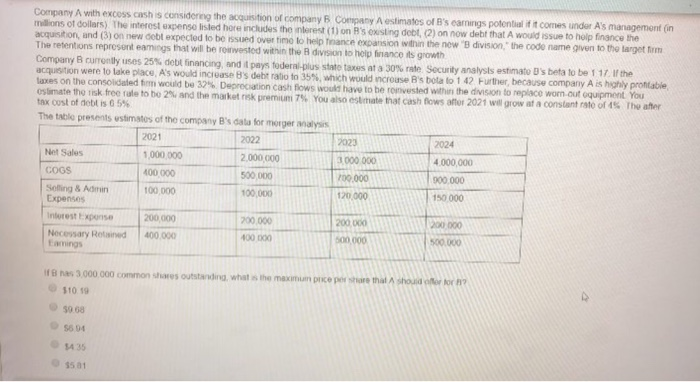

Company A with excess cash is considering the acquisition of company 5 Company A estimates of B's caringspotential if it comes under A's management in millions of dollars). The interest expense listed here includes the interest (1) on B's exsting debt, (2) on now debt that A would issue to help finance the acquisition, and (3) on new debt expected to be issued over time to help finance expansion within the new division, the code name given to the target tom The retentions representeamings that will be rivested within the division to help finance is growth Company currently uses 25% debt financing, and it pays fodern plus state taxes at a 30% Security analysis estimate os beta to be 1 17 the acquisition were to take place, A's would increase's debt ratio to 35%, which would incrouse Bs botalo 1 42 Further because company A is highly prontable axes on the consolidated fimm would be 329 Depreciation cash flows would have to be rovested within the division to replace wom-out equipment You estimate the risk free rute to be 2 and the market risk premium 7%You also estimate that cash flows after 2021 will grow at a constant rate of 15 Theater tax cost of debt is 65% The table presents ustimates of the company's data for morger Malysis 2021 2023 2024 Net Sales 1.000.000 2.000.000 3 000 000 4,000,000 COGS 100 000 500 000 700.000 900.000 Solling & Admin 100 000 100.000 120.000 150 000 Expenses Interest Expense 200,000 200.000 200 000 200 000 Necessary Rotmine 400.000 400 DO 500 000 Eings 2022 IBM 3.000.000 common shares outstanding, what is the maximum price per share that should for for 51019 5068 5604 435 5501 Company A with excess cash is considering the acquisition of company 5 Company A estimates of B's caringspotential if it comes under A's management in millions of dollars). The interest expense listed here includes the interest (1) on B's exsting debt, (2) on now debt that A would issue to help finance the acquisition, and (3) on new debt expected to be issued over time to help finance expansion within the new division, the code name given to the target tom The retentions representeamings that will be rivested within the division to help finance is growth Company currently uses 25% debt financing, and it pays fodern plus state taxes at a 30% Security analysis estimate os beta to be 1 17 the acquisition were to take place, A's would increase's debt ratio to 35%, which would incrouse Bs botalo 1 42 Further because company A is highly prontable axes on the consolidated fimm would be 329 Depreciation cash flows would have to be rovested within the division to replace wom-out equipment You estimate the risk free rute to be 2 and the market risk premium 7%You also estimate that cash flows after 2021 will grow at a constant rate of 15 Theater tax cost of debt is 65% The table presents ustimates of the company's data for morger Malysis 2021 2023 2024 Net Sales 1.000.000 2.000.000 3 000 000 4,000,000 COGS 100 000 500 000 700.000 900.000 Solling & Admin 100 000 100.000 120.000 150 000 Expenses Interest Expense 200,000 200.000 200 000 200 000 Necessary Rotmine 400.000 400 DO 500 000 Eings 2022 IBM 3.000.000 common shares outstanding, what is the maximum price per share that should for for 51019 5068 5604 435 5501