Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company Background Information: Rainier Company uses special strapping equipment in its packaging business. The equipment was purchased in January 2024 for $10,000,000 and had

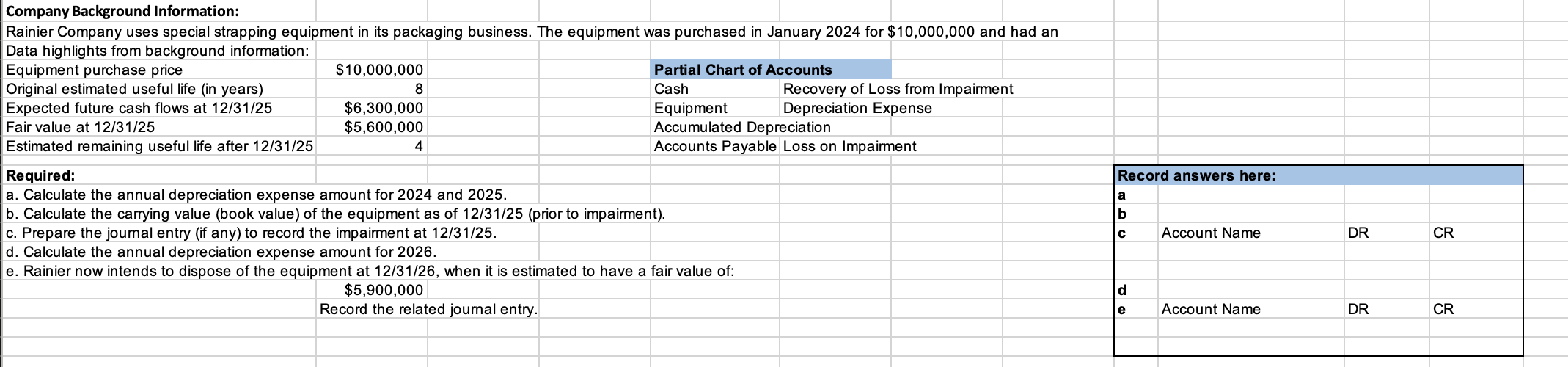

Company Background Information: Rainier Company uses special strapping equipment in its packaging business. The equipment was purchased in January 2024 for $10,000,000 and had an Data highlights from background information: Equipment purchase price Original estimated useful life (in years) Expected future cash flows at 12/31/25 $10,000,000 8 $6,300,000 $5,600,000 Estimated remaining useful life after 12/31/25 4 Required: Fair value at 12/31/25 Partial Chart of Accounts Cash Equipment Recovery of Loss from Impairment Depreciation Expense Accumulated Depreciation Accounts Payable Loss on Impairment a. Calculate the annual depreciation expense amount for 2024 and 2025. b. Calculate the carrying value (book value) of the equipment as of 12/31/25 (prior to impairment). c. Prepare the journal entry (if any) to record the impairment at 12/31/25. d. Calculate the annual depreciation expense amount for 2026. e. Rainier now intends to dispose of the equipment at 12/31/26, when it is estimated to have a fair value of: $5,900,000 Record the related journal entry. Record answers here: a b Account Name DR CR d e Account Name DR CR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started