Company : Lay Hong Berhad - use the latest annual report (2021)

Reference for the question as below :

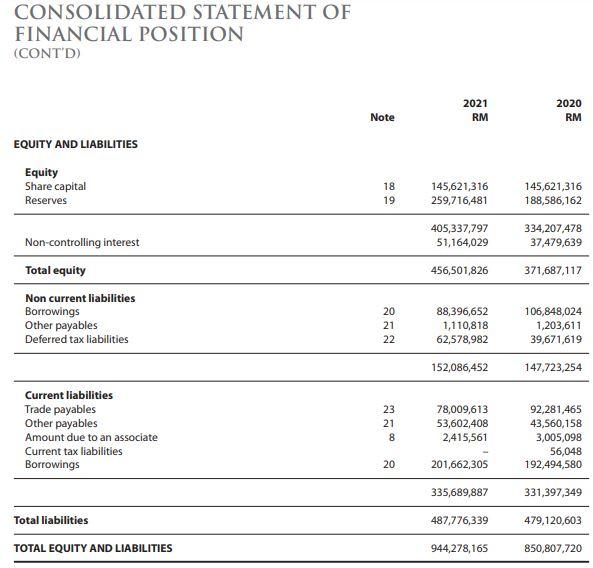

(1) Statement of financial position

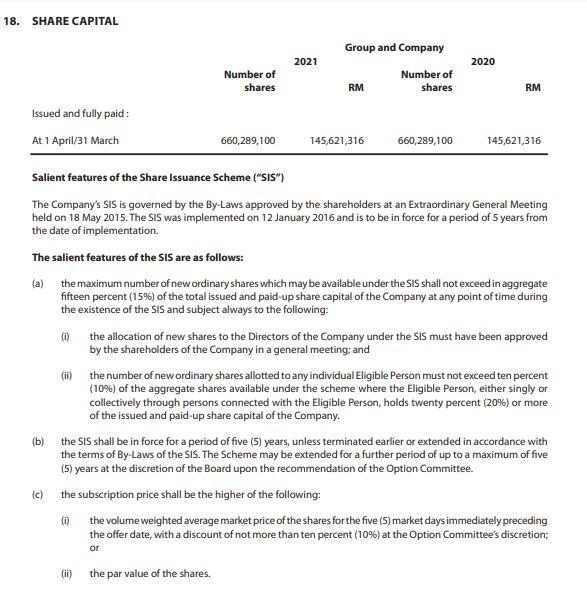

(2) Share Capital

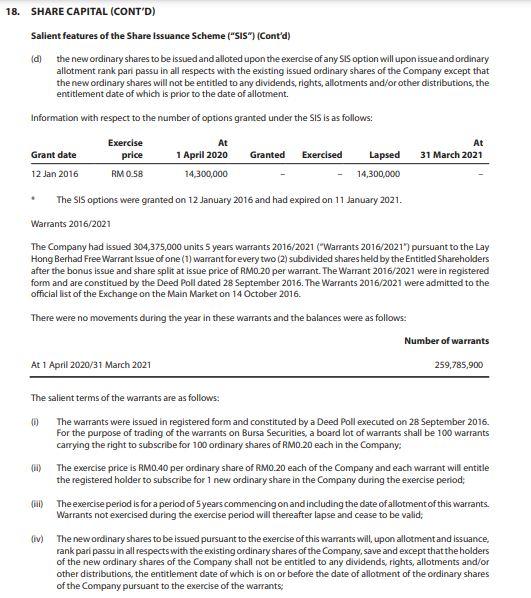

(3) Share Capital (CONT'D)

