COMPANY: APPLE INC.

Analyze the significant trends for the 3 years for the companys liquidity. Include the inventory valuation method the company uses, as well as the policy for credit and collection and the effect these have on liquidity ratios.

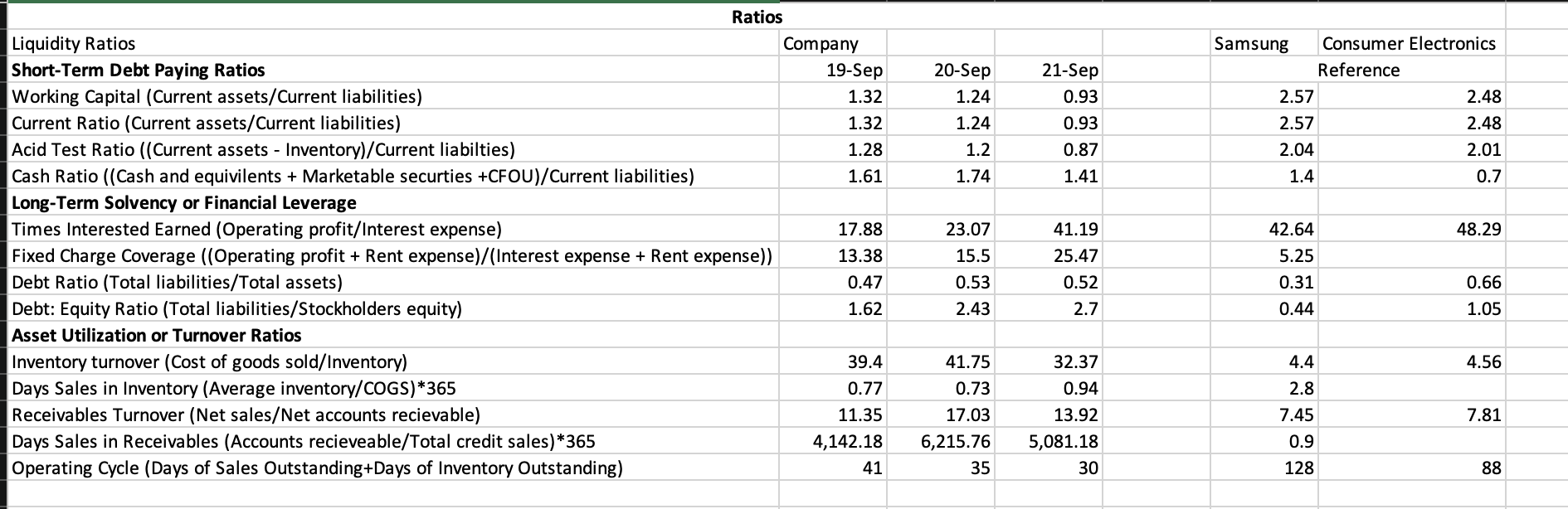

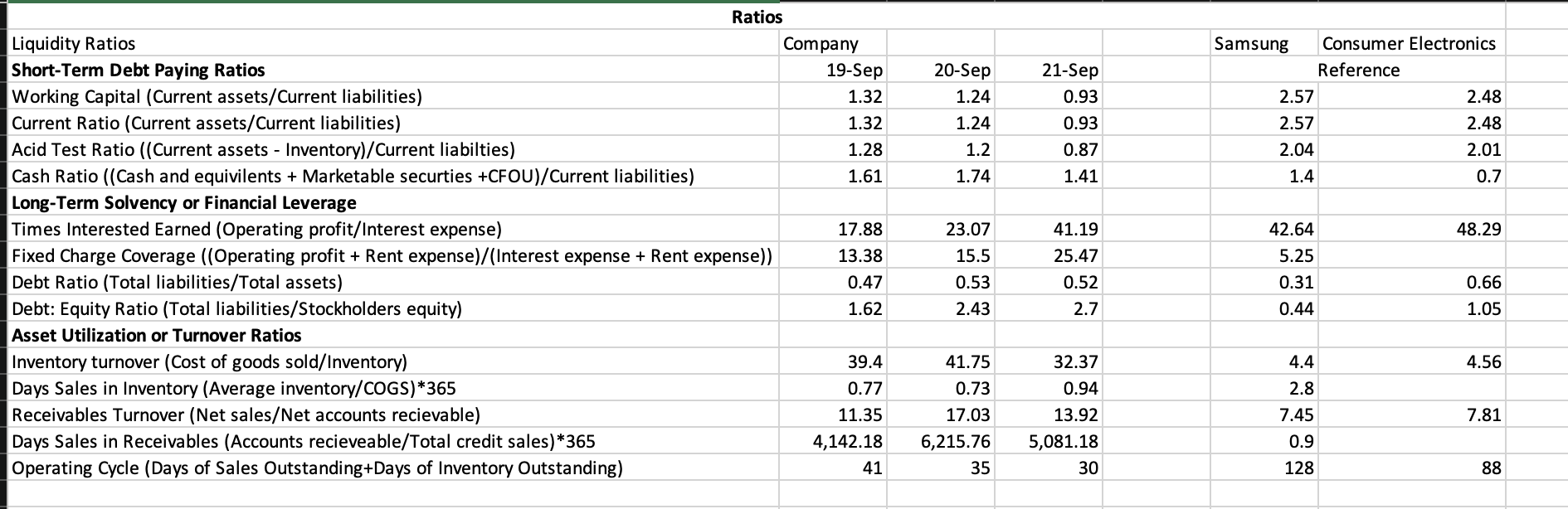

Ratios Liquidity Ratios Short-Term Debt Paying Ratios Working Capital (Current assets/Current liabilities) Current Ratio (Current assets/Current liabilities) Acid Test Ratio ((Current assets - Inventory)/Current liabilties) Cash Ratio ((Cash and equivilents + Marketable securties +CFOU)/Current liabilities) Long-Term Solvency or Financial Leverage Times Interested Earned (Operating profit/Interest expense) Fixed Charge Coverage ((Operating profit + Rent expense)/(Interest expense + Rent expense)) Debt Ratio (Total liabilities/Total assets) Debt: Equity Ratio (Total liabilities/Stockholders equity) Asset Utilization or Turnover Ratios Inventory turnover (Cost of goods sold/Inventory) Days Sales in Inventory (Average inventory/COGS)*365 Receivables Turnover (Net sales/Net accounts recievable) Days Sales in Receivables (Accounts recieveable/Total credit sales) *365 Operating Cycle (Days of Sales Outstanding+Days of Inventory Outstanding) Company 19-Sep 1.32 1.32 1.28 1.61 17.88 13.38 0.47 1.62 39.4 0.77 11.35 4,142.18 41 20-Sep 1.24 1.24 1.2 1.74 23.07 15.5 0.53 2.43 41.75 0.73 17.03 6,215.76 35 21-Sep 0.93 0.93 0.87 1.41 41.19 25.47 0.52 2.7 32.37 0.94 