Question

Company Background Premier Ovens Pty Ltd has been in business in Lidcombe, NSW since July, 2016. The company was started by Scott Rose and operates

Company Background

Premier Ovens Pty Ltd has been in business in Lidcombe, NSW since July, 2016. The company was started by Scott Rose and operates a large warehouse which sells electrical and gas oven products from all over the world on a wholesale basis to other electrical oven shops on both credit and cash terms. The company's Share Capital consists of 4,374,000 Ordinary Shares, originally issued at $1 each and which are owned by various members of the Rose family. The company has employed a combination of sales and administration staff to run the business since July, 2016. The company has been profitable since it was originally formed.

Accounting System Information & Procedures

The company has a financial year end of 30 June and prepares adjusting entries at the end of the financial year.

To ensure efficiency of its accounting procedures, the company uses the following Special Journals to maintain its accounting records:

- Sales Journal (SJ): to record all sales of Inventory on credit

- Purchases Journal (PJ): to record all Purchases of Inventory on credit

- Cash Receipts Journal (CRJ): to record all Cash Receipts

- Cash Payments Journal (CPJ): to record all Cash Payments

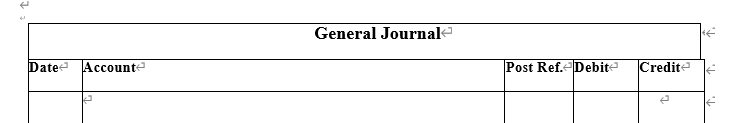

- General Journal (GJ): to r ecord all transactions other than the above.

Business transactions are recorded for Premier Ovens Pty Ltd on a daily basis in one of these five journals in the accounts.

Additionally, the company maintains a general ledger to record postings from the journals. Subsidiary Ledgers are used to record the separate details of Accounts Receivable and Accounts Payable. Transactions are posted immediately to the relevant ledger account if they are entered into the general journal, the other column of the Cash Receipts Journal or Cash Payments Journal, or if they affect any of the Accounts Receivable or Accounts Payable subsidiary ledger accounts. Apart from these transactions, totals of the special journals are taken at the end of the month and then posted to the appropriate accounts. The company uses a periodic inventory system.

In practice, the company would be required to collect and pay Goods and Services Tax (GST) on its sales and purchases. However, for the purposes of this exercise, GST has been excluded.

Please Note: All amounts in this practice set should be rounded off to the nearest dollar.

Question

So that's all the information give to tell us, we have to calculate the unknown data.

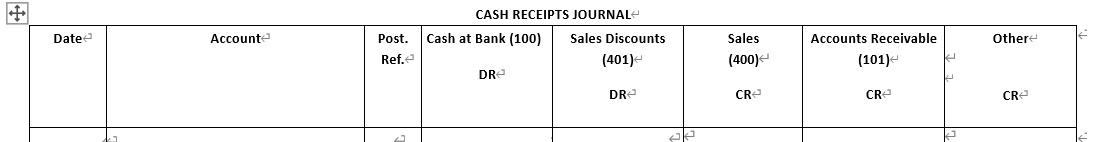

Write the CASH RECEIPTS JOURNAL AND GENERAL JOURNEY by this format.