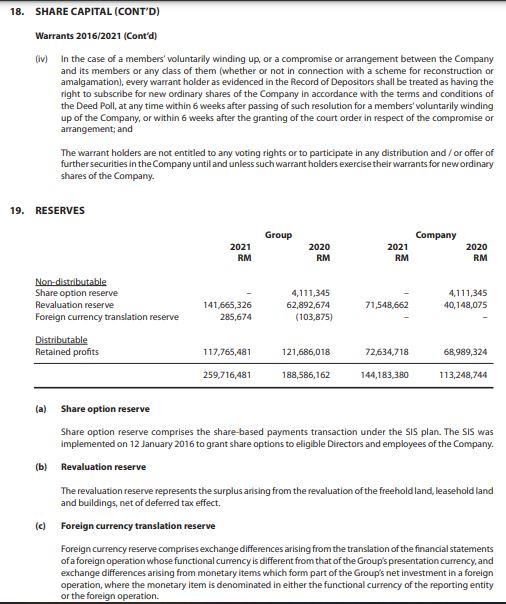

(4) Reserves

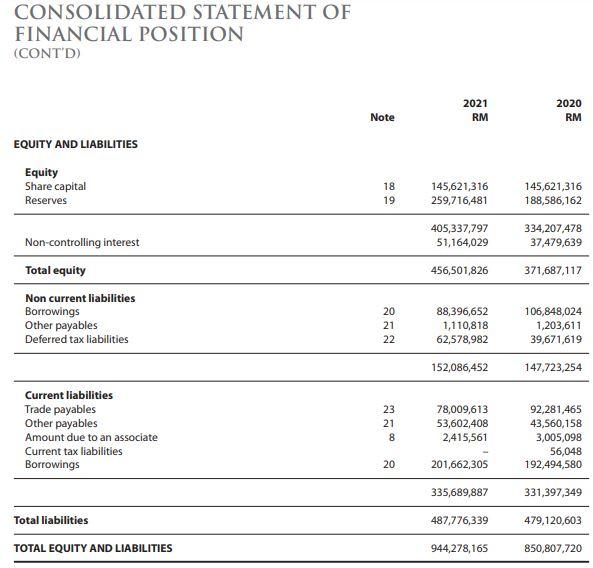

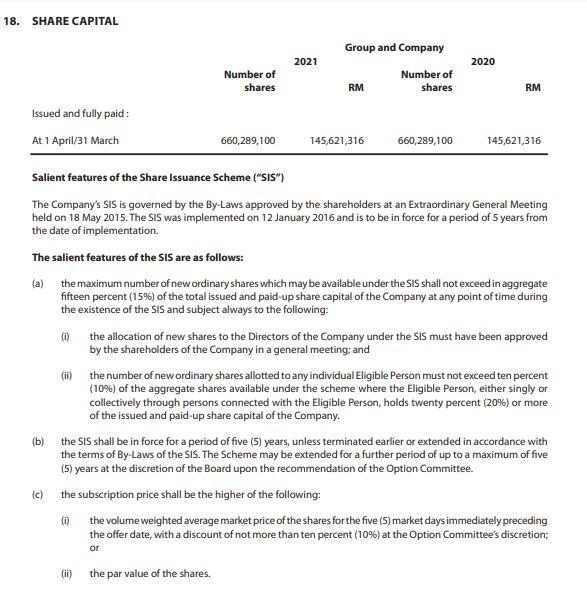

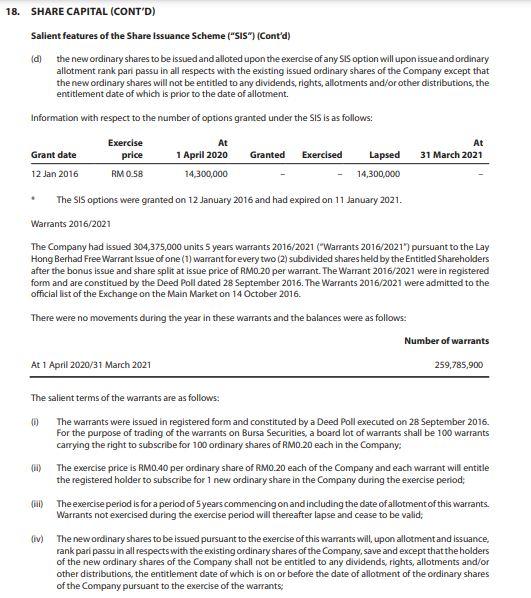

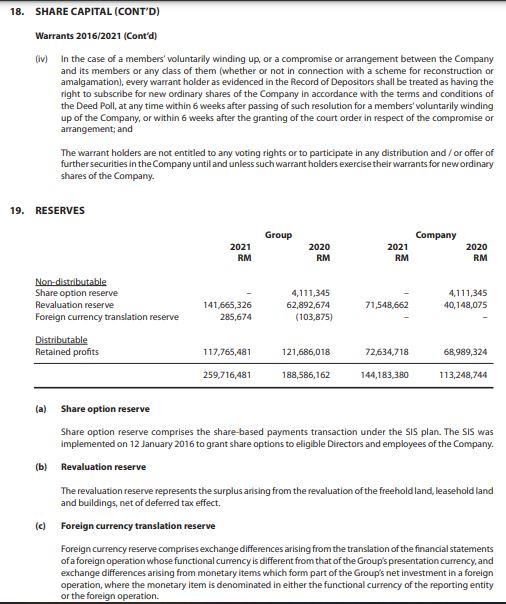

Task B: Assuming the interest rate is expected to increase by year 2023 in anticipation of the recovering economy and higher inflation rate, discuss the suitability of raising equity financing from the company's viewpoint. CONSOLIDATED STATEMENT OF FINANCIAL POSITION (CONTD) 2021 RM 2020 RM Note EQUITY AND LIABILITIES Equity Share capital Reserves 18 19 145,621,316 259,716,481 145,621,316 188,586,162 405,337,797 51,164,029 334,207,478 37,479,639 456,501,826 371,687,117 Non-controlling interest Total equity Non current liabilities Borrowings Other payables Deferred tax liabilities 20 21 22 88,396,652 1,110,818 62,578,982 106,848,024 1,203,611 39,671,619 152,086,452 147,723,254 23 21 Current liabilities Trade payables Other payables Am due to an associate Current tax liabilities Borrowings 78,009,613 53,602,408 2,415,561 92,281,465 43,560,158 3,005,098 56,048 192,494,580 20 201,662,305 335,689,887 331,397,349 487,776,339 479,120,603 Total liabilities TOTAL EQUITY AND LIABILITIES 944,278,165 850,807,720 18. SHARE CAPITAL Group and Company 2021 2020 Number of shares RM Number of shares RM Issued and fully paid: At 1 April/31 March 660,289,100 145,621,316 660,289,100 145,621,316 Salient features of the Share Issuance Scheme ("SIS) The Company's SiS is governed by the By-Laws approved by the shareholders at an Extraordinary General Meeting held on 18 May 2015. The SiS was implemented on 12 January 2016 and is to be in force for a period of 5 years from the date of implementation The salient features of the SIS are as follows: (a) the maximum number of new ordinary shares which may be available under the SIS shall not exceed in aggregate fifteen percent (15%) of the total issued and paid-up share capital of the Company at any point of time during the existence of the SIS and subject always to the following: () the allocation of new shares to the Directors of the Company under the SiS must have been approved by the shareholders of the Company in a general meeting, and the number of new ordinary shares allotted to any individual Eligible Person must not exceed ten percent (10%) of the aggregate shares available under the scheme where the Eligible Person, either singly or collectively through persons connected with the Eligible Person, holds twenty percent (20%) or more of the issued and paid-up share capital of the Company. (b) the SiS shall be in force for a period of five (5) years, unless terminated earlier or extended in accordance with the terms of By-Laws of the SIS. The Scheme may be extended for a further period of up to a maximum of five (5) years at the discretion of the Board upon the recommendation of the Option Committee. the subscription price shall be the higher of the following: (1) the volume weighted average market price of the shares for the five (5) market days immediately preceding the offer date, with a discount of not more than ten percent (10%) at the Option Committee's discretion: (ii) (c) or (ii) the par value of the shares. 