Question

Company X operates in a wide space providing financing and advisory solutions to owners of Senior Living, Healthcare, Hospitals, and Market-Rate/Affordable Multifamily projects. In todays

Company X operates in a wide space providing financing and advisory solutions to owners of Senior Living, Healthcare, Hospitals, and Market-Rate/Affordable Multifamily projects. In today’s marketplace much of the financing solutions required to meet clients’ needs include some form of agency-insured mortgage (i.e. FNMA, FHLMC, FHA, etc.). The mortgages allow a borrower to receive a non-recourse loan (the only collateral is the property itself), at historically low rates by “borrowing” the credit score of a government-insured entity.

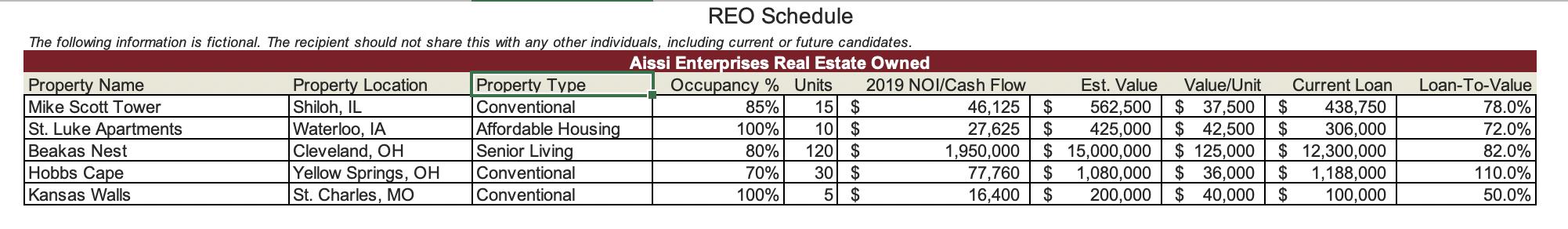

One of Company X's existing clients, Aissi Enterprises, recently heard that FHA is offering attractive interest rates to strong borrowers and has approached an originator at the firm to request an insured loan on a Market-Rate Multifamily Housing property they have owned since late 2017. The property they currently own contains 150 units located in Kansas City, Kansas and has $5,650,000 of existing debt from Bank of Capri. The client feels that the property is under-levered and can afford at least $8,250,000 of debt. The client has a large appetite for multifamily projects and is looking to grow, therefore they would like to refinance the existing debt and take any remaining cash to acquire a new property they are considering purchasing.