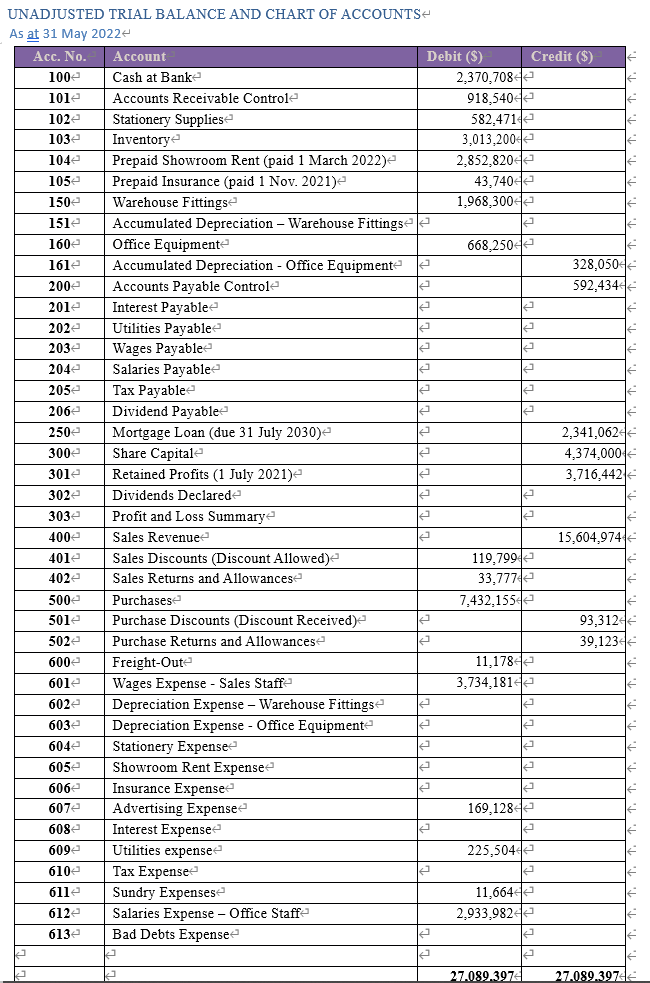

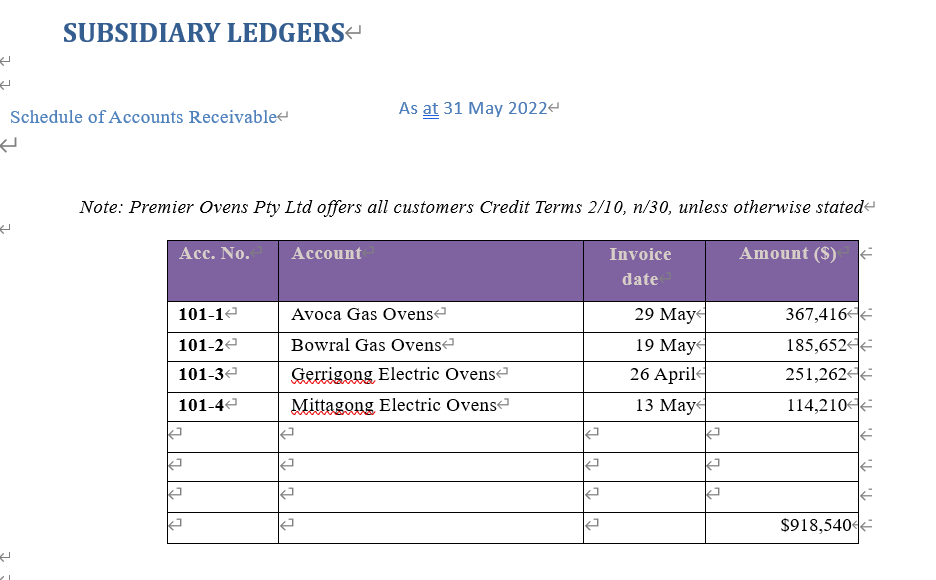

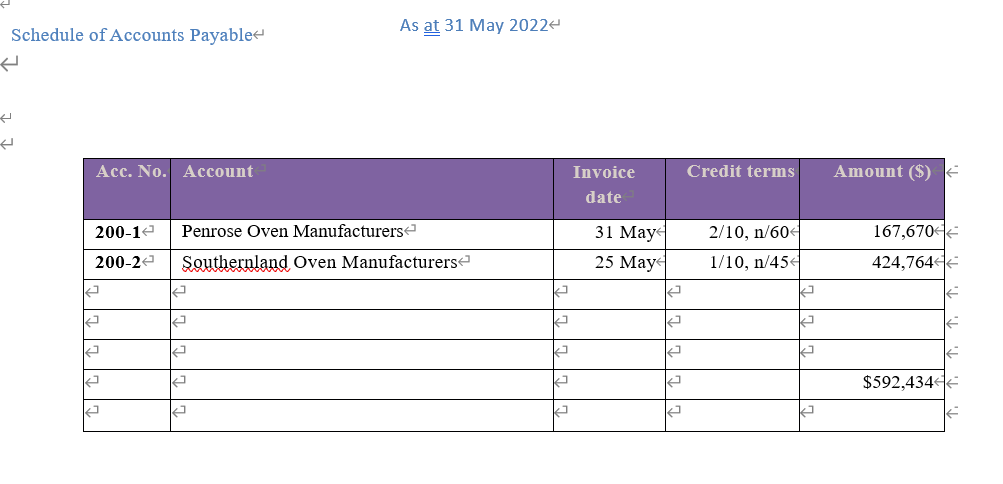

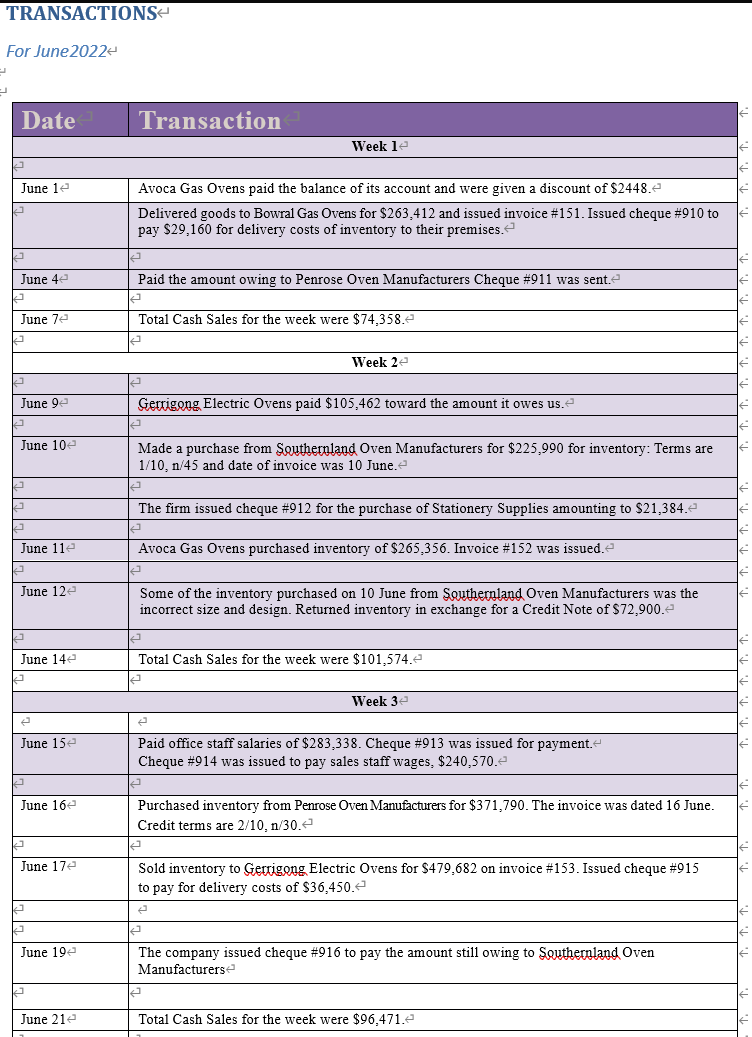

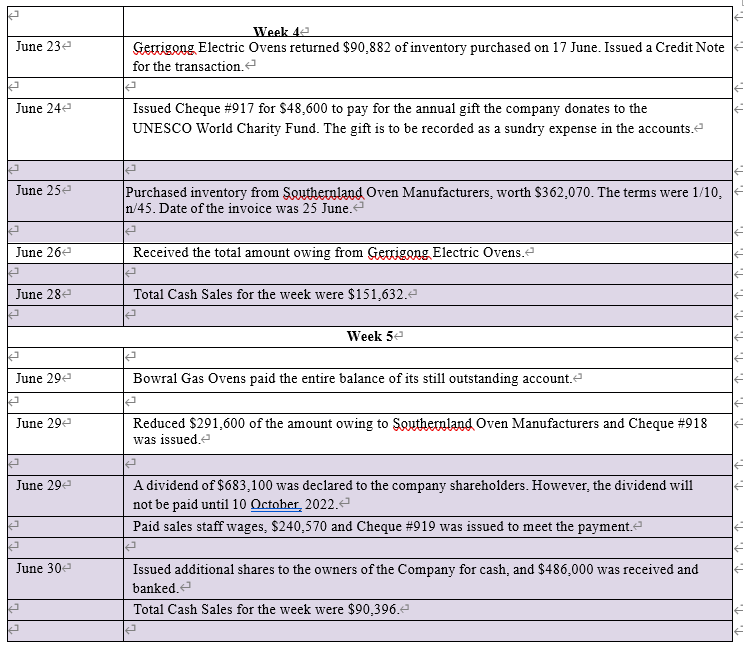

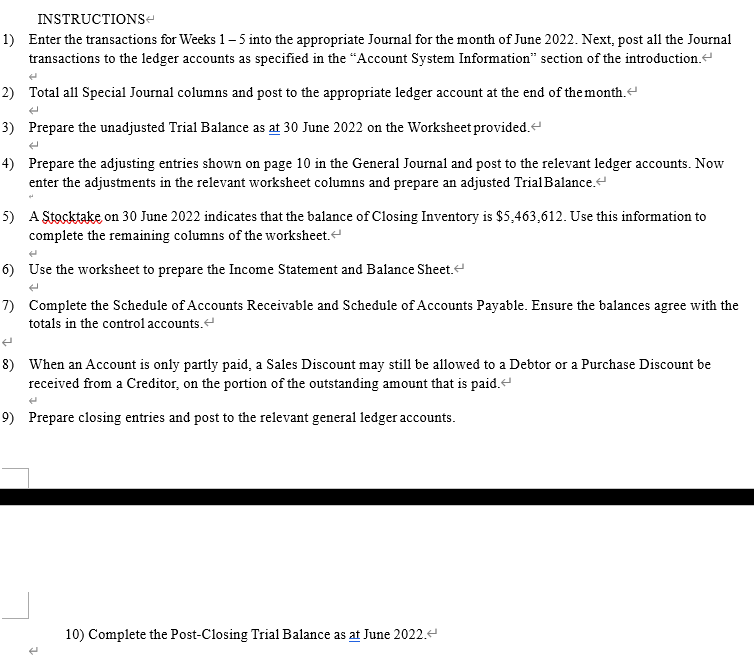

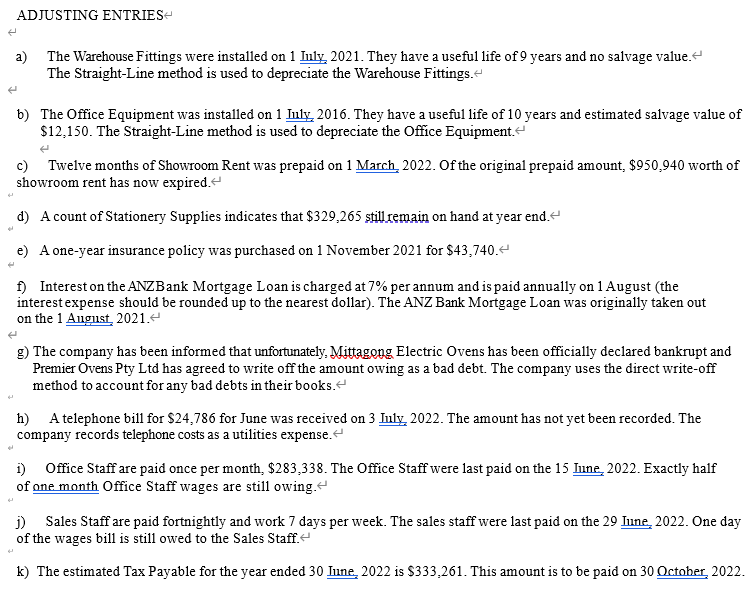

1042 161 UNADJUSTED TRIAL BALANCE AND CHART OF ACCOUNTS As at 31 May 2022 Acc. No. Account Debit (S) Credit ($) 100 Cash at Banke 2,370,7084 1012 Accounts Receivable Controle 918,54042 102 Stationery Suppliese 582,471 1032 Inventory 3,013,2004 Prepaid Showroom Rent (paid 1 March 2022) 2,852,8204 105 Prepaid Insurance (paid 1 Nov. 2021) 43,74042 150 Warehouse Fittings 1,968,3004 151e Accumulated Depreciation - Warehouse Fittingsel 1602 Office Equipment 668,25042 Accumulated Depreciation - Office Equipment 328,050 200 Accounts Payable Controle 592.434 2012 Interest Payable 2022 Utilities Payable 203e Wages Payable 204 Salaries Payable 205 Tax Payable 2062 Dividend Payable 250 Mortgage Loan (due 31 July 2030) 2,341,0624 3002 Share Capital 4,374,000 301e Retained Profits (1 July 2021) 3,716,442 302e Dividends Declarede 3032 Profit and Loss Summary 4002 Sales Revenuee 15,604,974 401e Sales Discounts (Discount Allowed) 119.799 4022 Sales Returns and Allowancese 33,7774 500 Purchasese 7.432.15542 501e Purchase Discounts (Discount Received) 93,312 5022 Purchase Returns and Allowancese 39,1234 600 Freight-Oute 11,1784 601e Wages Expense - Sales Staff 3,734,18142 602e Depreciation Expense - Warehouse Fittings Depreciation Expense - Office Equipment 604 Stationery Expense 6052 Showroom Rent Expense 6062 Insurance Expense 607e Advertising Expensee 169.1282 608 Interest Expensee 609 Utilities expensee 225,5044 6102 Tax Expense olle Sundry Expenses 11,6644 6122 Salaries Expense - Office Staff 2,933,98242 613 Bad Debts Expense 603e 27.089.3974 27.089.3974! SUBSIDIARY LEDGERSH 2 Schedule of Accounts Receivable As at 31 May 2022 Note: Premier Ovens Pty Ltd offers all customers Credit Terms 2/10, n/30, unless otherwise stated N Acc. No. Account Amount ($) Invoice date 101-12 101-22 101-32 Avoca Gas Ovense Bowral Gas Ovense Gerrigong Electric Ovens Mittagong Electric Ovens 29 May 19 May 26 April 13 May 367,416 185,6524 251,262 101-42 114,2107 2 $918,540 2 Schedule of Accounts Payable As at 31 May 20224 Acc. No. Account Credit terms Amount ($) Invoice date 200-12 Penrose Oven Manufacturers 167,670 31 May 25 May 2/10, n/60 1/10, n 454 200-22 Southernland Oven Manufacturers 