Answered step by step

Verified Expert Solution

Question

1 Approved Answer

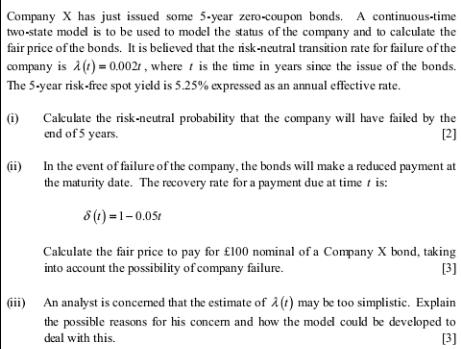

Company X has just issued some 5-year zero-coupon bonds. A continuous-time two-state model is to be used to model the status of the company

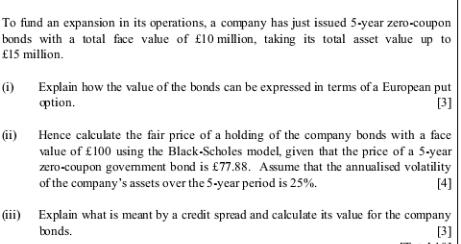

Company X has just issued some 5-year zero-coupon bonds. A continuous-time two-state model is to be used to model the status of the company and to calculate the fair price of the bonds. It is believed that the risk-neutral transition rate for failure of the company is (t) = 0.0021, where is the time in years since the issue of the bonds. The 5-year risk-free spot yield is 5.25% expressed as an annual effective rate. (i) Calculate the risk-neutral probability that the company will have failed by the end of 5 years. [2] (ii) In the event of failure of the company, the bonds will make a reduced payment at the maturity date. The recovery rate for a payment due at time it is: 8(t) = 1-0.05r Calculate the fair price to pay for 100 nominal of a Company X bond, taking into account the possibility of company failure. [3] (iii) An analyst is concerned that the estimate of 2 (t) may be too simplistic. Explain the possible reasons for his concern and how the model could be developed to deal with this. [3] To find an expansion in its operations, a company has just issued 5-year zero-coupon bonds with a total face value of 10 million, taking its total asset value up to 15 million. (i) Explain how the value of the bonds can be expressed in terms of a European put option. [3] (ii) Hence calculate the fair price of a holding of the company bonds with a face value of 100 using the Black-Scholes model, given that the price of a 5-year zero-coupon govemment bond is 77.88. Assume that the annualised volatility of the company's assets over the 5-year period is 25%. [4] [3] (iii) Explain what is meant by a credit spread and calculate its value for the company bonds.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i To find the riskneutral probability of failure by the end of 5 years Let qt probability of surviva...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started