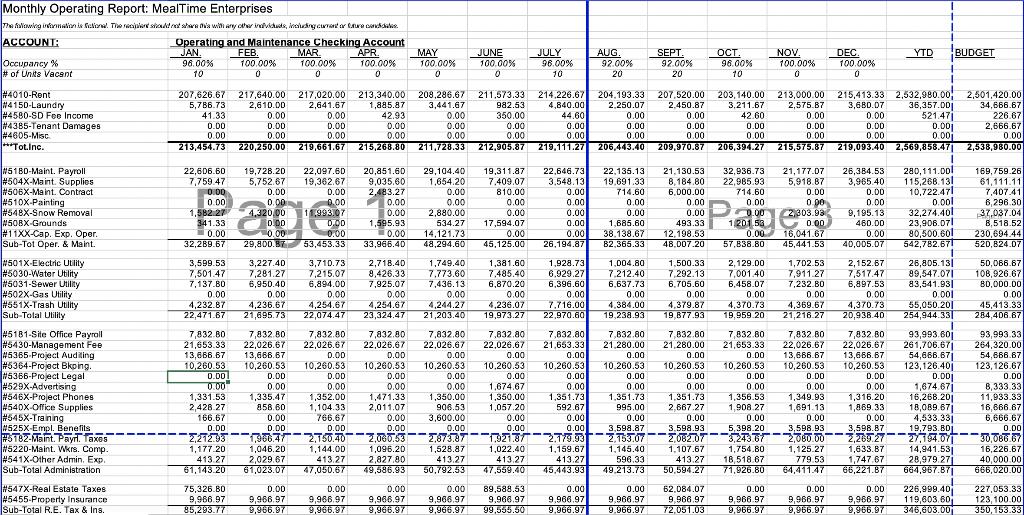

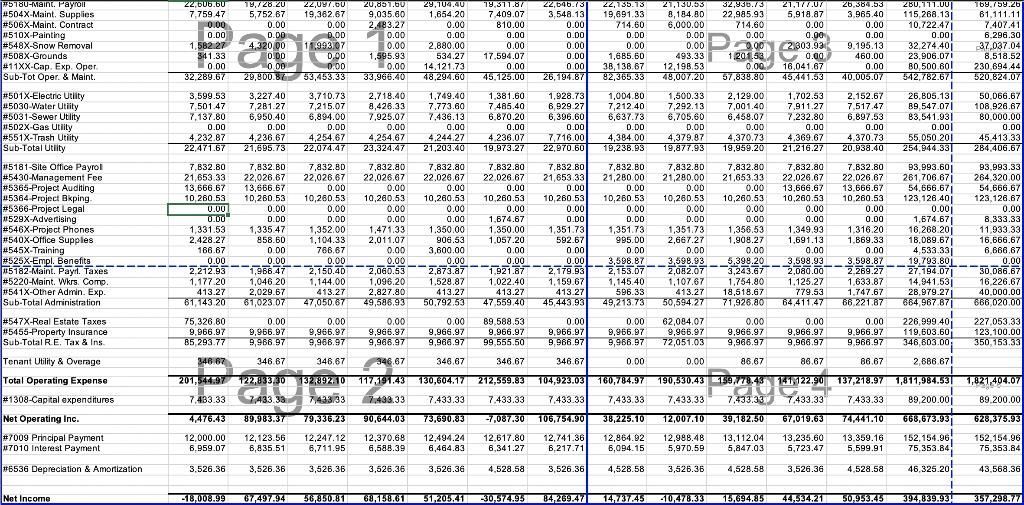

The client has been a long-standing client of Company X and has five other loans outstanding totaling approximately $17,000,000. The originator has received the facility’s income statement and budget in Excel. Your manager has asked you to determine if the property can afford to take on this debt and if it is a prudent credit decision for Company X to make.

Details

- Assumptions

- Assume that the borrowing entity is a single-purpose entity which only owns the subject property and receives 100% of the net cash-flow.

- The interest rates today are 4.13% for a 30-year loan term with 30-year amortization.

- Company X will charge a fee of 1% to make the loan and there will be another 1% of various costs related to closing the loan. These fees can be included in the new loan.

- Assume property did not request or receive any COVID relief funds.

- Credit Limits

- The program limits the loan to a maximum of 80% of the project’s value.

- The program requires that the project can generate cash flow of at least 125% (1.25x) of the projected debt payments.

- Borrower Group

- Aissi Enterprises, the owner of the borrowing entity, currently has $550,000 of liquidity.

- You have the following information on their other loans with Company X.

Please include:

- A PDF summary memo of your assessment and recommendation to proceed with a loan as described below. This memo should consist of no more than 500 words but may include additional tables and charts. In total the memo must not exceed two pages.

- An Excel model of your business case and calculations. Please ensure your excel model references the source excel provided.

