Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company J shows the following information on its 2020 income statement: Sales $200,000 Costs $110,000 Depreciation $9,000. Interest $14,000 a. The company's tax rate

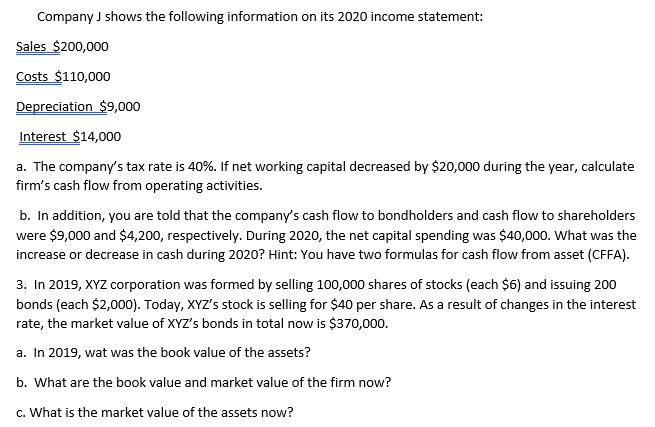

Company J shows the following information on its 2020 income statement: Sales $200,000 Costs $110,000 Depreciation $9,000. Interest $14,000 a. The company's tax rate is 40%. If net working capital decreased by $20,000 during the year, calculate firm's cash flow from operating activities. b. In addition, you are told that the company's cash flow to bondholders and cash flow to shareholders were $9,000 and $4,200, respectively. During 2020, the net capital spending was $40,000. What was the increase or decrease in cash during 2020? Hint: You have two formulas for cash flow from asset (CFFA). 3. In 2019, XYZ corporation was formed by selling 100,000 shares of stocks (each $6) and issuing 200 bonds (each $2,000). Today, XYZ's stock is selling for $40 per share. As a result of changes in the interest rate, the market value of XYZ's bonds in total now is $370,000. a. In 2019, wat was the book value of the assets? b. What are the book value and market value of the firm now? c. What is the market value of the assets now?

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the cash flow from operating activities we need to start with net income and make adjustments for noncash expenses and changes in worki...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started