Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company FIN3610-ETRA just launched a new project. The required return is 11% The project will last for 3 years. Every year, the revenues generated from

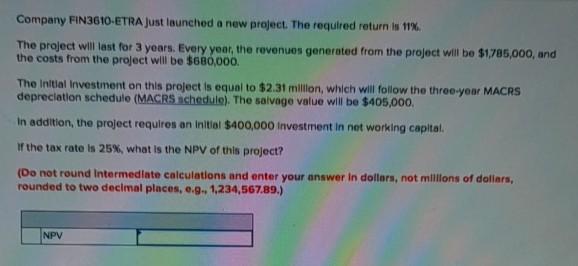

Company FIN3610-ETRA just launched a new project. The required return is 11% The project will last for 3 years. Every year, the revenues generated from the project will be $1,785,000, and the costs from the project will be $680,000. The initial Investment on this project is equal to $2.31 milion, which will follow the three year MACRS depreciation schedule (MACRS schedule). The salvage value will be $405,000 In addition, the project requires an initial $400,000 investment in net working capital If the tax rate is 25%, what is the NPV of this project? (Do not round Intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to two decimal places, e... 1,234,567.89.) NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started