Question

Company X information: CEO: Kyle with a 30% share Vice CEO: Nancy with a 20% share 2 Cousins 10% each ( 1 of them is

Company X information:

CEO: Kyle with a 30% share

Vice CEO: Nancy with a 20% share

2 Cousins 10% each ( 1 of them is accountant manager - the other not involved in this business)

30% share left trade publicly

CEO Transition

Kyle wants to take a long holiday since he has worked in this position for 40 years. So, he decided to transfer his business to his daughter - Nancy to keep running a business. As the highest-ranking executive, Nancy would be earning a sizable $400,000 base salary, in addition to benefits, performance bonuses, and stock options. Still stubbornly certain that Walmart would be nothing but trouble, Kyle left Nancy with a challenge: "If you're able to sign contracts with Walmart and improve Company X's net income by 20 percent over the previous year, I'Il leaves a provision for an additional performance bonus: 5 percent of the remaining 30 percent of my stock, currently worth $ 1,500,000." If she were successful, the bonus would allow Nancy to equalize her ownership with her father’s.

At the end of the year, Nancy scheduled a meeting with her father, Kyle, and the CFO, Euclid, to present and discuss the fiscal year's financial performance. She was proud of how she had led the company and was already imagining herself on a well-deserved vacation in the Bahamas after collecting Kyle's promised bonus.

