Answered step by step

Verified Expert Solution

Question

1 Approved Answer

COMPANY NAME: General Electric Please show this all in excel or you can submit here with normal text, I can copy and paste it. Thank

COMPANY NAME: General Electric

COMPANY NAME: General Electric

Please show this all in excel or you can submit here with normal text, I can copy and paste it. Thank you so much!

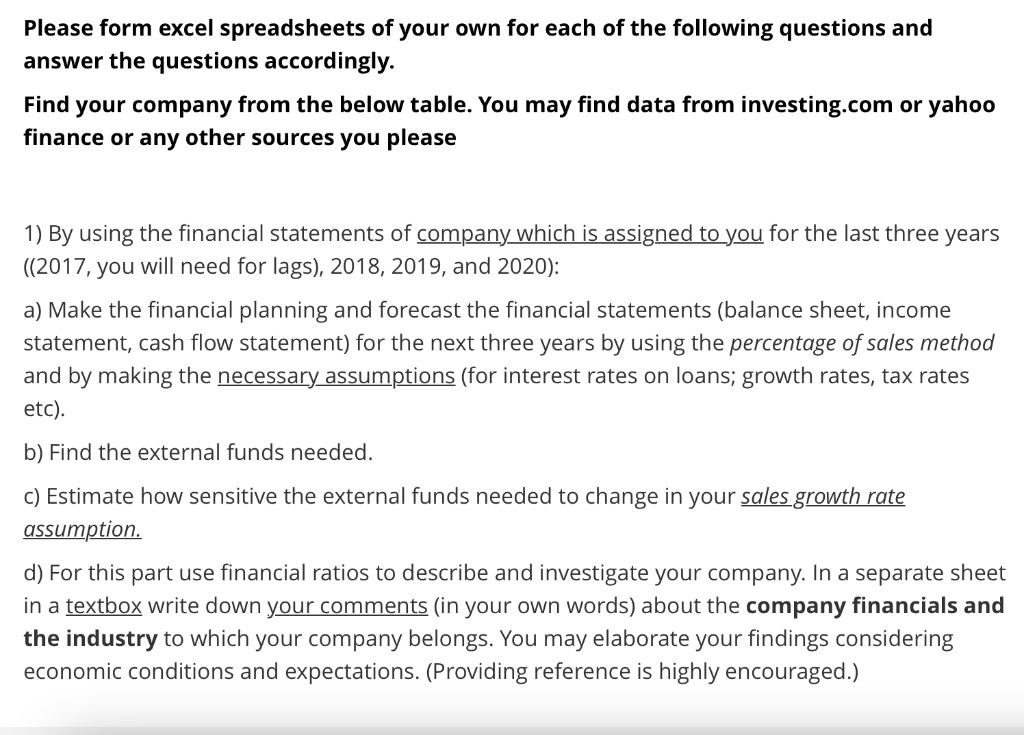

Please form excel spreadsheets of your own for each of the following questions and answer the questions accordingly. Find your company from the below table. You may find data from investing.com or yahoo finance or any other sources you please 1) By using the financial statements of company which is assigned to you for the last three years ((2017, you will need for lags), 2018, 2019, and 2020): a) Make the financial planning and forecast the financial statements (balance sheet, income statement, cash flow statement) for the next three years by using the percentage of sales method and by making the necessary assumptions (for interest rates on loans; growth rates, tax rates etc). b) Find the external funds needed. c) Estimate how sensitive the external funds needed to change in your sales growth rate assumption. d) For this part use financial ratios to describe and investigate your company. In a separate sheet in a textbox write down your comments (in your own words) about the company financials and the industry to which your company belongs. You may elaborate your findings considering economic conditions and expectations. (Providing reference is highly encouraged.) Please form excel spreadsheets of your own for each of the following questions and answer the questions accordingly. Find your company from the below table. You may find data from investing.com or yahoo finance or any other sources you please 1) By using the financial statements of company which is assigned to you for the last three years ((2017, you will need for lags), 2018, 2019, and 2020): a) Make the financial planning and forecast the financial statements (balance sheet, income statement, cash flow statement) for the next three years by using the percentage of sales method and by making the necessary assumptions (for interest rates on loans; growth rates, tax rates etc). b) Find the external funds needed. c) Estimate how sensitive the external funds needed to change in your sales growth rate assumption. d) For this part use financial ratios to describe and investigate your company. In a separate sheet in a textbox write down your comments (in your own words) about the company financials and the industry to which your company belongs. You may elaborate your findings considering economic conditions and expectations. (Providing reference is highly encouraged.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started