Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company Valuation BOAC Airline Supply is trading at $15/share but you think that price may not be right. You have the following data and you

Company Valuation

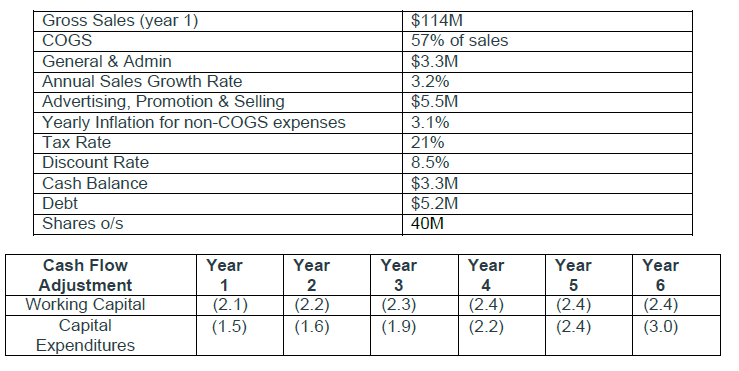

BOAC Airline Supply is trading at $15/share but you think that price may not be right. You have the following data and you want to use it to calculate its share price:

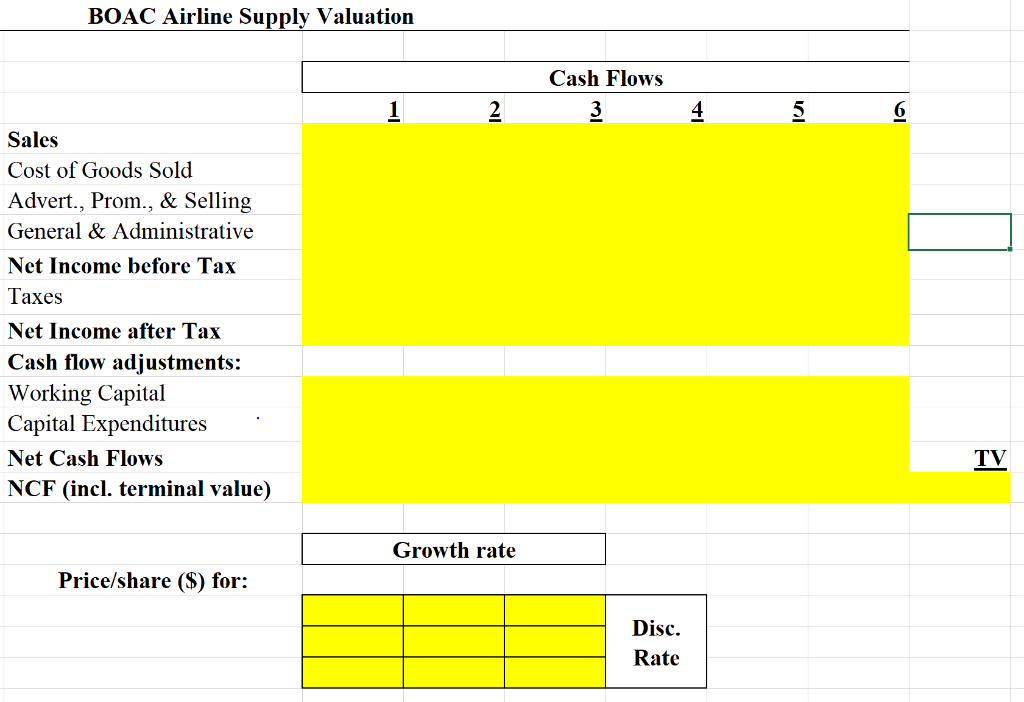

Calculate the per-share price and run sensitivities for growth rates of 3.0%, 3.5%, and 4% as well as discount rates of 8%, 9%, and 10%. Put these in a matrix.

IMPORTANT: SHOW FORMULAS USED TO CALCULATE

Gross Sales (year 1) COGS General & Admin Annual Sales Growth Rate Advertising, Promotion & Selling Yearly Inflation for non-COGS expenses Tax Rate Discount Rate Cash Balance Debt Shares o/s $114M 57% of sales $3.3M 3.2% $5.5M 3.1% 21% 8.5% $3.3M $5.2M 40M Cash Flow Adjustment Working Capital Capital Expenditures Year 1 (2.1) (1.5) Year 2 (2.2) (1.6) Year 3 (2.3) (1.9) Year 4 (2.4) (2.2) Year 5 (2.4) (2.4) Year 6 (2.4) (3.0) BOAC Airline Supply Valuation Cash Flows 3 2 4 6 Sales Cost of Goods Sold Advert., Prom., & Selling General & Administrative Net Income before Tax Taxes Net Income after Tax Cash flow adjustments: Working Capital Capital Expenditures Net Cash Flows NCF (incl. terminal value) TV Growth rate Price/share ($) for: Disc. Rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started