424,7644 ka le ke $592,4344 TRANSACTIONS For June 2022 Date Transaction Week 1 June 1e Avoca Gas Ovens paid the balance of its account and were given discount of $2448.2 Delivered goods to Bowral Gas Ovens for $263,412 and issued invoice #151. Issued cheque #910 to pay $29,160 for delivery costs of inventory to their premises. June 42 Paid the amount owing to Penrose Oven Manufacturers Cheque #911 was sente June 7e Total Cash Sales for the week were $74,358.2 Week 22 June 92 Gerrigong Electric Ovens paid $105,462 toward the amount it owes us.e June 10 Made a purchase from Southernland Oven Manufacturers for $225.990 for inventory: Terms are 1/10, n/45 and date of invoice was 10 June.e The firm issued cheque #912 for the purchase of Stationery Supplies amounting to $21,384.2 June 11e Avoca Gas Ovens purchased inventory of $265.356. Invoice #152 was issuede June 12e Some of the inventory purchased on 10 June from Southernland Oven Manufacturers was the incorrect size and design. Returned inventory in exchange for a Credit Note of $72,900.- June 14e Total Cash Sales for the week were $ 101,574.2 Week 3e June 15e Paid office staff salaries of $283,338. Cheque #913 was issued for payment. Cheque #914 was issued to pay sales staff wages, $240,570.2 June 16e Purchased inventory from Penrose Oven Manufacturers for $371,790. The invoice was dated 16 June. Credit terms are 2/10, n/30. June 17e Sold inventory to Gerrigong Electric Ovens for $479,682 on invoice #153. Issued cheque #915 to pay for delivery costs of $36,450.- June 192 The company issued cheque #916 to pay the amount still owing to Southernland Oven Manufacturers June 21e Total Cash Sales for the week were $96,471.e June 23e Week 4 Gerrigong Electric Ovens returned $90.882 of inventory purchased on 17 June. Issued a Credit Note for the transaction. June 24e Issued Cheque #917 for $48.600 to pay for the annual gift the company donates to the UNESCO World Charity Fund. The gift is to be recorded as a sundry expense in the accounts. June 25e Purchased inventory from Southernland Oven Manufacturers, worth $362.070. The terms were 1/10, n/45. Date of the invoice was 25 June. June 26 Received the total amount owing from Gerrigong Electric Ovens. June 28 Total Cash Sales for the week were $151,632. Week 5e June 29 Bowral Gas Ovens paid the entire balance of its still outstanding accounte June 29 Reduced $291,600 of the amount owing to Southernland Oven Manufacturers and Cheque #918 was