13.92 5,081.18 30 Samsung Consumer Electronics Reference 2.48 2.48 2.01 0.7 48.29 0.66 1.05 4.56 7.81 88 2.57 2.57 2.04 1.4 42.64 5.25 0.31 0.44 4.4 2.8 7.45 0.9 128 Ratios Liquidity Ratios Short-Term Debt Paying Ratios Working Capital (Current assets/Current liabilities) Current Ratio (Current assets/Current liabilities) Acid Test Ratio ((Current assets - Inventory)/Current liabilties) Cash Ratio ((Cash and equivilents + Marketable securties +CFOU)/Current liabilities) Long-Term Solvency or Financial Leverage Times Interested Earned (Operating profit/Interest expense) Fixed Charge Coverage ((Operating profit + Rent expense)/(Interest expense + Rent expense)) Debt Ratio (Total liabilities/Total assets) Debt: Equity Ratio (Total liabilities/Stockholders equity) Asset Utilization or Turnover Ratios Inventory turnover (Cost of goods sold/Inventory) Days Sales in Inventory (Average inventory/COGS)*365 Receivables Turnover (Net sales/Net accounts recievable) Days Sales in Receivables (Accounts recieveable/Total credit sales) *365 Operating Cycle (Days of Sales Outstanding+Days of Inventory Outstanding) Company 19-Sep 1.32 1.32 1.28 1.61 17.88 13.38 0.47 1.62 39.4 0.77 11.35 4,142.18 41 20-Sep 1.24 1.24 1.2 1.74 23.07 15.5 0.53 2.43 41.75 0.73 17.03 6,215.76 35 21-Sep 0.93 0.93 0.87 1.41 41.19 25.47 0.52 2.7 32.37 0.94 13.92 5,081.18 30 Samsung Consumer Electronics Reference 2.48 2.48 2.01 0.7 48.29 0.66 1.05 4.56 7.81 88 2.57 2.57 2.04 1.4 42.64 5.25 0.31 0.44 4.4 2.8 7.45 0.9 128