18. SHARE CAPITAL (CONT'D) Salient features of the Share issuance Scheme ("S15") (Cont'd) (d) the new ordinary shares to be issued and alloted upon the exercise of any SIS option will upon issue and ordinary allotment rank pari passu in all respects with the existing issued ordinary shares of the Company except that the new ordinary shares will not be entitled to any dividends , rights, allotments and/or other distributions, the entitlement date of which is prior to the date of allotment. Information with respect to the number of options granted under the SIS is as follows: Grant date Exercise price RM 0.58 At 1 April 2020 Granted Exercised Lapsed At 31 March 2021 12 Jan 2016 14,300,000 14,300,000 The SiS options were granted on 12 January 2016 and had expired on 11 January 2021. Warrants 2016/2021 The Company had issued 304,375,000 units 5 years warrants 2016/2021 "Warrants 2016/2021) pursuant to the Lay Hong Berhad Free Warrant issue of one (1) warrant for every two (2) subdivided shares held by the Entitled Shareholders after the bonus issue and share split at issue price of RM0.20 per warrant. The Warrant 2016/2021 were in registered form and are constitued by the Deed Poll dated 28 September 2016. The Warrants 2016/2021 were admitted to the official list of the Exchange on the Main Market on 14 October 2016. There were no movements during the year in these warrants and the balances were as follows: Number of warrants At 1 April 2020/31 March 2021 259,785,900 The salient terms of the warrants are as follows: 0 The warrants were issued in registered form and constituted by a Deed Poll executed on 28 September 2016 For the purpose of trading of the warrants on Bursa Securities, a board lot of warrants shall be 100 warrants carrying the right to subscribe for 100 ordinary shares of RM0.20 each in the Company: 00) The exercise price is RM0.40 per ordinary share of RM0.20 each of the Company and each warrant will entitle the registered holder to subscribe for 1 new ordinary share in the Company during the exercise period (H) The exercise period is for a period of 5 years commencing on and including the date of allotment of this warrants. Warrants not exercised during the exercise period will thereafter lapse and cease to be valid, (iv) The new ordinary shares to be issued pursuant to the exercise of this warrants will, upon allotment and issuance. rank pari passu in all respects with the existing ordinary shares of the Company, save and except that the holders of the new ordinary shares of the Company shall not be entitled to any dividends, rights, allotments and/or other distributions, the entitlement date of which is on or before the date of allotment of the ordinary shares of the Company pursuant to the exercise of the warrants: 18. SHARE CAPITAL (CONT'D) Warrants 2016/2021 (Cont'd) (iv) In the case of a members' voluntarily winding up or a compromise or arrangement between the Company and its members or any class of them (whether or not in connection with a scheme for reconstruction or amalgamation), every warrant holder as evidenced in the Record of Depositors shall be treated as having the right to subscribe for new ordinary shares of the Company in accordance with the terms and conditions of the Deed Poll, at any time within 6 weeks after passing of such resolution for a members' voluntarily winding up of the Company, or within 6 weeks after the granting of the court order in respect of the compromise or arrangement and The warrant holders are not entitled to any voting rights or to participate in any distribution and/or offer of further securities in the Company until and unless such warrant holders exercise their warrants for new ordinary shares of the Company. 