Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company is Lockheed Martin: Develop a specific recommendation, with supporting rationale , as to whether the assigned company's recent trends and results in financial performance

Company is Lockheed Martin:

Develop a specific recommendation, with supporting rationale, as to whether the assigned company's recent trends and results in financial performance is of sufficient financial strength, will THE COMPANY be financially sustainable over the next two to three years, and which steps should be done to improve its financial stability?

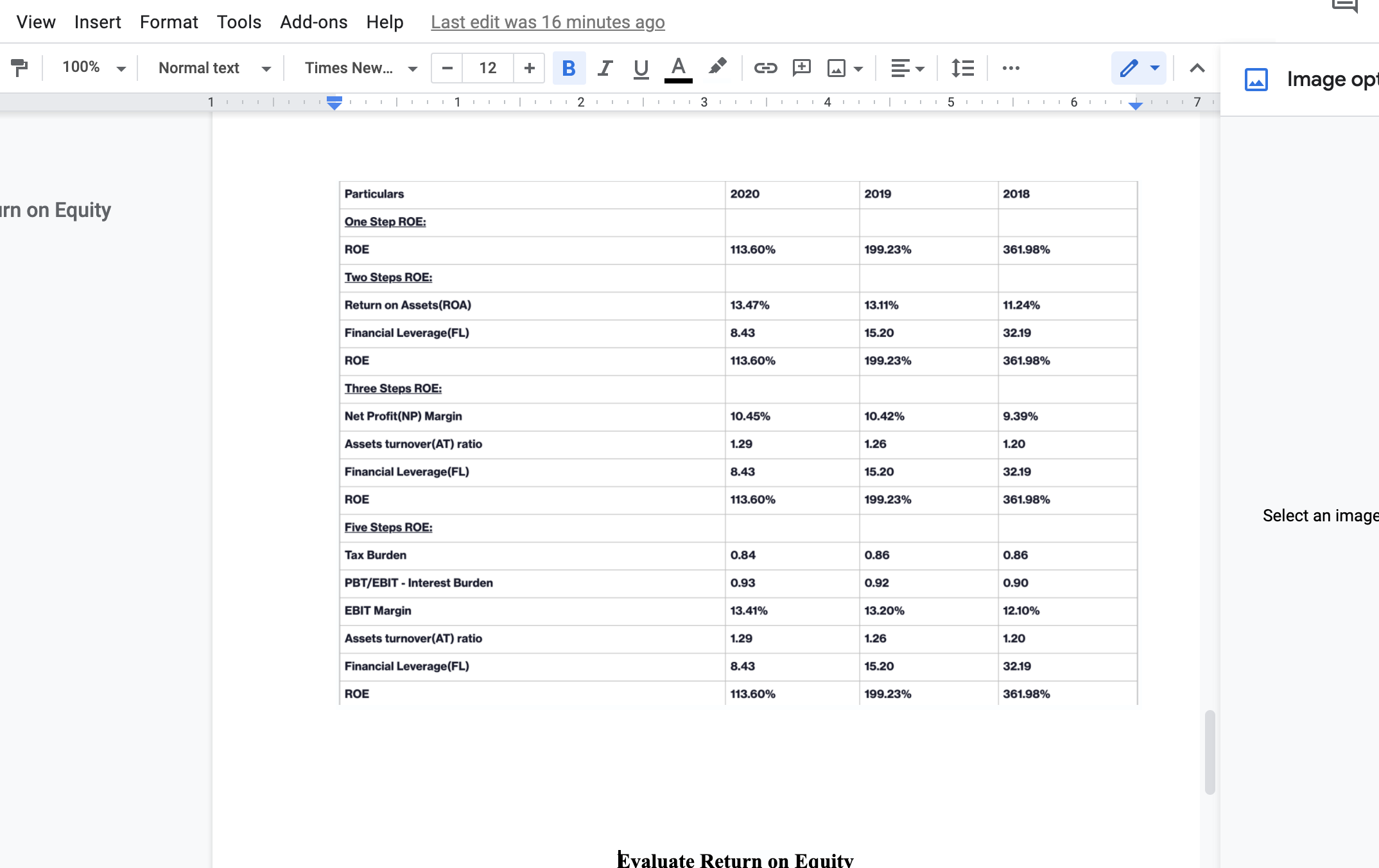

View Insert Format Tools Add-ons Help 100% rn on Equity Normal text 1 I I I T I Times New... I I I I T Particulars ROE | I One Step ROE: I ROE Last edit was 16 minutes ago BI UA - ROE Five Steps ROE: Tax Burden I 1 Two Steps ROE: Return on Assets(ROA) Financial Leverage (FL) I ROE Three Steps ROE: Net Profit(NP) Margin Assets turnover(AT) ratio Financial Leverage (FL) 12 I PBT/EBIT - Interest Burden EBIT Margin Assets turnover (AT) ratio Financial Leverage (FL) I T + I I I 2 I I I | I I I | 2020 113.60% 13.47% 8.43 113.60% 10.45% 1.29 8.43 113.60% 0.84 0.93 13.41% 1.29 8.43 113.60% A I I I 4 I Evaluate Return on Equity I I I 2019 199.23% 13.11% 15.20 199.23% 10.42% 1.26 15.20 199.23% 0.86 0.92 13.20% 1.26 15.20 199.23% I I t= 5 : I | I 2018 361.98% 11.24% 32.19 361.98% 9.39% 1.20 32.19 361.98% 0.86 0.90 I 12.10% 1.20 32.19 361.98% I 6 I I I 7 Image opt Select an image

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To evaluate the financial strength and sustainability of Lockheed Martin over the next two to three years lets analyze the companys recent trends and results in financial performance particularly focu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started