issuede June 29 A dividend of $683,100 was declared to the company shareholders. However, the dividend will not be paid until 10 October 2022. Paid sales staff wages. $240,570 and Cheque #919 was issued to meet the paymente T. June 302 Issued additional shares to the owners of the Company for cash, and $486,000 was received and bankede Total Cash Sales for the week were $90,396. INSTRUCTIONS 1) Enter the transactions for Weeks 1 - 5 into the appropriate Journal for the month of June 2022. Next, post all the Journal transactions to the ledger accounts as specified in the "Account System Information" section of the introduction. 2) Total all Special Journal columns and post to the appropriate ledger account at the end of the month. 3) Prepare the unadjusted Trial Balance as at 30 June 2022 on the Worksheet provided. 4) Prepare the adjusting entries shown on page 10 in the General Journal and post to the relevant ledger accounts. Now enter the adjustments in the relevant worksheet columns and prepare an adjusted TrialBalance. 5) A Stocktake on 30 June 2022 indicates that the balance of Closing Inventory is $5,463,612. Use this information to complete the remaining columns of the worksheet. 6) Use the worksheet to prepare the Income Statement and Balance Sheet 7) Complete the Schedule of Accounts Receivable and Schedule of Accounts Payable. Ensure the balances agree with the totals in the control accounts. 8) When an Account is only partly paid, a Sales Discount may still be allowed to a Debtor or a Purchase Discount be received from a Creditor, on the portion of the outstanding amount that is paid. 9) Prepare closing entries and post to the relevant general ledger accounts. 10) Complete the Post-Closing Trial Balance as at June 2022. ADJUSTING ENTRIES a) The Warehouse Fittings were installed on 1 Iuly 2021. They have a useful life of 9 years and no salvage value. The Straight-Line method is used to depreciate the Warehouse Fittings. b) The Office Equipment was installed on 1 July 2016. They have a useful life of 10 years and estimated salvage value of $12,150. The Straight-Line method is used to depreciate the Office Equipment. c) Twelve months of Showroom Rent was prepaid on 1 March 2022. Of the original prepaid amount. $950.940 worth of showroom rent has now expired. d) A count of Stationery Supplies indicates that $329,265 still remain on hand at year end. e) A one-year insurance policy was purchased on 1 November 2021 for $43,740. f) Interest