19. RESERVES Group Company 2021 RM 2020 RM 2021 RM 2020 RM Non-distributable Share option reserve Revaluation reserve Foreign currency translation reserve 4,111,345 62,892,674 (103,875) 4,111,345 40,148,075 141,665,326 285,674 71,548,662 Distributable Retained profits 117,765,481 121,686,018 72634,718 68,989,324 259,716,481 188,586,162 144,183,380 113,248,744 (a) Share option reserve Share option reserve comprises the share-based payments transaction under the sis plan. The SiS was implemented on 12 January 2016 to grant share options to eligible Directors and employees of the Company. (b) Revaluation reserve The revaluation reserve represents the surplus ansing from the revaluation of the freehold land, leasehold land and buildings, net of deferred tax effect. (c) Foreign currency translation reserve Foreign currency reserve comprises exchange differences arising from the translation of the financial statements of a foreign operation whose functional currency is different from that of the Group's presentation currency, and exchange differences arising from monetary items which form part of the Group's net investment in a foreign operation, where the monetary item is denominated in either the functional currency of the reporting entity or the foreign operation. Task B: Assuming the interest rate is expected to increase by year 2023 in anticipation of the recovering economy and higher inflation rate, discuss the suitability of raising equity financing from the company's viewpoint. CONSOLIDATED STATEMENT OF FINANCIAL POSITION (CONTD) 2021 RM 2020 RM Note EQUITY AND LIABILITIES Equity Share capital Reserves 18 19 145,621,316 259,716,481 145,621,316 188,586,162 405,337,797 51,164,029 334,207,478 37,479,639 456,501,826 371,687,117 Non-controlling interest Total equity Non current liabilities Borrowings Other payables Deferred tax liabilities 20 21 22 88,396,652 1,110,818 62,578,982 106,848,024 1,203,611 39,671,619 152,086,452 147,723,254 23 21 Current liabilities Trade payables Other payables Am due to an associate Current tax liabilities Borrowings 78,009,613 53,602,408 2,415,561 92,281,465 43,560,158 3,005,098 56,048 192,494,580 20 201,662,305 335,689,887 331,397,349 487,776,339 479,120,603 Total liabilities TOTAL EQUITY AND LIABILITIES 944,278,165 850,807,720 18. SHARE CAPITAL Group and Company 2021 2020 Number of shares RM Number of shares RM Issued and fully paid: At 1 April/31 March 660,289,100 145,621,316 660,289,100 145,621,316 Salient features of the Share Issuance Scheme ("SIS) The Company's SiS is governed by the By-Laws approved by the shareholders at an Extraordinary General Meeting held on 18 May 2015. The SiS was implemented on 12 January 2016 and is to be in force for a period of 5 years from the date of implementation The salient