Question

Company has become the subject of a takeover offer. The Companys current share price is $12.40 per share, and shareholders have been offered $17.00 per

Company has become the subject of a takeover offer. The Company’s current share price is $12.40 per share, and shareholders have been offered $17.00 per share.

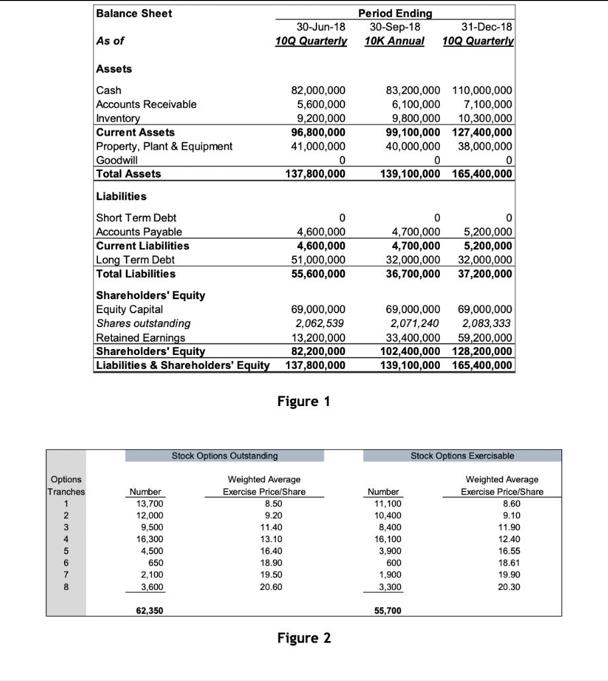

Calculate the fully diluted shares outstanding given the following information about the Company from Figure 1 and Figure 2 below and the fact that the Company has convertible bonds outstanding with the following financial statement note regarding the bonds:

“the Company has outstanding $10 million of 5.25% convertible notes which are included in Long-term debt on the Balance Sheet.

The notes are payable in cash at maturity unless holders exercise their option to convert the notes into shares of common stock.

The initial conversion rate, provided under the terms of the Notes, is 76.9231 shares of common stock per $1,000 principal amount of notes.”

Options Tranches 1 2 3 4 8 Balance Sheet As of Assets Cash Accounts Receivable Inventory Current Assets Property, Plant & Equipment Goodwill Total Assets Liabilities Short Term Debt Accounts Payable Current Liabilities Long Term Debt Total Liabilities Shareholders' Equity Equity Capital Shares outstanding Retained Earnings Number 13,700 12,000 9,500 16,300 4,500 650 2,100 3,600 30-Jun-18 10Q Quarterly 62,350 Stock Options Outstanding Shareholders' Equity Liabilities & Shareholders' Equity 137,800,000 Figure 1 82,000,000 5,600,000 9,200,000 96,800,000 41,000,000 137,800,000 8.50 9.20 11.40 13.10 16.40 18.90 19.50 20.60 Weighted Average Exercise Price/Share 0 4,600,000 4,600,000 51,000,000 55,600,000 0 69,000,000 2,062,539 13,200,000 82,200,000 Figure 2 Period Ending 30-Sep-18 31-Dec-18 10K Annual 10Q Quarterly 83,200,000 110,000,000 6,100,000 7,100,000 9,800,000 10,300,000 99,100,000 127,400,000 40,000,000 38,000,000 165,400,000 0 139,100,000 0 0 4,700,000 5,200,000 4,700,000 5,200,000 32,000,000 32,000,000 36,700,000 37,200,000 55,700 69,000,000 69,000,000 2,071,240 2,083,333 33,400,000 59,200,000 102,400,000 128,200,000 139,100,000 165,400,000 Stock Options Exercisable Weighted Average Number Exercise Price/Share 11,100 8.60 10,400 9.10 8,400 11.90 IT 16,100 12.40 3,900 16.55 600 18.61 1,900 19.90 3,300 20.30

Step by Step Solution

3.57 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the fully diluted shares outstanding we need to consider the additional shares that would be created if all convertibles and options were ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started