Answered step by step

Verified Expert Solution

Question

1 Approved Answer

company, which is one of several companies owned and managed by the same family. The summarised acquisition and integration of other companies. Glory Ple

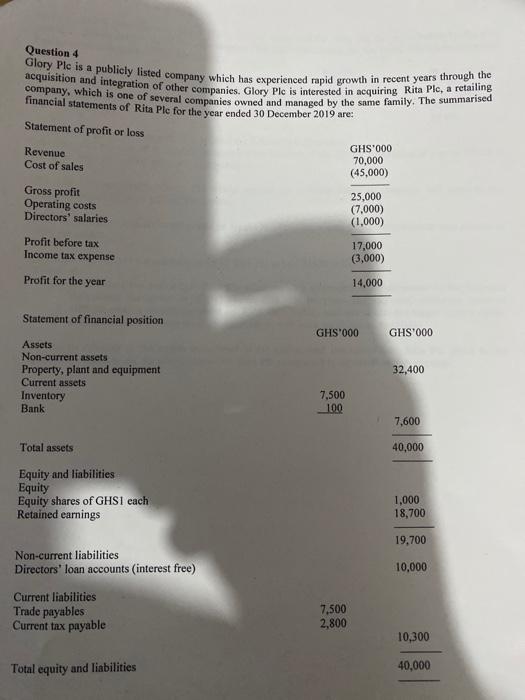

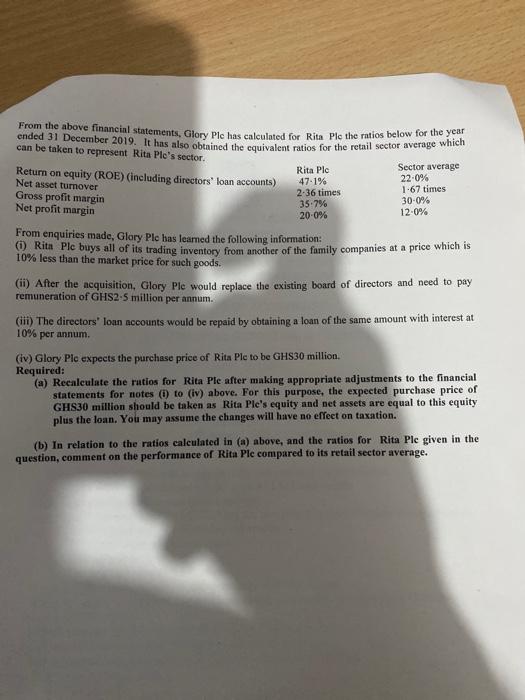

company, which is one of several companies owned and managed by the same family. The summarised acquisition and integration of other companies. Glory Ple is interested in acquiring Rita Plc, a retailing Glory Plc is a publicly listed company which has experienced rapid growth in recent years through the Question 4 financial statements of Rita Ple for the vear ended 30 December 2019 are: Statement of profit or loss Revenue Cost of sales GHS'000 70,000 (45,000) Gross profit Operating costs Directors' salaries 25,000 (7,000) (1,000) Profit before tax Income tax expense 17,000 (3,000) Profit for the year 14,000 Statement of financial position GHS'000 GHS'000 Assets Non-current assets Property, plant and equipment Current assets 32,400 Inventory Bank 7,500 100 7,600 Total assets 40,000 Equity and liabilities Equity Equity shares of GHSI cach Retained earnings 1,000 18,700 19,700 Non-current liabilities Directors' loan accounts (interest free) 10,000 Current liabilities Trade payables Current tax payable 7,500 2,800 10,300 Total equity and liabilities 40,000 From the above financial statements, Glory Ple has calculated for Rita Ple the ratios below for the ch ended 31 December 2019. It has also obrained the cauivalent ratios for the retail sector average wihew can be taken to represent Rita Ple's sector. Return on equity (ROE) (including directors' loan accounts) Net asset turmover Gross profit margin Net profit margin Sector average 22-0% 1-67 times 30-0% 12-0% Rita Ple 47-1% 2-36 times 35:7% 20-0% From enquiries made, Glory Ple has leamed the following information: () Rita Ple buys all of its trading inventory from another of the family companies at a price which is 10% less than the market price for such goods. (ii) After the acquisition, Glory Ple would replace the existing board of directors and need to pay remuneration of GHS2-5 million per annum. (iii) The directors' loan accounts would be repaid by obtaining a loan of the same amount with interest at 10% per annum. (iv) Glory Ple expects the purchase price of Rita Ple to be GHS30 million. Required: (a) Recalculate the rutios for Rita Ple after making appropriate adjustments to the financial statements for notes (i) to (iv) above. For this purpose, the expected purchase price of GHS30 million should be taken as Rita Ple's equity and net assets are equal to this equity plus the loan. You may assume the changes will have no effect on taxation. (b) In relation to the ratios calculated in (a) above, and the ratios for Rita Ple given in the question, comment on the performance of Rita Ple compared to its retail sector average.

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

PART A Effect of Adjustments 1 Rita Plc buys all of its trading inventory from another of the f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started