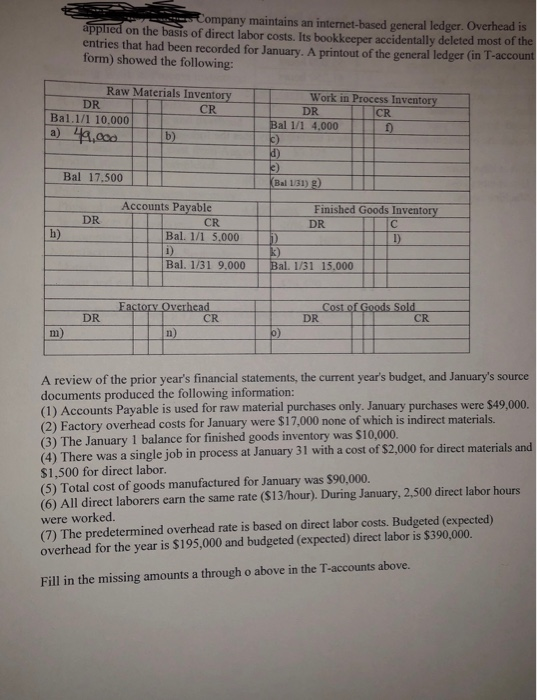

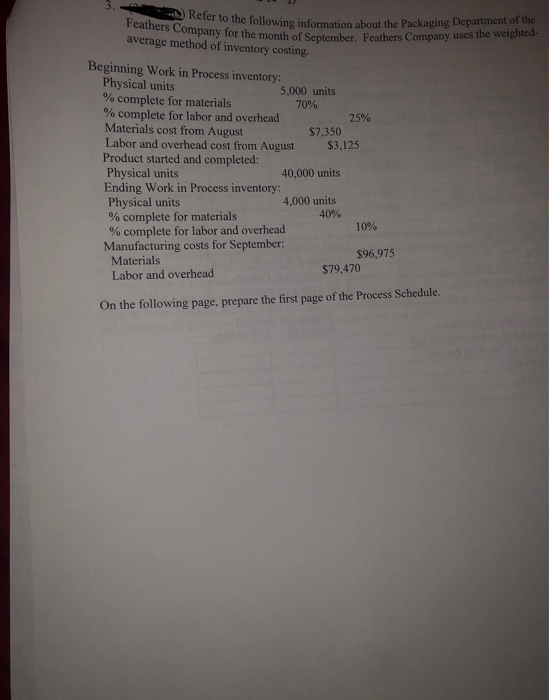

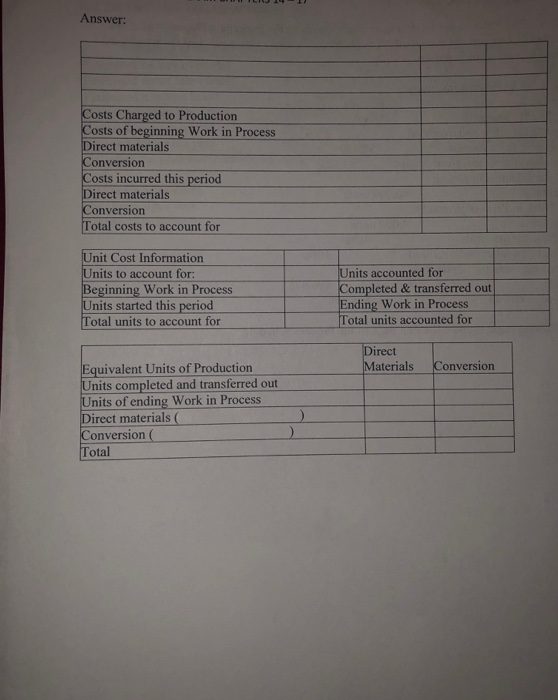

Company maintains an internet-based general ledger. Overhead is applied on the basis of direct labor costs. Its bookkeeper accidentally deleted most of the entries that had been recorded for January. A printout of the general ledger (in T-account form) showed the following: Raw Materials Inventory DR CR Bal.1/1 10.000 b) Work in Process Inventory DR CR Bal 1/1 4.000 a) 49.000 Bal 17.500 Bal 131) g) DR Accounts Payable CR Bal. 1/1 5.000 Finished Goods Inventory DRC h) Bal. 1/31 9.000 Bal. 1/31 15,000 Factory Overhead CR n) Cost of Goods Sold DR CR DR | m) ) A review of the prior year's financial statements, the current year's budget, and January's source documents produced the following information: (1) Accounts Payable is used for raw material purchases only. January purchases were $49,000, (2) Factory overhead costs for January were $17,000 none of which is indirect materials. (3) The January 1 balance for finished goods inventory was $10,000. (4) There was a single job in process at January 31 with a cost of $2,000 for direct materials and $1,500 for direct labor. (5) Total cost of goods manufactured for January was $90,000. (6) All direct laborers earn the same rate ($13/hour). During January, 2.500 direct labor hours were worked. (7) The predetermined overhead rate is based on direct labor costs. Budgeted (expected) overhead for the year is $195,000 and budgeted (expected) direct labor is $390,000. Fill in the missing amounts a through o above in the T-accounts above. Refer to the following into Feathers Company for th following information about the Packaging Department of the es Company for the month of September. Feathers Company uses average method of inventory costing. Beginning Work in Process inventory: Physical units 5,000 units % complete for materials 70% % complete for labor and overhead 25% Materials cost from August $7,350 Labor and overhead cost from August $3,125 Product started and completed: Physical units 40,000 units Ending Work in Process inventory Physical units 4,000 units % complete for materials 40% % complete for labor and overhead Manufacturing costs for September: $96,975 Materials Labor and overhead $79,470 10% On the following page, prepare the first page of the Process Schedule, Answer: Costs Charged to Production Costs of beginning Work in Process Direct materials Conversion Costs incurred this period Direct materials Conversion Total costs to account for Unit Cost Information Units to account for: Beginning Work in Process Units started this period Total units to account for Units accounted for Completed & transferred out Ending Work in Process Total units accounted for Direct Materials Conversion Equivalent Units of Production Units completed and transferred out Units of ending Work in Process Direct materials Conversion Total )