Question

Company P manufactures valves used by a multitude of companies in owned products. Company P outsources all sales staff & pays 20 percent commission on

Company P manufactures valves used by a multitude of companies in owned products. Company P outsources all sales staff & pays 20 percent commission on all sales, denoted as

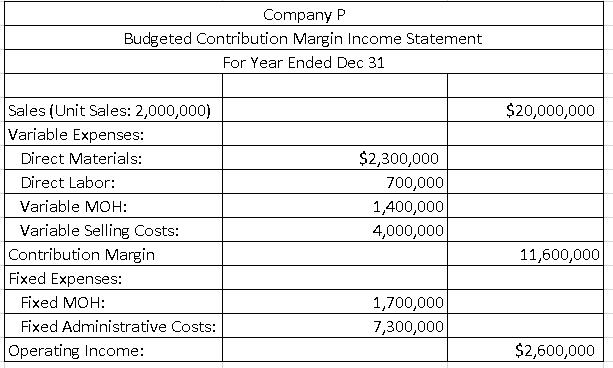

Variable Selling Costs. This is the budgeted income statement for Company P's upcoming year:

Company P is planning a few options for the upcoming year. They want to know how their break-even point, operating income (O.I), and unit sales are affected to maintain the current O.I. Each set of questions moving forward is not reliant on the previous set. Please show full work for max credit.

1) What is Company P's break-even point in unit sales under the budgeted contribution margin income statement displayed above? Round to the nearest whole number.

2)

a) What would be Company P's new operating income (O.I) if they decided to hire their own sales force paying a total combined salary of $1,500,000 to all hired sales staff & an additional commission of 10 percent of sales? Although sales are not expected to change in this hypothetical question, fixed administrative costs will also increase by $200,000 per yr. Company P will no longer outsource the sales staff at 20 percent of the sales.

b) Using the hypothetical question 2a, find the new break-even point in unit sales. Round to the nearest whole number.

c) Using the hypothetical question 2a, find the # of units Company P must sell to maintain an operating income of $2,600,000. Round to the nearest whole number.

3) In this hypothetical question, Company P chooses to stay with the outsourced sales staff despite the commission percentage now being increased to 25% due to a new contract. Also, Company P has decided it is best to increase its selling price by $1 per valve to offset the increased commission cost. How will this affect the operating income O.I of Company P?

4) Make a new Contribution Margin Income Statement keeping the following changes in mind to the original Budgeted Contribution Margin Income Statement displayed above. Use said format & show work.

Company P wants to use better material to increase product quality due to complaints. Doing so will increase the direct material cost by $0.20 per valve.

Due to Company P’s higher quality valves, they believe they can increase unit sales by 300,000 units in the 1st year of change.

Company P wants to communicate with current customers & potential customers about their newly increased product quality which will cause an additional fixed cost of $250,000.

Company P doesn't want to raise the selling price per valve during the year of initial change.

Company P Budgeted Contribution Margin Income Statement For Year Ended Dec 31 Sales (Unit Sales: 2,000,000) Variable Expenses: Direct Materials: Direct Labor: Variable MOH: Variable Selling Costs: Contribution Margin Fixed Expenses: Fixed MOH: Fixed Administrative Costs: Operating Income: $2,300,000 700,000 1,400,000 4,000,000 1,700,000 7,300,000 $20,000,000 11,600,000 $2,600,000

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 Breakeven Point in Units Fixed Cost Contribution Margin Per unit 17000007300000 58 900000058 15517...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started