Monthly Operating Report: MealTime Enterprises The following information is fictional. The recipiend should not share this with any other individuals, including current or ture candidates. ACCOUNT: Operating and Maintenance Checking Account JAN. 96.00% 10 Occupancy % # of Units Vacant # 4010-Rent #4150-Laundry #4580-SD Fee Income #4385-Tenant Damages #4605-Misc ***Tot.Inc. #5180-Maint. Payroll #504X-Maint. Supplies #506X-Maint. Contract. #510X-Painting #548X-Snow Removal #508X-Grounds #11XX-Cap. Exp. Oper. Sub-Tot Oper. & Maint. #501X-Electric Utility #5030-Water Utility #5031-Sewer Utility #502X-Gas Utility #551X-Trash Utility Sub-Total Utility #5181-Site Office Payroll #5430-Management Fee #5365-Project Auditing. #5364-Project Bkping. #5366-Project Legal #529X-Advertising #546X-Project Phones #540X-Office Supplies #545X-Training #525X-Empl. Benefits #5182-Maint. Payni. Taxes #5220-Maint. Wkrs. Comp. #541X-Other Admin. Exp. Sub-Total Administration #547X-Real Estate Taxes 45455-Property Insurance Sub-Total R.E. Tax & Ins. 207,626.67 5,786.73 217,640.00 2,610.00 0.00 41.33 0.00 0.00 0.00 0.00 213,454.73 220,250.00 22,606.60 7,759.47 0.00 0.00 1,582.27 341.33 0.00 32,289.67 3,599.53 7,501.47 7,137.80 FEB. 100.00% 10.00 0 1,331.53 2,428.27 166.67 0.00 2,212.93 1,177.20 413.27 61,143.20 MAR. 100.00% 0 75,326.80 9,966.97 85,293.77 217,020.00 2,641.67 9,035.60 2,483.27 0.00 0.00 1,595.93 0.00 33,966.40 3,227.40 3,710.73 2,718.40 1,749.40 7,281.27 7,215.07 8,426.33 7,773.60 6,950.40 6,894.00 7,925.07 7,436.13 0.00 0.00 0.00 0.00 0.00 4,232.87 4,236.67 4,254.67 4,254.67 4,244.27 22,471.67 21,695.73 22,074.47 23,324.47 21,203.40 213,340.00 208,286.67 3,441.67 1,885.87 0.00 42.93 0.00 0.00 0.00 0.00 219,661.67 215,268.80 7,832.80 7,832.80 7,832.80 7,832.80 21,653.33 22,026.67 22,026.67 22,026.67 13,666.67 13,666.67 0.00 10,260.53 10,260.53 10,260.53 10,260.53 0.00 0.00 D.OD 0.00 0.00 0.00 0.00 APR. 100.00% 0 0.00 0.00 0.00 0.00 4,320.00 11.993.07 0.00 0.00 0.00 0.00 29,800.87 53,453.33 1,335.47 1,352.00 858.60 0.00 0.00 1,104.33 766.67 0.00 1,966.47 2,150.40 1,046.20 1,144.00 2,029.67 413.27 47,050.67 61,023.07 MAY 100.00% 0 0.00 19,728.20 22,097.60 20,851.60 29,104.40 19,311.87 5.752.67 19.362.67 1,654.20 7,409.07 0.00 810.00 0.00 2,880.00 0.00 0.00 534.27 17,594.07 0.00 14,121.73 0.00 0.00 48,294.60 45,125.00 26,194.87 0.00 0.00 0.00 0.00 0.00 211,728.33 1,471.33 2,011.07 JUNE 100.00% 0 0.00 0.00 2,060.53 1,096.20 2,827.80 49,586.93 50,792.53 JULY 96.00% 10 0.00 1,674.67 1,350.00 1,057.20 0.00 0.00 214,226.67 204.193.33 4,840.00 2,250.07 44.60 0.00 0.00 0.00 0.00 0.00 1.921.87 1,022,40 413.27 47,559.40 0.00 0.00 0.00 0.00 89,588.53 9,966.97 9,966.97 9,966.97 9,966,97 9,966.97 9,966.97 9,966.97 9,966.97 99,555.50 9,966.97 AUG. 92.00% 20 SEPT. 92.00% 20 0.00 9,966.97 9.966.97 211,573.33 982.53 350.00 0.00 0.00 212,905.87 219,111.27 206,443.40 209,970.87 206,394.27 215,575.87 219,093.40 2,569,858.47 22,646.73 22,135.13 21,130.53 32,936.73 3.548.13 19,691.33 8,184.80 22,985.93 0.00 714.60 6,000.00 714.60 0.00 0.00 0.00 1,685.60 493.33 1/201.53 38.138.67 12,198.53 0.00 82,365.33 48.007.20 57,838.80 . 