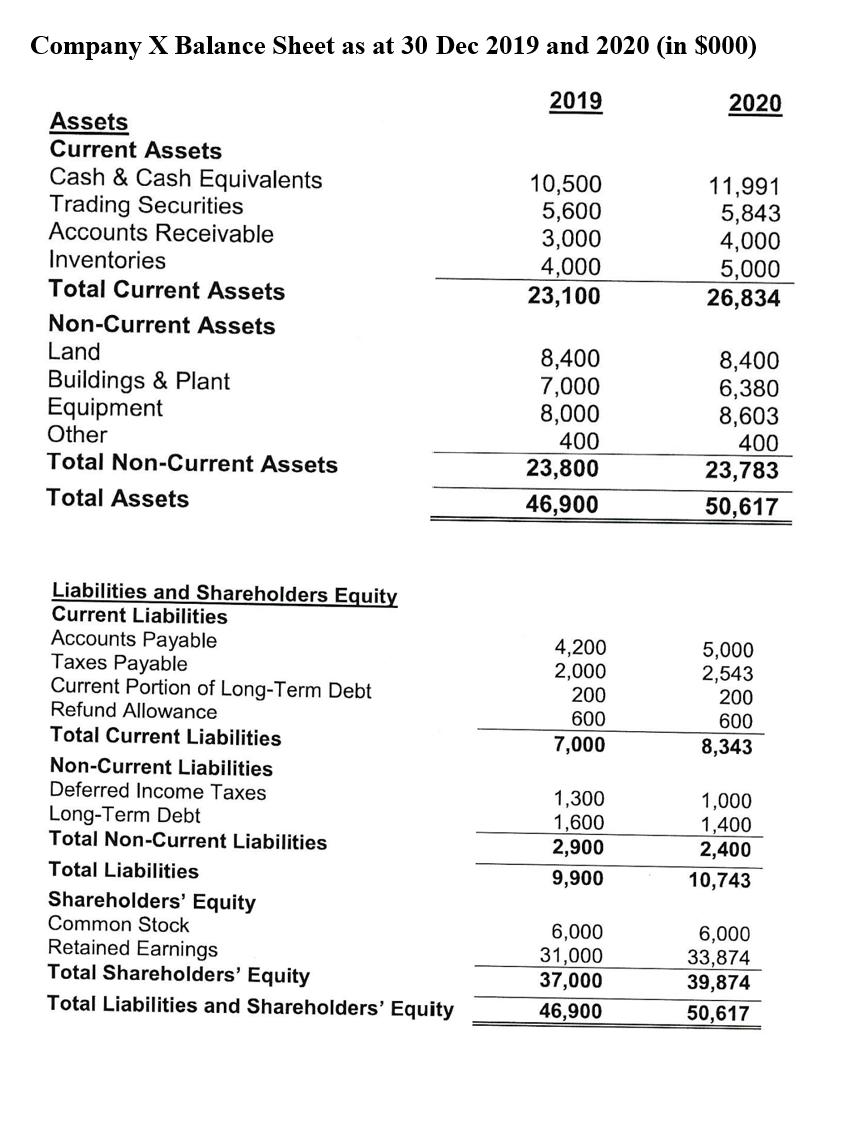

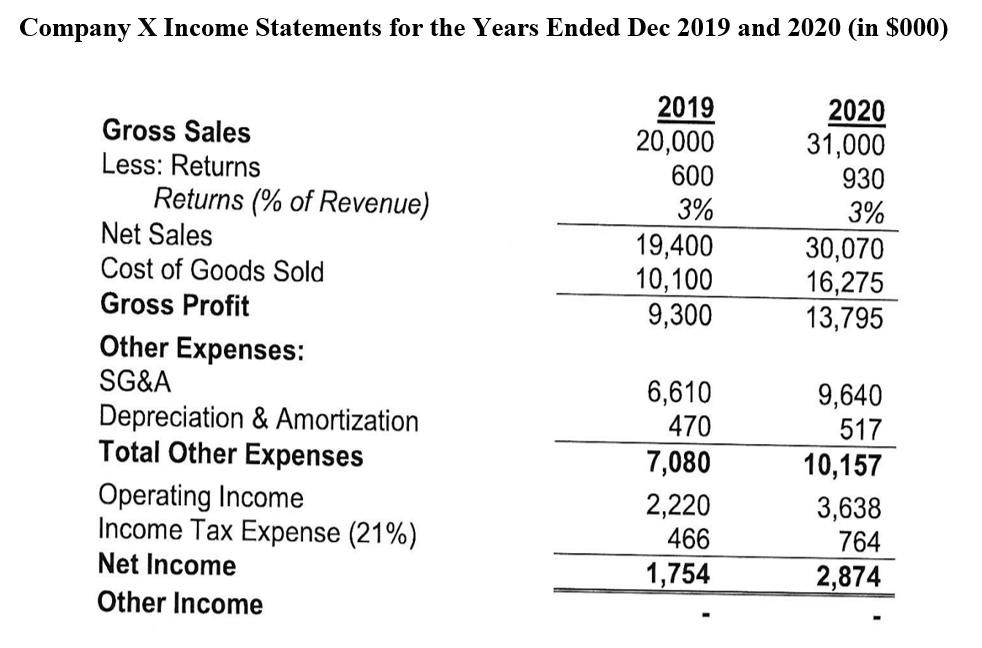

Although Kyle had expected top-line growth from the Walmart contract, he was pleasantly surprised that Nancy had both executed her strategic vision and proven that it made sense financially. Flipping through his copy of the financial statements, he noted to himself that gross sales and net income had grown by 55 percent and 64 percent, respectively, over the previous year. Pausing on the notes to the financial statements, Kyle was hesitant to call attention to certain policies that differed from previous years and could potentially give rise to several issues in his agreement with Nancy. (Company X’s 2019 and 2020 financial statements).

Having worked with all of Company X's key clients prior to the Walmart contract, Kyle wanted to make sure those relationships had been maintained. While reviewing the company's sales logs, he noticed that a longstanding customer, Statesman Bookstore, had generated significantly more sales in the current year than it had the previous year. Upon examination, he saw that an uncharacteristically large order had been placed at the end of the year, made even stranger by the fact that it had occurred after the holiday rush. The order was placed on December 28, shipped out on December 31, and although well within a day S drive-delivered on January 2.

Kyle made an inquiry with the account manager, who shared that he had been surprised that Nancy had stepped in to close this particular sale, especially given the rush of end-of-period reporting. The entire order, worth $1 million, was returned on January 14, with no explanation provided. When the account manager had brought up this transaction with Nancy, concerned about the odd circumstances, she told him: "This is just how business is done. Sometimes our clients mistakenly order inventory, and it`s best not to call them out on it to preserve the relationship. After all, they're a legacy account that has been purchased from us for the better part of fifteen years.

Kyle recalled that Nancy Nancy had informed him of her office consolidation plans, so he turned to the balance sheet to review Company X's long-term assets. Upon inspection, he noticed that the company booked a gain on the sale of $200,000 of a building with a book value of $ 800,000. The gain was included as part of the company's selling, general, and administrative expenses. He was pleased that Nancy had becn managing cost-cutting on her own but wondered whether the gain recorded could be accredited to financial performance as part of the deal they had made, was it fair to include that in the company's adjusted results?

