by A is 6%, interest on Co. B debt repaid is 4%; interest on cash is 1% Tax rates is 25% Uses: Co.B 8.20 55680 20 EPS Y1 EPS Y2 EPS Y3 Number of shares Share price Co. A 11.30 13.70 16.10 8,000.00 23.00 Sources: Existing Cash New Debt Issued New Equity Issued Total Sources: Equity Buyout M&A Fees &A Financing Fees Debt Repayment Total Uses 5 2000 56306.6 16704 75010.6 9.90 10.60 5,800.00 8.00 19305.6 75010.6 Co. A Co.B (+ (+) (-) New Co. A 56306.6 -54306.6 ASSETS Current assets: : Cash and cash equivalents Inventories Accounts receivable, net and other Total current assets 73879.2 57769.2 47390.4 216709.2 25400 13739.2 13341.6 60080.8 101279.2 71508.4 60732 233519.6 F Property and equipment, net Goodwill Other assets Total assets 175917.6 48060 32029.2 472716 49437.6 11638.4 8961.6 130118.4 20840.8 5 225355.2 80539.2 40995.8 580409.8 -41270.4 -509.6 124617.6 1872 81889.2 208378.8 89074.8 75510 30553.6 509.6 23649.6 54712.8 18796 21770.4 F LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Short term portion of LT debt Other current liabilities Total current liabilities Long-term debt Other long-term liabilities Stockholders' equity: Common stock Additional paid-in capital Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 155171.2 1872 105538.8 262582 145381.4 97280.4 56306.6 -18796 16704 18 68644.8 31089.6 99752.4 472716 4 19135.2 15700 34839.2 130118.4 -4 -19135.2 -15720 16722 68644.8 31069.6 116436.4 621680.2