96.00% 10 0.00 0.00 207,520.00 203,140.00 213,000.00 215,413.33 2,532,980.00 2,450.87 36,357.00 0.00 521.471 3,211.67 42.60 2,575.87 0.00 3,680.07 0.00 0.00 0.00 0.00 0.001 0.00 0.00 0.00 0.00 0.00 0.00 P NOV. 100.00% 0 0.00 62,084.07 9.966.97 9,966.97 9.966.97 72,051.03 DEC. 100.00% 0 0.00 0.00 1 YTD BUDGET 93.993.33 1,381.60 1,928.73 1,004.80 1,500.33 2,129.00 1,702.53 2,152.67 26,805.13 7,485.40 6,929.27 7,212.40 7,292.13 7,001.40 7,911.27 7,517.47 89,547.071 6,870.20 6,396.60 6,637.73 6,705.60 6,458.07 7,232.80 6,897.53 83,541.931 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.001 4,236.07 7,716.00 4.384.00 4,379.87 4,370.73 4,369.67 4,370.73 55,050.201 19,973.27 22,970.60 19,238.93 19,877.93 19,959.20 21,216.27 20,938.40 254,944.33 7,832.80 7,832.80 7,832.80 7,832.80 7,832.80 7,832.80 7,832.80 7,832.80 93,993.601 22,026.67 22,026.67 21,653.33 21.280.00 21,280.00 21,653.33 22,026.67 22,026.67 261,706.671 0.00 0.00 0.00 0.00 0.00 0.00 13,666.67 13,666.67 10,260.53 10.260.53 10.260.53 10.260.53 10,260.53 10,260.53 10,260.53 10,260.53 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 1,350.00 1,351.73 1,351.73 1,351.73 1,356.531 1,349.93 1,316.20 906.53 995.00 2,667.27 1,908.27 1,691.13 1,869.33 0.00 0.00 0.00 0.00 0.00 0.00 3,598.87 3.598.93 5,398.201 3,598.93 3,598.87 19,793.801 2.179.93 2,153.07 2,082.07 3,243.67 3,243.67 2,080.00 2,080.00 2,269.27 27,194.071 1,159.67 1,145.40 1,107.67 1,754.80 1,125.27 1,633.87 14,941.531 413.27 596.33 413.27 18,518.67 779.53 1,747.67 28,979.271 45,443.93 49.213.73 50,594.27 71,926.80 64,411.47 66,221.87 664,967.871 264,320.00 54,666.67 54,666.67 123,126.401 123,126.67 0.001 1,674.671 16,268.201 592.67 18,089.671 4,533.331 0.00 3,600.00 0.00 2.873.87 1,528.87 413.27 21,177.07 26,384.53 280,111.00 5,918.87 3,965.40 115.268 131 0.00 0.00 10,722.471 0.00 0.00 0.001 2,303.93 9,195.13 32,274.401 0.00 460.00 23,906.071 16.041.67 0.00 80,500 601 45,441.53 40,005.07 542,782.671 2,501,420.00 34,666.67 226.67 2,666.67 0.00 2,538,980.00 0.00 0.00 226,999.40 9,966.97 9,966.97 119,603.60 9,966.97 9,966.97 9,966.97 346,603.00 0.00 9,966.97 169,759.26 61,111.11 7,407.41 6,296.30 37.037.04 8,518.52 230,694.44 520,824.07 50,066.67 108,926.67 80,000.00 0.00 45,413.33 284,406.67 0.00 8.333.33 11,933.33 16,666.67 6,666.67 0.00 30,086.67 16,226.67 40,000.00 666,020.00 227,053.33 123,100.00 350,153.33

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Principles of methylation analysis using bisulfite genomic sequencing After treatment with sodium bi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started