on the ANZBank Mortgage Loan is charged at 7% per annum and is paid annually on 1 August (the interest expense should be rounded up to the nearest dollar). The ANZ Bank Mortgage Loan was originally taken out on the 1 August, 2021. g) The company has been informed that unfortunately, Mittagong Electric Ovens has been officially declared bankrupt and Premier Ovens Pty Ltd has agreed to write off the amount owing as a bad debt. The company uses the direct write-off method to account for any bad debts in their books. h) A telephone bill for $24.786 for June was received on 3 July, 2022. The amount has not yet been recorded. The company records telephone costs as a utilities expense. i) Office Staff are paid once per month, $283,338. The Office Staff were last paid on the 15 Iune 2022. Exactly half of one month Office Staff wages are still owing. j) Sales Staff are paid fortnightly and work 7 days per week. The sales staff were last paid on the 29 June 2022. One day of the wages bill is still owed to the Sales Staff. k) The estimated Tax Payable for the year ended 30 June 2022 is $333,261. This amount is to be paid on 30 October, 2022. CASH RECEIPTS JOURNAL Datee Account Cash at Bank (100) Other Post. Ref. Sales Discounts (401) Sales (400) Accounts Receivable (101) DR DR cre CR cre General Journal Date Account Post Ref. Debit Credite 1042 161 UNADJUSTED TRIAL BALANCE AND CHART OF ACCOUNTS As at 31 May 2022 Acc. No. Account Debit (S) Credit ($) 100 Cash at Banke 2,370,7084 1012 Accounts Receivable Controle 918,54042 102 Stationery Suppliese 582,471 1032 Inventory 3,013,2004 Prepaid Showroom Rent (paid 1 March 2022) 2,852,8204 105 Prepaid Insurance (paid 1 Nov. 2021) 43,74042 150 Warehouse Fittings 1,968,3004 151e Accumulated Depreciation - Warehouse Fittingsel 1602 Office Equipment 668,25042 Accumulated Depreciation - Office Equipment 328,050 200 Accounts Payable Controle 592.434 2012 Interest Payable 2022 Utilities Payable 203e Wages Payable 204 Salaries Payable 205 Tax Payable 2062 Dividend Payable 250 Mortgage Loan (due 31 July 2030) 2,341,0624 3002 Share Capital 4,374,000 301e Retained Profits (1 July 2021) 3,716,442 302e Dividends Declarede 3032 Profit and Loss Summary 4002 Sales Revenuee 15,604,974 401e Sales Discounts (Discount Allowed) 119.799 4022 Sales Returns and Allowancese 33,7774 500 Purchasese 7.432.15542 501e Purchase Discounts (Discount Received) 93,312 5022 Purchase Returns and Allowancese 39,1234 600 Freight-Oute 11,1784 