Question

Company A purchased equipment on January 1, 2020 for $1,700,000. The equipment is depreciated on the double-declining balance method over an estimated useful life

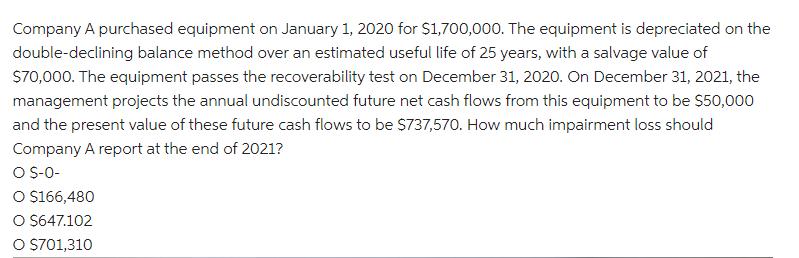

Company A purchased equipment on January 1, 2020 for $1,700,000. The equipment is depreciated on the double-declining balance method over an estimated useful life of 25 years, with a salvage value of S70,000. The equipment passes the recoverability test on December 31, 2020. On December 31, 2021, the management projects the annual undiscounted future net cash flows from this equipment to be $50,000 and the present value of these future cash flows to be $737,570. How much impairment loss should Company A report at the end of 2021? O S-0- O $166,480 O $647.102 O S701,310

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Depreciation 100 25 4 Under triple declining method depreciation 4 3 12 Year Openin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Interpreting and Analyzing Financial Statements

Authors: Karen P. Schoenebeck, Mark P. Holtzman

6th edition

132746247, 978-0132746243

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App