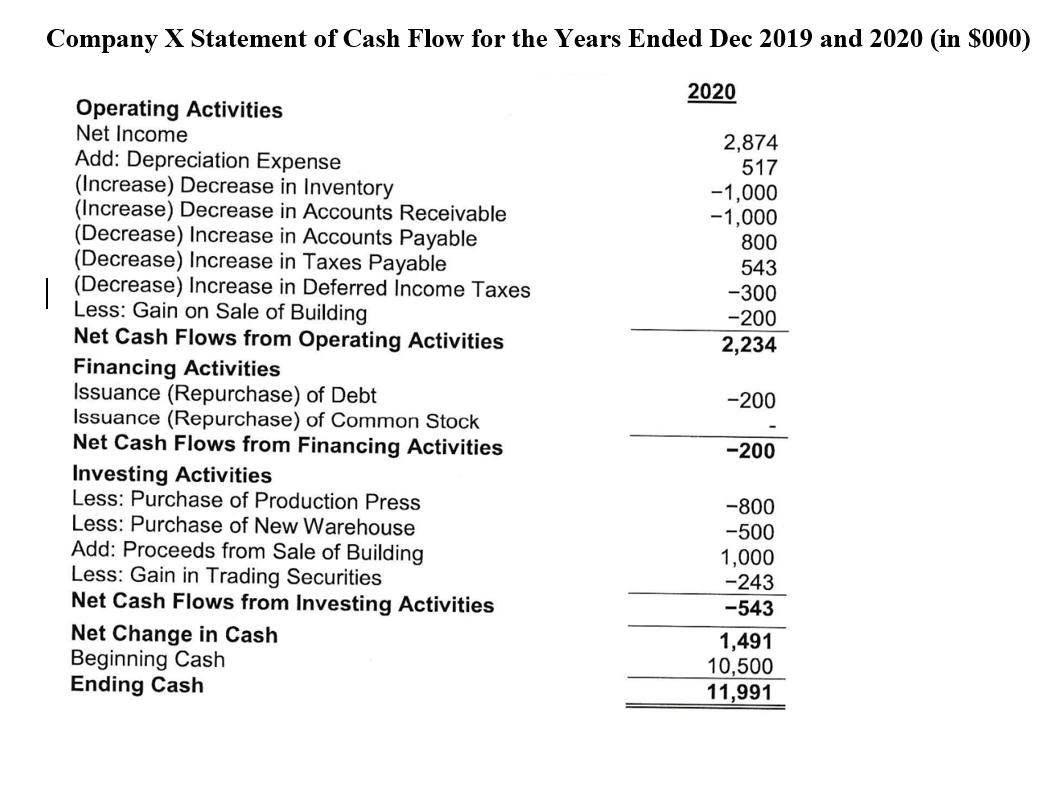

Kyle knew that Company X's manufacturing capacity had been insufficient to meet the high-volume requirements for Walmart, so he turned to the capital expenditures in the cash flows from investing. In the notes, several purchases were disclosed, including a softcover manufacturing press for $ 800,000 and a new storage warehouse for $500,000. The depreciation amounts seemed lower than he would have expected, given Company X's historical conservatism when making useful life and depreciation schedule assumptions. After reading the notes to the financial statements, he realized that Nancy had (seemingly arbitrarily) switched to using straight-line depreciation for the investment in the press and new manufacturing line acquired that year. Given that Company X had made similar investments in the past and depreciated them using the declining balance method at a rate of 10 percent, he wondered why the change in accounting policy for the press company and the new manufacturing line had been deemed necessary, and how it would be viewed by the company’s external editor. There was no change in the depreciation method for the buildings.

Simply put, although Kyle had full confidence in Nancy's ability to manage and lead teams, he had some concerns over her accounting policies and practices, particularly the suspicious sale and return. This was sure to be an awkward discussion, regardless of whether he brought it up first with management or the customer. More broadly, he wished he had been more specific regarding the measurement of performance for the incentive bonus. Based on their terms, he was certain that Nancy would be expecting her payout- and she would be right since she had grown her net income by over 20 percent. Howe ver, cash flows from operations had declined from the previous year, which struck him as odd: had Nancy only selected accounting methods that improved Company X's net income? And would it make sense for the CEO to earn a sizable bonus despite the business generating less cash? He wondered what terms he should place on future performance bonuses to ensure that management incentives were aligned with what was best for his company.

As a public company, Kyle knew that Company X's financial statements would be judged by its external auditors, who had worked with the company for several years. With the audit committee meeting coming up, he was concerned that the company's first year as a public company would be tarnished by a negative audit report. He wondered if Nancy and the CFO should re-evaluate some of their accounting methods before then to be more conservative.

As Statement Reporter, you must consider whether any adjustments to Company X’s financial statements are required:

a. Justify your recommendations to Director at your upcoming meeting, considering both accounting principles/standards and the determination of Nancy’s bonus.

b. Summarize the impact of each adjustment on the financial statements.

Company X Balance Sheet as at 30 Dec 2019 and 2020 (in $000) 2019 Assets Current Assets Cash & Cash Equivalents Trading Securities Accounts Receivable Inventories Total Current Assets Non-Current Assets Land Buildings & Plant Equipment Other Total on-Current Assets Total Assets Liabilities and Shareholders Equity Current Liabilities Accounts Payable Taxes Payable Current Portion of Long-Term Debt Refund Allowance Total Current Liabilities Non-Current Liabilities Deferred Income Taxes Long-Term Debt Total Non-Current Liabilities Total Liabilities Shareholders' Equity Common Stock Retained Earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity 10,500 5,600 3,000 4,000 23,100 8,400 7,000 8,000 400 23,800 46,900 4,200 2,000 200 600 7,000 1,300 1,600 2,900 9,900 6,000 31,000 37,000 46,900 2020 11,991 5,843 4,000 5,000 26,834 8,400 6,380 8,603 400 23,783 50,617 5,000 2,543 200 600 8,343 1,000 1,400 2,400 10,743 6,000 33,874 39,874 50,617

Step by Step Solution

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Here are the detailed calculations for each adjustment 1 Reversing 1M suspicious sale to Statesman ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started