Answered step by step

Verified Expert Solution

Question

1 Approved Answer

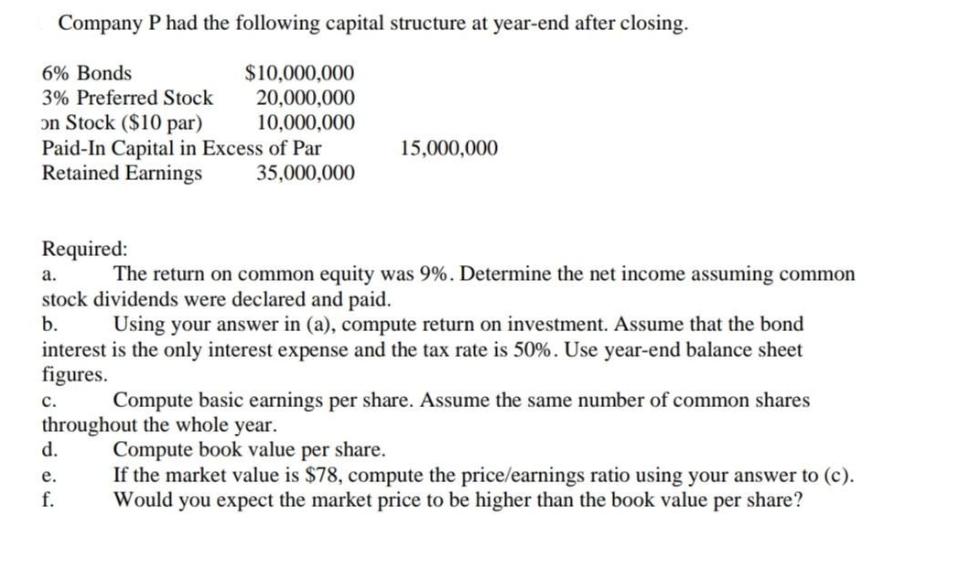

Company P had the following capital structure at year-end after closing. 6% Bonds 3% Preferred Stock on Stock ($10 par) Paid-In Capital in Excess

Company P had the following capital structure at year-end after closing. 6% Bonds 3% Preferred Stock on Stock ($10 par) Paid-In Capital in Excess of Par Retained Earnings $10,000,000 20,000,000 10,000,000 35,000,000 d. e. f. 15,000,000 Required: a. The return on common equity was 9%. Determine the net income assuming common stock dividends were declared and paid. b. Using your answer in (a), compute return on investment. Assume that the bond interest is the only interest expense and the tax rate is 50%. Use year-end balance sheet figures. C. Compute basic earnings per share. Assume the same number of common shares throughout the whole year. Compute book value per share. If the market value is $78, compute the price/earnings ratio using your answer to (c). Would you expect the market price to be higher than the book value per share?

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To answer the given questions lets calculate the required values step by step a The return on common equity is 9 We can use the formula for return on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started