Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company LDC is contemplating on acquiring new machine replace the old one. Year O is when the new machine will be acquired and the

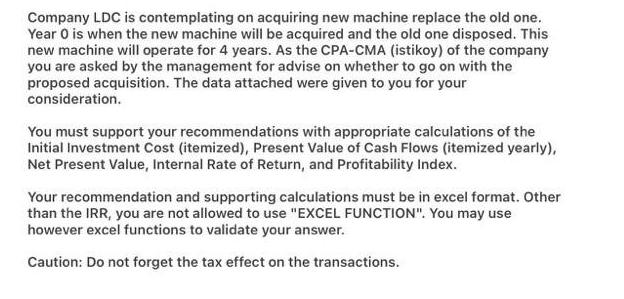

Company LDC is contemplating on acquiring new machine replace the old one. Year O is when the new machine will be acquired and the old one disposed. This new machine will operate for 4 years. As the CPA-CMA (istikoy) of the company you are asked by the management for advise on whether to go on with the proposed acquisition. The data attached were given to you for your consideration. You must support your recommendations with appropriate calculations of the Initial Investment Cost (itemized), Present Value of Cash Flows (itemized yearly), Net Present Value, Internal Rate of Return, and Profitability Index. Your recommendation and supporting calculations must be in excel format. Other than the IRR, you are not allowed to use "EXCEL FUNCTION". You may use however excel functions to validate your answer. Caution: Do not forget the tax effect on the transactions. Old Machine New Machine Acquisition Cost Accumulated Dep'n Disposal Price - Old Machine at year 0 Remaining Life - years Sales Commission to agent for disposal of old machine 320,000.00 480,000.00 192,000.00 80,000.00 100,000.00 4 4 10% Asset Removal Cost 2,000.00 95,000.00 Tax Rate 40% 40% Revenue per annum 400,000.00 1,400,000.00 Cash Opex per annum WC to recover at end of life 320,000.00 1,000,000.00 50,000.00 200,000.00 Sales value net of commission at end of life (pretax) 1,500.00 wC Commitment for new machine One-time employee training - year 1 pretax 200,000.00 50,000.00 WACC 10% Employee relocation cost at end of year 4 (pretax) 150,000.00

Step by Step Solution

★★★★★

3.32 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Initial Cashflows Particulars Amount Acqusition cost of new machine 480000 Disposal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started