Answered step by step

Verified Expert Solution

Question

1 Approved Answer

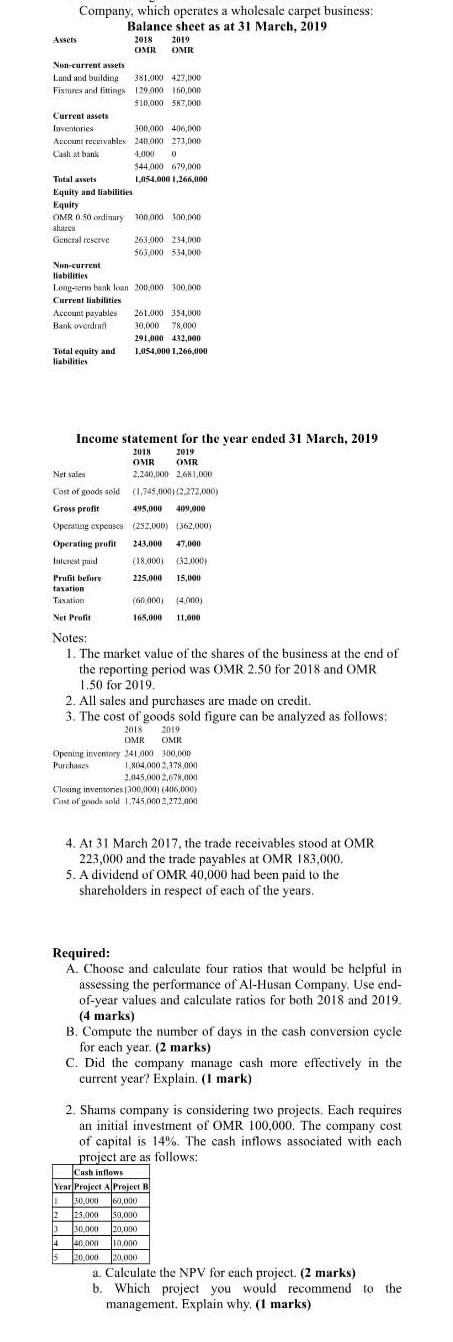

Company, which operates a wholesale carpet business: Balance sheet as at 31 March, 2019 Assets 2018 2019 OMR OMR Non-current assets Land add building 381.41

Company, which operates a wholesale carpet business: Balance sheet as at 31 March, 2019 Assets 2018 2019 OMR OMR Non-current assets Land add building 381.41 427,1 Fixtures and its 119.00 160,000 $10.00XI 587,000 Current assets Inventories 10) (ki 400,000 Arcot receivables 241.XI 271.000 Casli at bank 4.IXI 0 5440X) 629,000 Tutal assets 1.054.000 1.266,100 Equity and liabilities Equity OMR 0.50 ccimary 300,000 100,000 slar General reserve 263.00 234.000 ) 563.XI 334,000 Non-current liabilities Long-term bank loan 200.00 100.000 Current liabilities Account payables 261.002 354,000 Bank overdret 30,000 78,000 291,000 492.000 Total equity and 1.4$4,000 1,266.400 liabilities Income statement for the year ended 31 March, 2019 201N 2019 OMR OMR Nel sales 2.240,000 2.681,00 Cost of goods sold (1,745,2000) 2.272,000) Gross profit 495,000 409.000 Operating expenses (257.000) 362.000 Operating profil 243,000 47,000 Interest muid (18.00) 132.100) Prulit belum 225,000 15,000 taxation Texation 16.000 (4000) Net Pronto 165.000 11,000 Notes: 1. The market value of the shares of the business at the end of the reporting period was OMR 2.50 for 2018 and OMR 1.50 for 2019, 2. All sales and purchases are made on credit. 3. The cost of goods sold figure can be analyzed as follows: 2018 2019 OMR OMR Opening inventory 241,000 300,000 Purchase 1.804,000 2,478,000 2.045,000 2,678.000 Closing inventories 300.000 (406,000) Cast old sold 1.745,000 2,272.000 4. At 31 March 2017, the trade receivables stood at OMR 223,000 and the trade payables at OMR 183,000. 5. A dividend of OMR 40,000 had been paid to the shareholders in respect of each of the years. Required: A. Choose and calculate four ratios that would be helpful in assessing the performance of Al-Husan Company. Use end- of-year values and calculate ratios for both 2018 and 2019, (4 marks) B. Compute the number of days in the cash conversion cycle for each year. (2 marks) C. Did the company manage cash more effectively in the current year? Explain. (1 mark) 2. Shams company is considering two projects. Each requires an initial investment of OMR 100,000. The company cost of capital is 14%. The cash inflows associated with each project are as follows: Cash intlows Yent Project A Project B 30.000 60,000 25. 50,000 3 10.000 20.000 40.000 20.00 20,000 a. Calculate the NPV for each project. (2 marks) b. Which project you would recommend to the management. Explain why. (1 marks) 1 2 14 10,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started