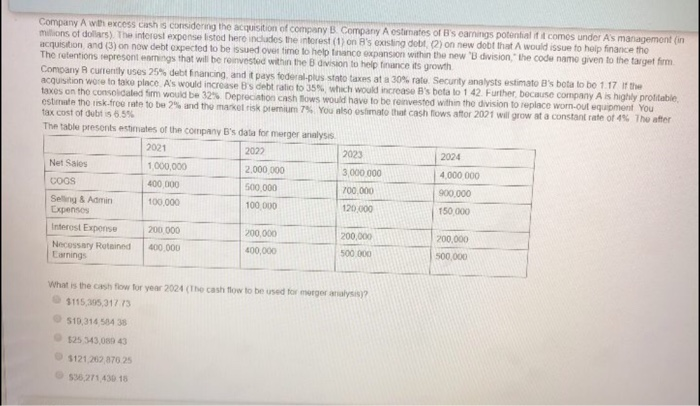

Company A with excess cash is considering the acquisition of company B. Company A estimates of Bscamnings potential it comes under As managemont in millions of dollars). The interest expense Isted here indudes the interest (1) on B's existing debt. (2) on new dobt that A would issue to help finance the acquisition, and (3) on now debt expected to be issued over time to help finance expansion within the new 'B division, the code name given to the target firm The retentions represent earings that will be reinvested within the division to help finance its growth Company currently uses 25% debt financing, and it pays federal-plus stato taxes at a 30% rate. Secunty analysts estimato B' bota to be 1.17 If the acquisition wore to take place A's would increases debtracto 35%, which would increase B's betalo 1 42. Further because company A is highly profitable taxes on the consolidated firm would be 32 Depreciation cash flows would have to be reinvested within the division to replace wom-out equipment You estimate the risk free rate to be 2% and the market risk premium 7% You also stimato that cash flows attor 2021 will grow at a constant rate of 4 Theater tax cost of dubt656 The table presents estimates of the company B's data for merger analysis 2021 2022 2023 2024 Net Sales 1,000,000 2.000000 3.000.000 4,000 000 COGS 400 000 500.000 700,000 900.000 Selling & Admin 100,000 100 000 120.000 150 000 Expenses Interest Expense Necessary Retained Linings 200.000 400.000 200,000 400,000 200.000 200,000 500.000 500.000 What is the cash flow for year 2024 (The cash flow to be used for merger analys)? 1115,305,31773 510.316514 38 525343,080 43 5121.262 870 25 535271430 15 Company A with excess cash is considering the acquisition of company B. Company A estimates of Bscamnings potential it comes under As managemont in millions of dollars). The interest expense Isted here indudes the interest (1) on B's existing debt. (2) on new dobt that A would issue to help finance the acquisition, and (3) on now debt expected to be issued over time to help finance expansion within the new 'B division, the code name given to the target firm The retentions represent earings that will be reinvested within the division to help finance its growth Company currently uses 25% debt financing, and it pays federal-plus stato taxes at a 30% rate. Secunty analysts estimato B' bota to be 1.17 If the acquisition wore to take place A's would increases debtracto 35%, which would increase B's betalo 1 42. Further because company A is highly profitable taxes on the consolidated firm would be 32 Depreciation cash flows would have to be reinvested within the division to replace wom-out equipment You estimate the risk free rate to be 2% and the market risk premium 7% You also stimato that cash flows attor 2021 will grow at a constant rate of 4 Theater tax cost of dubt656 The table presents estimates of the company B's data for merger analysis 2021 2022 2023 2024 Net Sales 1,000,000 2.000000 3.000.000 4,000 000 COGS 400 000 500.000 700,000 900.000 Selling & Admin 100,000 100 000 120.000 150 000 Expenses Interest Expense Necessary Retained Linings 200.000 400.000 200,000 400,000 200.000 200,000 500.000 500.000 What is the cash flow for year 2024 (The cash flow to be used for merger analys)? 1115,305,31773 510.316514 38 525343,080 43 5121.262 870 25 535271430 15