601e Wages Expense - Sales Staff 3,734,18142 602e Depreciation Expense - Warehouse Fittings Depreciation Expense - Office Equipment 604 Stationery Expense 6052 Showroom Rent Expense 6062 Insurance Expense 607e Advertising Expensee 169.1282 608 Interest Expensee 609 Utilities expensee 225,5044 6102 Tax Expense olle Sundry Expenses 11,6644 6122 Salaries Expense - Office Staff 2,933,98242 613 Bad Debts Expense 603e 27.089.3974 27.089.3974! SUBSIDIARY LEDGERSH 2 Schedule of Accounts Receivable As at 31 May 2022 Note: Premier Ovens Pty Ltd offers all customers Credit Terms 2/10, n/30, unless otherwise stated N Acc. No. Account Amount ($) Invoice date 101-12 101-22 101-32 Avoca Gas Ovense Bowral Gas Ovense Gerrigong Electric Ovens Mittagong Electric Ovens 29 May 19 May 26 April 13 May 367,416 185,6524 251,262 101-42 114,2107 2 $918,540 2 Schedule of Accounts Payable As at 31 May 20224 Acc. No. Account Credit terms Amount ($) Invoice date 200-12 Penrose Oven Manufacturers 167,670 31 May 25 May 2/10, n/60 1/10, n 454 200-22 Southernland Oven Manufacturers 424,7644 ka le ke $592,4344 TRANSACTIONS For June 2022 Date Transaction Week 1 June 1e Avoca Gas Ovens paid the balance of its account and were given discount of $2448.2 Delivered goods to Bowral Gas Ovens for $263,412 and issued invoice #151. Issued cheque #910 to pay $29,160 for delivery costs of inventory to their premises. June 42 Paid the amount owing to Penrose Oven Manufacturers Cheque #911 was sente June 7e Total Cash Sales for the week were $74,358.2 Week 22 June 92 Gerrigong Electric Ovens paid $105,462 toward the amount it owes us.e June 10 Made a purchase from Southernland Oven Manufacturers for $225.990 for inventory: Terms are 1/10, n/45 and date of invoice was 10 June.e The firm issued cheque #912 for the purchase of Stationery Supplies amounting to $21,384.2 June 11e Avoca Gas Ovens purchased inventory of $265.356. Invoice #152 was issuede June 12e Some of the inventory purchased on 10 June from Southernland Oven Manufacturers was the incorrect size and design. Returned inventory in exchange for a Credit Note of $72,900.- June 14e Total Cash Sales for the week were $ 101,574.2 Week 3e June 15e Paid office staff salaries of $283,338. Cheque #913 was issued for payment. Cheque #914 was issued to pay sales staff wages, $240,570.2 June 16e Purchased inventory from Penrose Oven Manufacturers for $371,790. The invoice was dated 16 June. Credit terms are 2/10, n/30. June 17e Sold inventory to Gerrigong Electric Ovens for $479,682 on invoice #153. Issued cheque #915 to pay for delivery costs of $36,450.