Answered step by step

Verified Expert Solution

Question

1 Approved Answer

company B! come statement. Company A and Company B have taken different approaches to selling glassware. Company A has decided to make glass stemware that

company B!

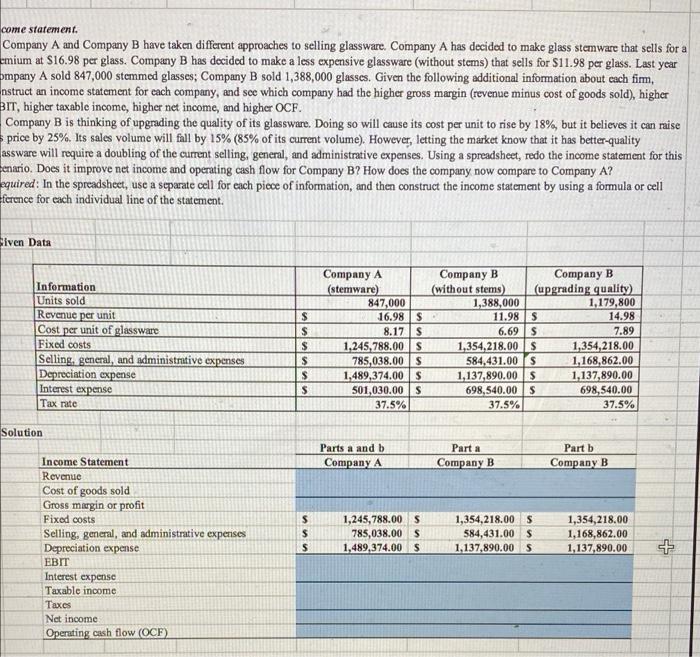

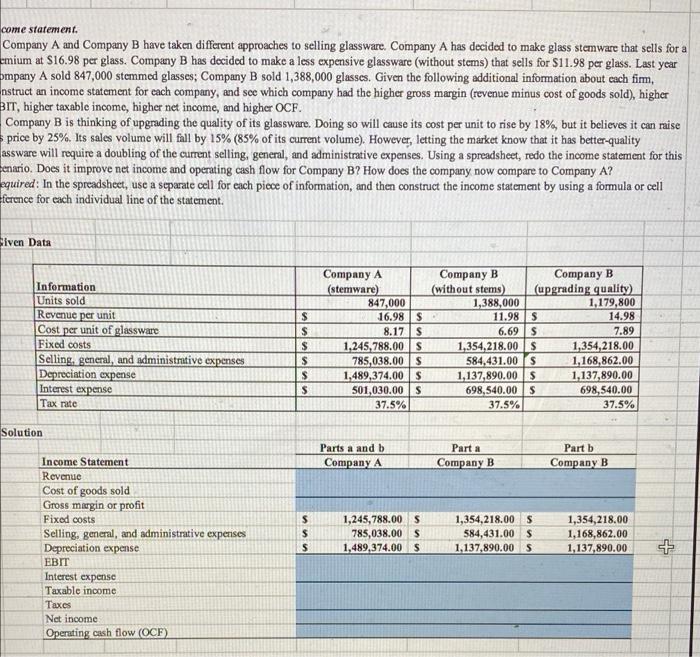

come statement. Company A and Company B have taken different approaches to selling glassware. Company A has decided to make glass stemware that sells for a emium at $16.98 per glass. Company B has decided to make a less expensive glassware (without stems) that sells for $11.98 per glass. Last year ompany A sold 847,000 stemmed glasses; Company B sold 1,388,000 glasses. Given the following additional information about each firm, nstruct an income statement for each company, and see which company had the higher gross margin (revenue minus cost of goods sold), higher BIT, higher taxable income, higher net income, and higher OCF. Company B is thinking of upgrading the quality of its glassware. Doing so will cause its cost per unit to rise by 18%, but it believes it can raise price by 25%. Its sales volume will full by 15% (85% of its current volume). However, letting the market know that it has better-quality assware will require a doubling of the current selling, general, and administrative expenses. Using a spreadsheet, redo the income statement for this Eenario. Does it improve net income and operating cash flow for Company B? How does the company now compare to Company A? squired: In the spreadsheet, use a separate cell for each piece of information, and then construct the income statement by using a formula or cell ference for each individual line of the statement. a a Siven Data Information Units sold Revenue per unit Cost per unit of glassware Fixed costs Selling, general, and administrative expenses Depreciation expense Interest expense Tax rate $ $ $ $ Company A (stemware) 847,000 16.98 S 8.17 S 1,245,788.00 s 785,038.00 s 1,489,374.00 s 501,030.00 37.5% Company B Company B (without stems) (upgrading quality) 1,388,000 1,179,800 11.985 14.98 6.69 s 7.89 1,354,218.00$ 1,354,218.00 584,431.00 1,168,862.00 1,137,890.00 $ 1,137,890.00 698,540.00 698,540.00 37.5% 37.5% $ Solution Parta Parts a and b Company A Company B Part b Company B Income Statement Revenue Cost of goods sold Gross margin or profit Fixed costs Selling, general, and administrative expenses Depreciation expense EBIT Interest expense Taxable income Taxes Net income Operating cash flow (OCF) $ $ $ 1,245,788.00 S 785,038.00 $ 1,489,374.00 $ 1,354,218.00 $ 584,431.00 s 1,137,890.00 5 1,354,218.00 1,168,862.00 1,137,890.00 +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started