Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company ABC has two employees. Last week the closing of the weekly payroll period. First employee earns $7.25 per hour, worked 38 hours (including

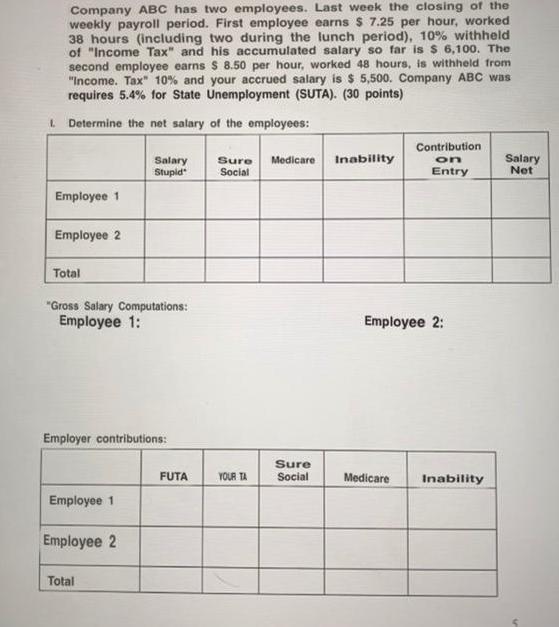

Company ABC has two employees. Last week the closing of the weekly payroll period. First employee earns $7.25 per hour, worked 38 hours (including two during the lunch period), 10% withheld of "Income Tax" and his accumulated salary so far is $ 6,100. The second employee earns $ 8.50 per hour, worked 48 hours, is withheld from "Income. Tax" 10% and your accrued salary is $ 5,500. Company ABC was requires 5.4% for State Unemployment (SUTA). (30 points) L. Determine the net salary of the employees: Employee 1 Employee 2 Total "Gross Salary Computations: Employee 1: Employer contributions: Employee 1 Salary Stupid Employee 2 Total FUTA Sure Medicare Social YOUR TA Sure Social Inability Contribution on Entry Employee 2: Medicare Inability Salary Net

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net salary of each employee and the employer contributions well go step by step for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started