features of the SIS are as follows: (a) the maximum number of new ordinary shares which may be available under the SIS shall not exceed in aggregate fifteen percent (15%) of the total issued and paid-up share capital of the Company at any point of time during the existence of the SIS and subject always to the following: () the allocation of new shares to the Directors of the Company under the SiS must have been approved by the shareholders of the Company in a general meeting, and the number of new ordinary shares allotted to any individual Eligible Person must not exceed ten percent (10%) of the aggregate shares available under the scheme where the Eligible Person, either singly or collectively through persons connected with the Eligible Person, holds twenty percent (20%) or more of the issued and paid-up share capital of the Company. (b) the SiS shall be in force for a period of five (5) years, unless terminated earlier or extended in accordance with the terms of By-Laws of the SIS. The Scheme may be extended for a further period of up to a maximum of five (5) years at the discretion of the Board upon the recommendation of the Option Committee. the subscription price shall be the higher of the following: (1) the volume weighted average market price of the shares for the five (5) market days immediately preceding the offer date, with a discount of not more than ten percent (10%) at the Option Committee's discretion: (ii) (c) or (ii) the par value of the shares. 18. SHARE CAPITAL (CONT'D) Salient features of the Share issuance Scheme ("S15") (Cont'd) (d) the new ordinary shares to be issued and alloted upon the exercise of any SIS option will upon issue and ordinary allotment rank pari passu in all respects with the existing issued ordinary shares of the Company except that the new ordinary shares will not be entitled to any dividends , rights, allotments and/or other distributions, the entitlement date of which is prior to the date of allotment. Information with respect to the number of options granted under the SIS is as follows: Grant date Exercise price RM 0.58 At 1 April 2020 Granted Exercised Lapsed At 31 March 2021 12 Jan 2016 14,300,000 14,300,000 The SiS options were granted on 12 January 2016 and had expired on 11 January 2021. Warrants 2016/2021 The Company had issued 304,375,000 units 5 years warrants 2016/2021 "Warrants 2016/2021) pursuant to the Lay Hong Berhad Free Warrant issue of one (1) warrant for every two (2) subdivided shares held by the Entitled Shareholders after the bonus issue and share split at issue price of RM0.20 per warrant. The Warrant 2016/2021 were in registered form and are constitued by the Deed Poll dated 28 September 2016. The Warrants 2016/2021 were admitted to the official list of the Exchange on the Main Market on 14 October 2016. There were no movements during the year in these warrants and the balances were as follows: Number of warrants At 1 April 2020/31 March 2021 259,785,900 The salient terms of the warrants are as follows: 0 The warrants were issued in registered form and constituted by a Deed Poll executed on 28 September 2016 For the purpose of trading of the warrants on Bursa Securities, a board lot of warrants shall be 100 warrants carrying the