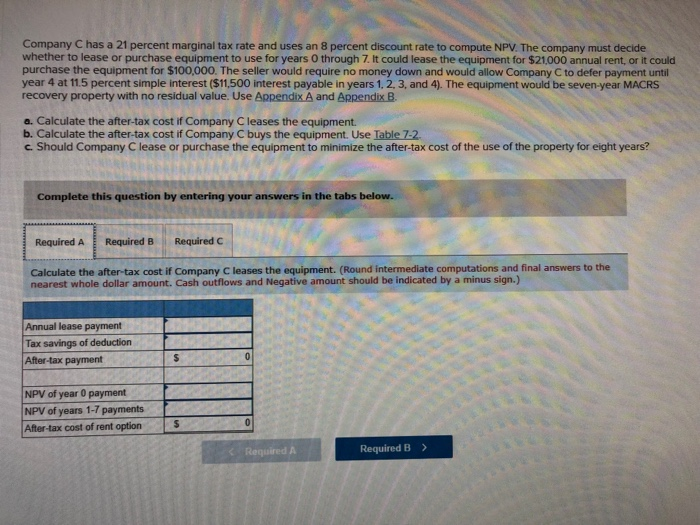

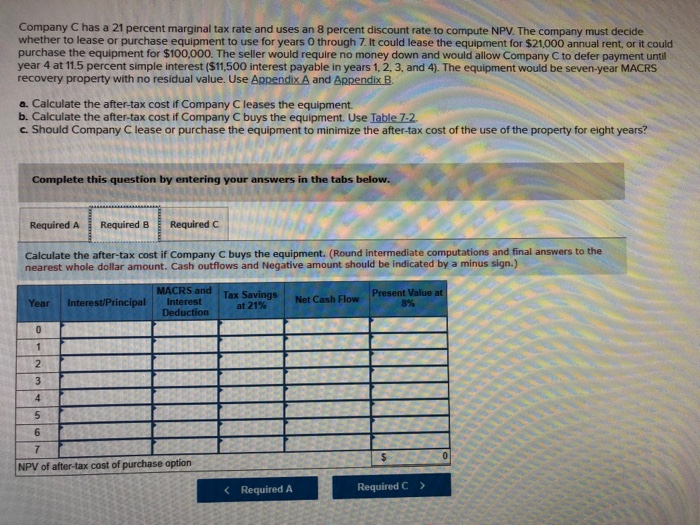

Company C has a 21 percent marginal tax rate and uses an 8 percent discount rate to compute NPV. The company must decide whether to lease or purchase equipment to use for years 0 through t could lease the equipment for $21,000 annual rent, or it could purchase the equipment for $100,000. The seller would require no money down and would allow Company C to defer payment until year 4 at 11.5 percent simple interest ($11,500 interest payable in years 1.2,3, and 4). The equipment would be seven-year MACRS recovery property with no residual value. Use Appendix A and Appendix B. o. Calculate the after-tax cost if Company C leases the equipment. b. Calculate the after-tax cost if Company C buys the equipment. Use Table 7-2. c. Should Company C lease or purchase the equipment to minimize the after-tax cost of the use of the property for eight years? Complete this question by entering your answers in the tabs below. Required A Required B Required C Calculate the after-tax cost if Company C leases the equipment. (Round intermediate computations and final answers to the nearest whole dollar amount. Cash outflows and Negative amount should be indicated by a minus sign.) Annual lease payment Tax savings of deduction After-tax payment NPV of year 0 payment NPV of years 1-7 payments After-tax cost of rent optionS Required B Company C has a 21 percent marginal tax rate and uses an 8 percent discount rate to compute NPV. The company must decide whether to lease or purchase equipment to use for years 0 through 7. It could lease the equipment for S21,000 annual rent, or it could purchase the equipment for $100,000. The seller would require no money down and would allow Company C to defer payment untl year 4 at 11.5 percent simple interest ($11,500 interest payable in years 1, 2, 3, and 4). The equipment would be seven-year MACRS recovery property with no residual value. Use Appendix A and Appendix B o. Calculate the after-tax cost if Company C leases the equipment b. Calculate the after-tax cost if Company C buys the equipment. Use Table 7-2 c. Should Company C lease or purchase the equipment to minimize the after-tax cost of the use of the property for eight years? Complete this question by entering your answers in the tabs below. Required A Required BRequired C Calculate the after-tax cost if Company C buys the equipment. (Round intermediate computations and final answers to the nearest whole dollar amount. Cash outflows and Negative amount should be indicated by a minus sign.) Present Value at 8% MACRS and lax Savings Net Cash Flow Year Interest/Principal Interest at21%s! NPV of after-tax cost of purchase option Company C has a 21 percent marginal tax rate and uses an 8 percent discount rate to compute NPV. The company must decide whether to lease or purchase equipment to use for years O through 7. It could lease the equipment for $21,000 annual rent, or it could purchase the equipment for $100,000. The seller would require no money down and would allow Company C to defer payment until year 4 at 11.5 percent simple interest ($11,500 interest payable in years 1. 2, 3, and 4). The equipment would be seven-year MACRS recovery property with no residual value. Use ARpendix A and Appendix B. a. Calculate the after-tax cost if Company C leases the equipment b. Calculate the after-tax cost if Company C buys the equipment. Use Table 7-2 c. Should Company C lease or purchase the equipment to minimize the after-tax cost of the use of the property for eight years? Complete this question by entering your answers in the tabs below. Required A Required BRequired C Should Company C lease or purchase the equipment to minimize the after-tax cost of the use of the property for eight years? OPurchase the equipmernt Lease the equipment Required B