Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company abc is a company working in powerhouse industry. we have the balance sheet for that company in 2016 as below. risk premium in stock

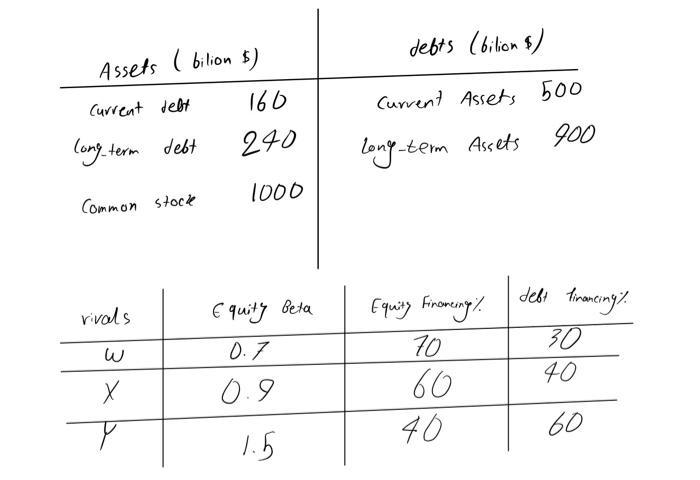

Company abc is a company working in powerhouse industry. we have the balance sheet for that company in 2016 as below. risk premium in stock market is 10% and risk premium in bond market is 5%. ytm for long-term bond now trading in market is20%. the abc company has 100 millions common stock each value at 8$ and it could rise money at risk-free rate. (all of the company debt are bank borrowing and it does not issued any bond).

the board of manager decided to consider a project in e-payment industry. there's information for 3 rivals in this industry as below.

calculate the discount rate that managers have to consider for this new project? (tax=20%)

Assets (bilion $) Current delt long-term debt Common stock rivals W X Y 160 240 1000 Equity Beta 0.7 0.9 1.5 debts (bilion $) Current Assets 500 -term Assets 900 debt financing. 30 40 60 long-term Equity Financing/ 70 60 40

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The discount rate that managers have to consider for this new project is 15 We begin by calculating ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started