- June 192 The company issued cheque #916 to pay the amount still owing to Southernland Oven Manufacturers June 21e Total Cash Sales for the week were $96,471.e June 23e Week 4 Gerrigong Electric Ovens returned $90.882 of inventory purchased on 17 June. Issued a Credit Note for the transaction. June 24e Issued Cheque #917 for $48.600 to pay for the annual gift the company donates to the UNESCO World Charity Fund. The gift is to be recorded as a sundry expense in the accounts. June 25e Purchased inventory from Southernland Oven Manufacturers, worth $362.070. The terms were 1/10, n/45. Date of the invoice was 25 June. June 26 Received the total amount owing from Gerrigong Electric Ovens. June 28 Total Cash Sales for the week were $151,632. Week 5e June 29 Bowral Gas Ovens paid the entire balance of its still outstanding accounte June 29 Reduced $291,600 of the amount owing to Southernland Oven Manufacturers and Cheque #918 was issuede June 29 A dividend of $683,100 was declared to the company shareholders. However, the dividend will not be paid until 10 October 2022. Paid sales staff wages. $240,570 and Cheque #919 was issued to meet the paymente T. June 302 Issued additional shares to the owners of the Company for cash, and $486,000 was received and bankede Total Cash Sales for the week were $90,396. INSTRUCTIONS 1) Enter the transactions for Weeks 1 - 5 into the appropriate Journal for the month of June 2022. Next, post all the Journal transactions to the ledger accounts as specified in the "Account System Information" section of the introduction. 2) Total all Special Journal columns and post to the appropriate ledger account at the end of the month. 3) Prepare the unadjusted Trial Balance as at 30 June 2022 on the Worksheet provided. 4) Prepare the adjusting entries shown on page 10 in the General Journal and post to the relevant ledger accounts. Now enter the adjustments in the relevant worksheet columns and prepare an adjusted TrialBalance. 5) A Stocktake on 30 June 2022 indicates that the balance of Closing Inventory is $5,463,612. Use this information to complete the remaining columns of the worksheet. 6) Use the worksheet to prepare the Income Statement and Balance Sheet 7) Complete the Schedule of Accounts Receivable and Schedule of Accounts Payable. Ensure the balances agree with the totals in the control accounts. 