Question

Company Accounting Workbook Use accepted accounting principles to follow and record your business transactions for a three-month period from the first step of the accounting

Company Accounting Workbook

Use accepted accounting principles to follow and record your business transactions for a three-month period from the first step of the accounting cycle through the reporting process. You will build on your work from Milestones One and Two to complete your workbook using the Company Accounting Workbook Template (linked in the What to Submit section).

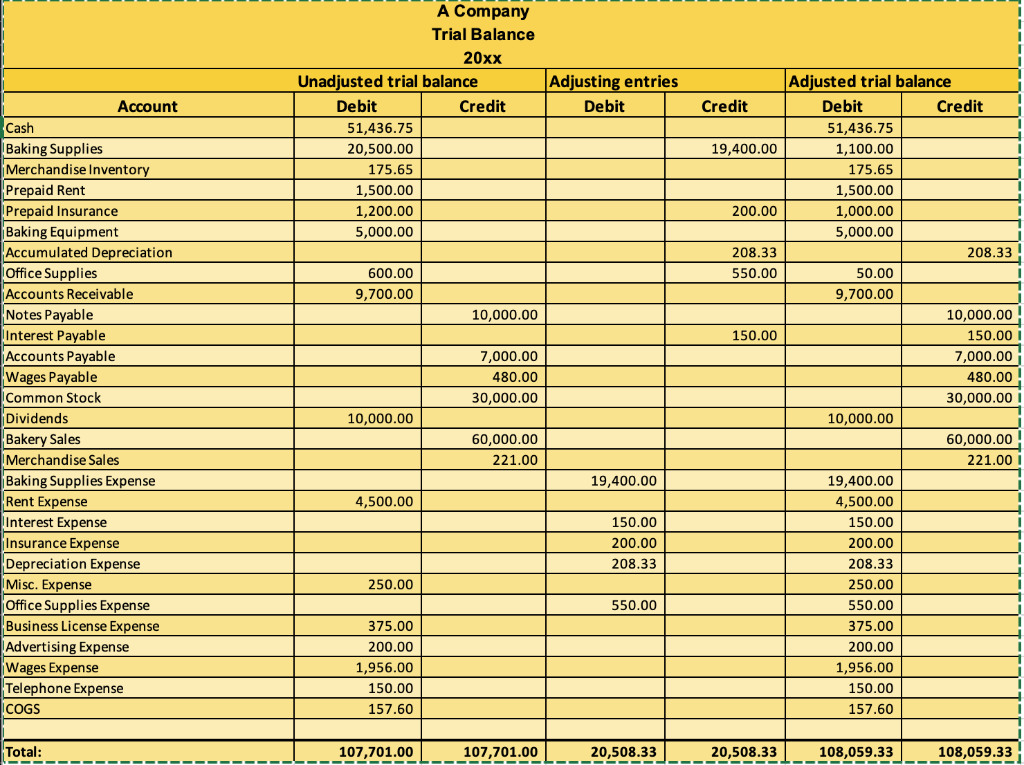

Your completed accounting workbook will consist of journal entries for each transaction and postings of transactions to account ledgers. You will develop a trial balance from ledger balances and adjust revenue and expense accounts, as necessary, to ensure that revenues and expenses are reported in the appropriate period under the accrual accounting method. The adjusted trial balance will be used to prepare the income statement, the statement of owners equity, and the balance sheet. After the preparation of the financial statements, closing entries will be entered to transfer earnings to equity and prepare temporary accounts for the new accounting period.

Use the instructions below to complete your workbook.

- Record Financial Data: Use accepted accounting principles to accurately capture business transactions for October, November, and December using the data provided in the accounting data appendix (linked in the Supporting Materials section). You will need to address the following:

- Accuracy: Prepare entries that are accurate in that they fully reflect the appropriate information.

- Completeness: Prepare entries that are complete for each month, including transferring posted entries to T accounts.

- Inventory Valuation: Prepare entries for the month of December to reflect the new line of products offered by the company, which includes using the data from the Inventory Valuation tab of the company accounting workbook.

- Accrual Basis: Apply the accrual basis of accounting and prepare adjusting entries to ensure accurate accounting for expenses that lack transactions in the current period.

- Unadjusted Trial Balance: Prepare the unadjusted trial balance portion of the Trial Balance tab of the company accounting workbook, ensuring that the total debits and credits match.

- Adjusting Entries: Prepare the Adjusting Entries tab of the company accounting workbook.

- Adjusted Trial Balance: Prepare the adjusted trial balance on the Trial Balance tab, ensuring that the debit and credit totals match.

- Financial Statements: Create financial statements using appropriate methods based on accepted accounting principles. Be sure to prepare these financial statements in the order listed, as there are important interdependencies among them.

- Income Statement: Prepare the income statement using the adjusted trial balance.

- Statement of Owners Equity: Prepare the statement of owners equity using the adjusted trial balance.

- Balance Sheet: Prepare the balance sheet using the adjusted trial balance.

- Closing Entries: Complete the Closing Entries tab of the company accounting workbook by closing all temporary income statement amounts to create closing entries.

- Post-Closing Trial Balance: Prepare the Post-Closing Trial Balance tab of the company accounting workbook in preparation for the next accounting period.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started