right to subscribe for 100 ordinary shares of RM0.20 each in the Company: 00) The exercise price is RM0.40 per ordinary share of RM0.20 each of the Company and each warrant will entitle the registered holder to subscribe for 1 new ordinary share in the Company during the exercise period (H) The exercise period is for a period of 5 years commencing on and including the date of allotment of this warrants. Warrants not exercised during the exercise period will thereafter lapse and cease to be valid, (iv) The new ordinary shares to be issued pursuant to the exercise of this warrants will, upon allotment and issuance. rank pari passu in all respects with the existing ordinary shares of the Company, save and except that the holders of the new ordinary shares of the Company shall not be entitled to any dividends, rights, allotments and/or other distributions, the entitlement date of which is on or before the date of allotment of the ordinary shares of the Company pursuant to the exercise of the warrants: 18. SHARE CAPITAL (CONT'D) Warrants 2016/2021 (Cont'd) (iv) In the case of a members' voluntarily winding up or a compromise or arrangement between the Company and its members or any class of them (whether or not in connection with a scheme for reconstruction or amalgamation), every warrant holder as evidenced in the Record of Depositors shall be treated as having the right to subscribe for new ordinary shares of the Company in accordance with the terms and conditions of the Deed Poll, at any time within 6 weeks after passing of such resolution for a members' voluntarily winding up of the Company, or within 6 weeks after the granting of the court order in respect of the compromise or arrangement and The warrant holders are not entitled to any voting rights or to participate in any distribution and/or offer of further securities in the Company until and unless such warrant holders exercise their warrants for new ordinary shares of the Company. 19. RESERVES Group Company 2021 RM 2020 RM 2021 RM 2020 RM Non-distributable Share option reserve Revaluation reserve Foreign currency translation reserve 4,111,345 62,892,674 (103,875) 4,111,345 40,148,075 141,665,326 285,674 71,548,662 Distributable Retained profits 117,765,481 121,686,018 72634,718 68,989,324 259,716,481 188,586,162 144,183,380 113,248,744 (a) Share option reserve Share option reserve comprises the share-based payments transaction under the sis plan. The SiS was implemented on 12 January 2016 to grant share options to eligible Directors and employees of the Company. (b) Revaluation reserve The revaluation reserve represents the surplus ansing from the revaluation of the freehold land, leasehold land and buildings, net of deferred tax effect. (c) Foreign currency translation reserve Foreign currency reserve comprises exchange differences arising from the translation of the financial statements of a foreign operation whose functional currency is different from that of the Group's presentation currency, and exchange differences arising from monetary items which form part of the Group's net investment in a foreign operation, where the monetary item is denominated in either the functional currency of the reporting entity or the foreign operation