Answered step by step

Verified Expert Solution

Question

1 Approved Answer

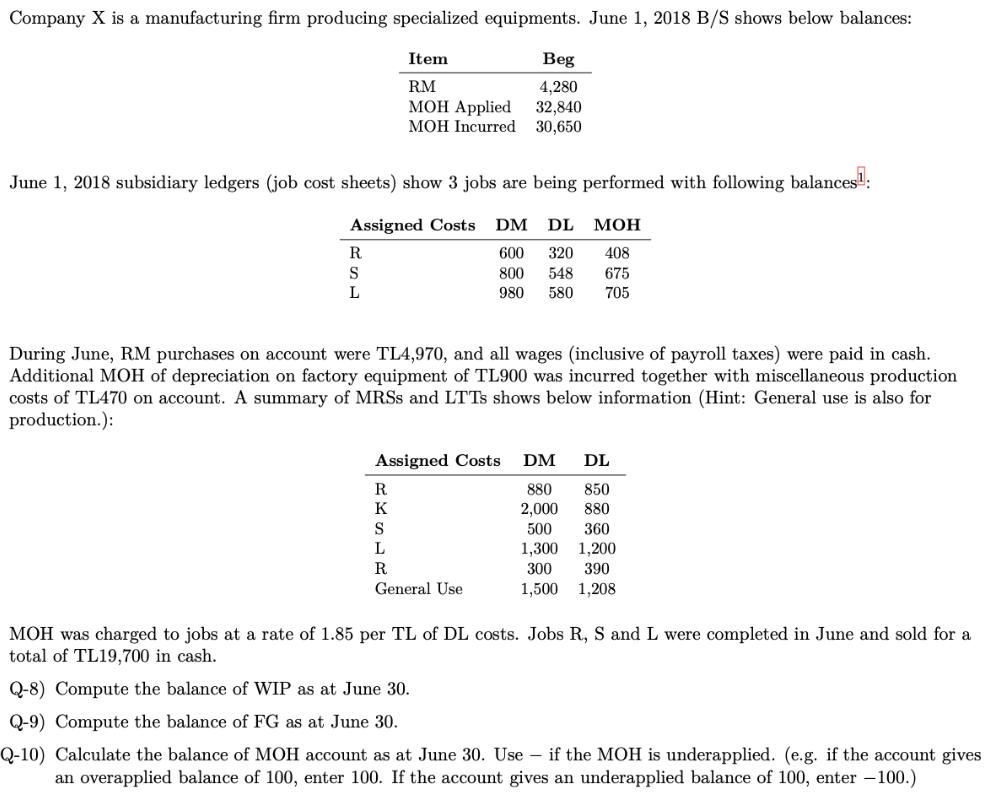

Company X is a manufacturing firm producing specialized equipments. June 1, 2018 B/S shows below balances: Item Beg RM 4,280 32,840 MOH Incurred 30,650

Company X is a manufacturing firm producing specialized equipments. June 1, 2018 B/S shows below balances: Item Beg RM 4,280 32,840 MOH Incurred 30,650 pplied June 1, 2018 subsidiary ledgers (job cost sheets) show 3 jobs are being performed with following balances": Assigned Costs DM DL R 600 320 408 S 800 548 675 980 580 705 During June, RM purchases on account were TL4,970, and all wages (inclusive of payroll taxes) were paid in cash. Additional MOH of depreciation on factory equipment of TL900 was incurred together with miscellaneous production costs of TL470 on account. A summary of MRSS and LTTS shows below information (Hint: General use is also for production.): Assigned Costs DM DL R. 880 850 K 2,000 880 S 500 360 L 1,300 1,200 R 300 390 General Use 1,500 1,208 MOH was charged to jobs at a rate of 1.85 per TL of DL costs. Jobs R, S and L were completed in June and sold for a total of TL19,700 in cash. Q-8) Compute the balance of WIP as at June 30. Q-9) Compute the balance of FG as at June 30. Q-10) Calculate the balance of MOH account as at June 30. Use if the MOH is underapplied. (e.g. if the account gives an overapplied balance of 100, enter 100. If the account gives an underapplied balance of 100, enter -100.)

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

answers Please give positive ratings so I can keep answering It would help me a lot Please comment i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started