Question

Company S acquired 80% of Company R on December 31, 2021, for $ 3,000,000 cash. On the date of acquisition, the fair market value of

Company S acquired 80% of Company R on December 31, 2021, for $ 3,000,000 cash.

On the date of acquisition, the fair market value of R’s net identifiable assets was equal to their book values except for inventories (fair value $1,800,000). capital assets (net) (fair value $ 3,200,000) and liabilities (fair value $ 2,400,000).

Required:

Using the fair value enterprise method of consolidation under IFRS:

1. Prepare all consolidation and elimination journal entries on December 31, 2021, and post these journal entries to the consolidation worksheet supplied to you.

2. Prepare a consolidated balance sheet in worksheet format as of December 31, 2021, using the

consolidation worksheet provided to you. Add additional accounts which you believe are necessary.

3.What specific numerical differences would exist in the final consolidated balance sheet if the identifiable net asset method of consolidation was used in the above circumstances?

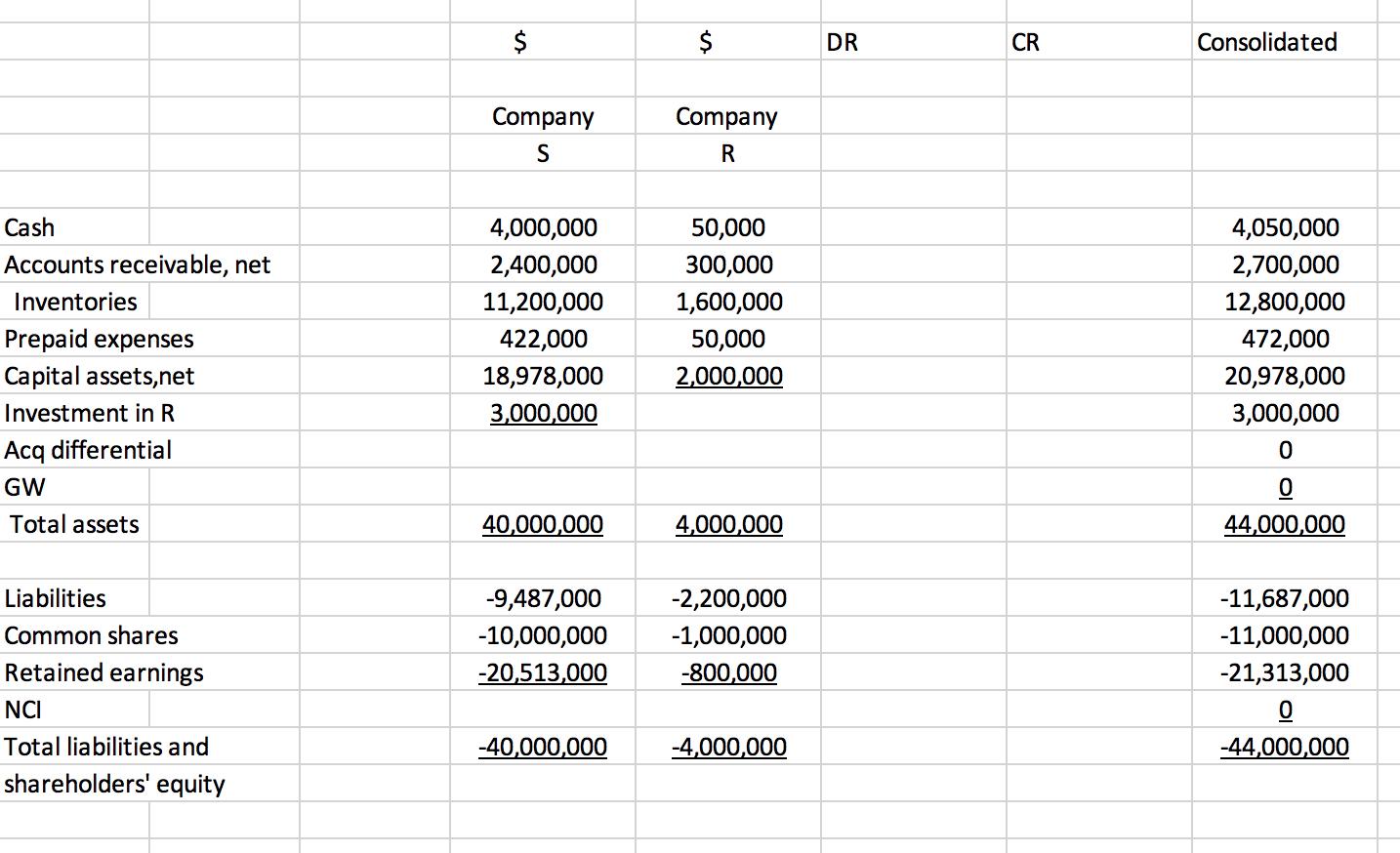

Consolidated Worksheet Provided:

Cash Accounts receivable, net Inventories Prepaid expenses Capital assets, net Investment in R Acq differential GW Total assets Liabilities Common shares Retained earnings NCI Total liabilities and shareholders' equity $ Company S 4,000,000 2,400,000 11,200,000 422,000 18,978,000 3,000,000 40,000,000 -9,487,000 -10,000,000 -20,513,000 -40,000,000 $ Company R 50,000 300,000 1,600,000 50,000 2,000,000 4,000,000 -2,200,000 -1,000,000 -800,000 -4,000,000 DR CR Consolidated 4,050,000 2,700,000 12,800,000 472,000 20,978,000 3,000,000 0 44,000,000 -11,687,000 -11,000,000 -21,313,000 -44,000,000

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Balance Sheet Assets Cash Accounts receivable Inventories ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started