8) When an Account is only partly paid, a Sales Discount may still be allowed to a Debtor or a Purchase Discount be received from a Creditor, on the portion of the outstanding amount that is paid. 9) Prepare closing entries and post to the relevant general ledger accounts. 10) Complete the Post-Closing Trial Balance as at June 2022. ADJUSTING ENTRIES a) The Warehouse Fittings were installed on 1 Iuly 2021. They have a useful life of 9 years and no salvage value. The Straight-Line method is used to depreciate the Warehouse Fittings. b) The Office Equipment was installed on 1 July 2016. They have a useful life of 10 years and estimated salvage value of $12,150. The Straight-Line method is used to depreciate the Office Equipment. c) Twelve months of Showroom Rent was prepaid on 1 March 2022. Of the original prepaid amount. $950.940 worth of showroom rent has now expired. d) A count of Stationery Supplies indicates that $329,265 still remain on hand at year end. e) A one-year insurance policy was purchased on 1 November 2021 for $43,740. f) Interest on the ANZBank Mortgage Loan is charged at 7% per annum and is paid annually on 1 August (the interest expense should be rounded up to the nearest dollar). The ANZ Bank Mortgage Loan was originally taken out on the 1 August, 2021. g) The company has been informed that unfortunately, Mittagong Electric Ovens has been officially declared bankrupt and Premier Ovens Pty Ltd has agreed to write off the amount owing as a bad debt. The company uses the direct write-off method to account for any bad debts in their books. h) A telephone bill for $24.786 for June was received on 3 July, 2022. The amount has not yet been recorded. The company records telephone costs as a utilities expense. i) Office Staff are paid once per month, $283,338. The Office Staff were last paid on the 15 Iune 2022. Exactly half of one month Office Staff wages are still owing. j) Sales Staff are paid fortnightly and work 7 days per week. The sales staff were last paid on the 29 June 2022. One day of the wages bill is still owed to the Sales Staff. k) The estimated Tax Payable for the year ended 30 June 2022 is $333,261. This amount is to be paid on 30 October, 2022. CASH RECEIPTS JOURNAL Datee Account Cash at Bank (100) Other Post. Ref. Sales Discounts (401) Sales (400) Accounts Receivable (101) DR DR cre CR cre General Journal Date Account Post Ref. Debit CrediteStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started