Answered step by step

Verified Expert Solution

Question

1 Approved Answer

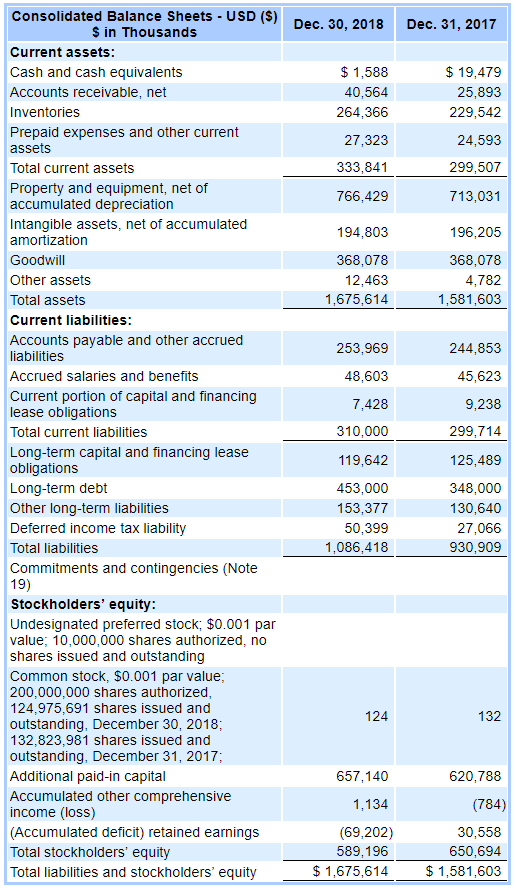

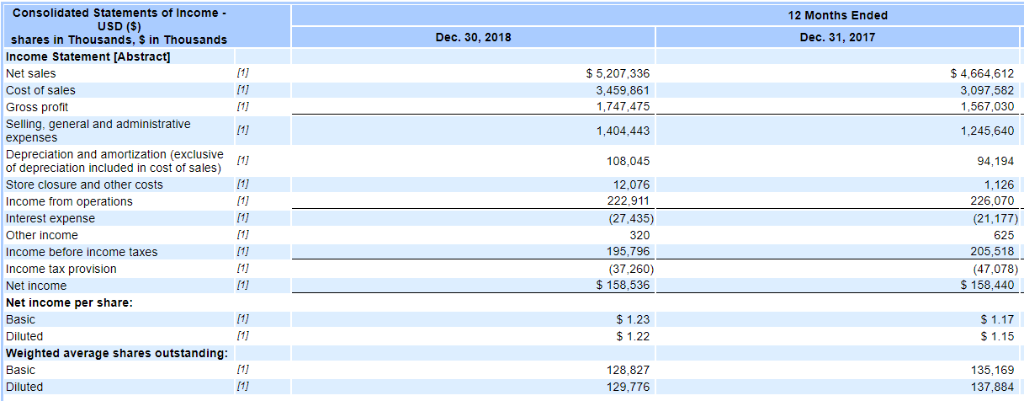

Company: Sprouts Farmers Market a) Compute an Altman-Z score for the company. b) Discuss any risk associated with the Altman-Z score THIS IS THE BALANCE

Company: Sprouts Farmers Market

a) Compute an Altman-Z score for the company.

b) Discuss any risk associated with the Altman-Z score

THIS IS THE BALANCE SHEET

THIS IS THE INCOME STATEMENT

Consolidated Balance Sheets USD (S) S inThousands Dec. 30, 2018 Dec. 31, 2017 Current assets: $1,588 $19,479 Cash and cash equivalents 40,564 Accounts receivable, net 25,893 Inventories 264,366 229,542 Prepaid expenses and other current assets 27,323 24,593 333,841 299,507 Total current assets Property and equipment, net of accumulated depreciation 766,429 713,031 Intangible assets, net of accumulated amortization 194,803 196,205 Goodwill 368,078 368,078 Other assets 12,463 4,782 1,675,614 1,581,603 Total assets Current liabilities: Accounts payable and other accrued liabilities 253,969 244,853 45,623 48,603 Accrued salaries and benefits Current portion of capital and financing lease obligations 7,428 9,238 310,000 299,714 Total current liabilities Long-term capital and financing lease obligations 119,642 125,489 Long-term debt Other long-term liabilities 453,000 348,000 153,377 130,640 27,066 930,909 Deferred income tax liability 50,399 1,086,418 Total liabilities Commitments and contingencies (Note Stockholders' equity: Undesignated preferred stock; $0.001 par value: 10,000,000 shares authorized, no shares issued and outstanding mon stock, $0.001 par value 200.000,000 shares authorized 124.975.691 shares issued and Com 124 132 outstanding, December 30, 2018 132.823.981 shares issued and outstanding, December 31, 2017, Additional paid-in capital 657,140 620,788 Accumulated other comprehensive income (loss) 1,134 (784) (69,202) 589,196 (Accumulated deficit) retained earnings 30,558 650,694 Total stockholders' equity Total liabilities and stockholders' equity $1,675,614 $1,581,603 Consolidated Statements of Income - 12 Months Ended USD (S) shares in Thousands. s in Thousands Dec. 30, 2018 Dec. 31, 2017 Income Statement [Abstract] $5,207.336 $4,664,612 Net sales Cost of sales 3,459,861 3,097,582 r1j 1,747,475 1,567,030 Gross profit Selling, general and administrative 1,404,443 1.245,640 expenses Depreciation and amortization (exclusive of depreciation included in cost of sales) 108,045 94,194 1,126 226,070 Store closure and other costs 12.076 222,911 17 Income from operations (21,177) 625 Interest expense (27,435) r1j Other income 320 195,796 205,518 Income before income taxes Income tax provision (37,260) $158,536 (47,078) $ 158,440 Net income Net income per share $ 1.23 Basic S 1.17 Diluted $1.22 S 1.15 Weighted average shares outstanding r1j BasIc 128,827 135,169 Diluted 129,776 137,884

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started