Answered step by step

Verified Expert Solution

Question

1 Approved Answer

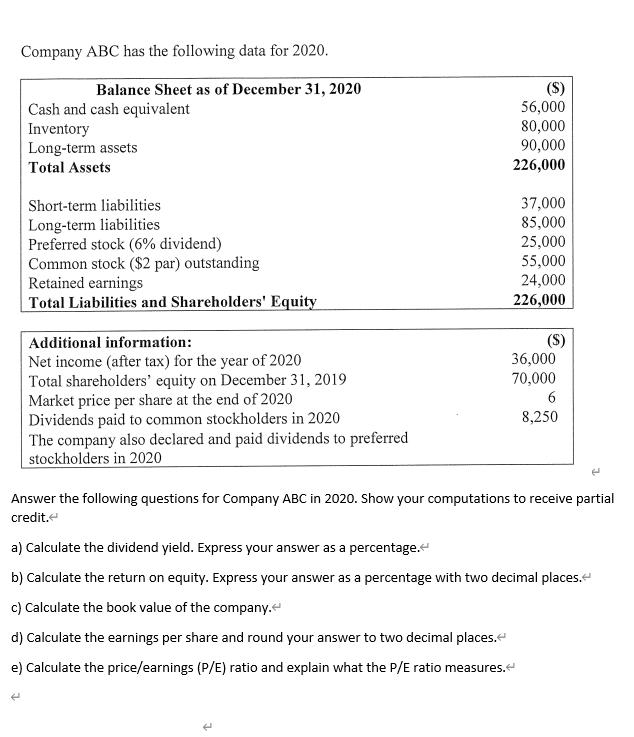

Company ABC has the following data for 2020. Balance Sheet as of December 31, 2020 Cash and cash equivalent Inventory Long-term assets Total Assets

Company ABC has the following data for 2020. Balance Sheet as of December 31, 2020 Cash and cash equivalent Inventory Long-term assets Total Assets Short-term liabilities Long-term liabilities Preferred stock (6% dividend) Common stock ($2 par) outstanding Retained earnings Total Liabilities and Shareholders' Equity Additional information: Net income (after tax) for the year of 2020 Total shareholders' equity on December 31, 2019 Market price per share at the end of 2020 Dividends paid to common stockholders in 2020 The company also declared and paid dividends to preferred stockholders in 2020 ($) 56,000 80,000 90,000 226,000 37,000 85,000 25,000 55,000 24,000 226,000 (S) 36,000 70,000 6 8,250 Answer the following questions for Company ABC in 2020. Show your computations to receive partial credit. a) Calculate the dividend yield. Express your answer as a percentage. < b) Calculate the return on equity. Express your answer as a percentage with two decimal places. c) Calculate the book value of the company. d) Calculate the earnings per share and round your answer to two decimal places. < e) Calculate the price/earnings (P/E) ratio and explain what the P/E ratio measures.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started