Answered step by step

Verified Expert Solution

Question

1 Approved Answer

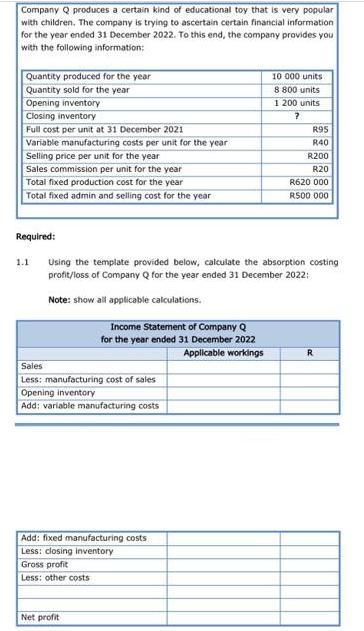

Company Q produces a certain kind of educational toy that is very popular with children. The company is trying to ascertain certain financial information

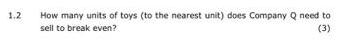

Company Q produces a certain kind of educational toy that is very popular with children. The company is trying to ascertain certain financial information for the year ended 31 December 2022. To this end, the company provides you with the following information: Quantity produced for the year Quantity sold for the year Opening inventory Closing inventory Full cost per unit at 31 December 2021 Variable manufacturing costs per unit for the year Selling price per unit for the year Sales commission per unit for the year Total fixed production cost for the year Total fixed admin and selling cost for the year Required: 1.1 Note: show all applicable calculations. Using the template provided below, calculate the absorption costing profit/loss of Company Q for the year ended 31 December 2022: Income Statement of Company Q for the year ended 31 December 2022 Applicable workings Sales Less: manufacturing cost of sales Opening inventory Add: variable manufacturing costs Add: fixed manufacturing costs Less: closing inventory Gross profit Less: other costs Net profit 10 000 units 8 800 units 1 200 units ? R95 R40 R200 R20 R620 000 R500 000 R 1.2 How many units of toys (to the nearest unit) does Company Q need to sell to break even? (3)

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the absorption costing profitloss for Company Q for the year ended 31 December 2022 you...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started