Question

Company D has sold a put option of 100,000 euros for speculative purposes. Assume that Company D will sell the euros received at the

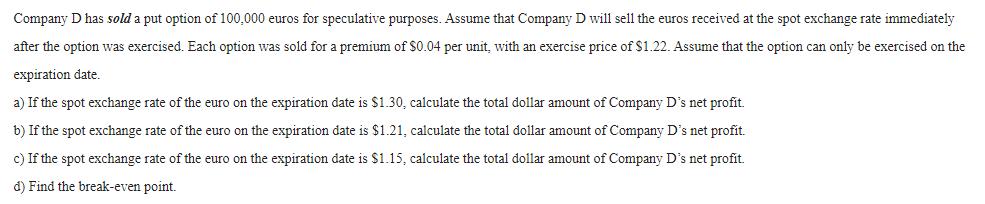

Company D has sold a put option of 100,000 euros for speculative purposes. Assume that Company D will sell the euros received at the spot exchange rate immediately after the option was exercised. Each option was sold for a premium of $0.04 per unit, with an exercise price of $1.22. Assume that the option can only be exercised on the expiration date. a) If the spot exchange rate of the euro on the expiration date is $1.30, calculate the total dollar amount of Company D's net profit. b) If the spot exchange rate of the euro on the expiration date is $1.21, calculate the total dollar amount of Company D's net profit. c) If the spot exchange rate of the euro on the expiration date is $1.15, calculate the total dollar amount of Company D's net profit. d) Find the break-even point.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International financial management

Authors: Jeff Madura

9th Edition

978-0324593495, 324568207, 324568193, 032459349X, 9780324568202, 9780324568196, 978-0324593471

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App