Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company X trades at a current share price of $1.94 and Billy wants to buy a October 16 call option for $4 with a premium

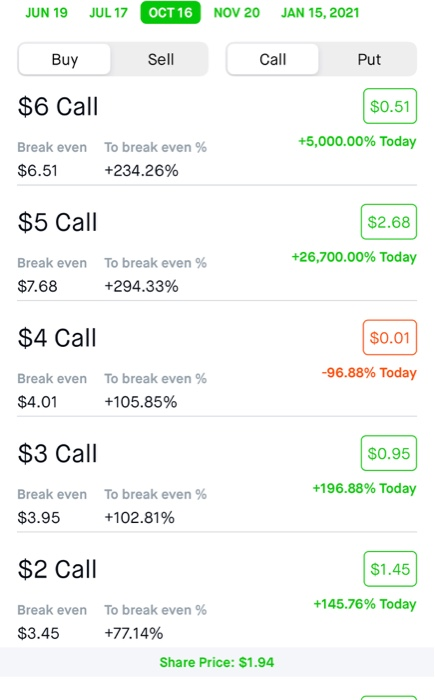

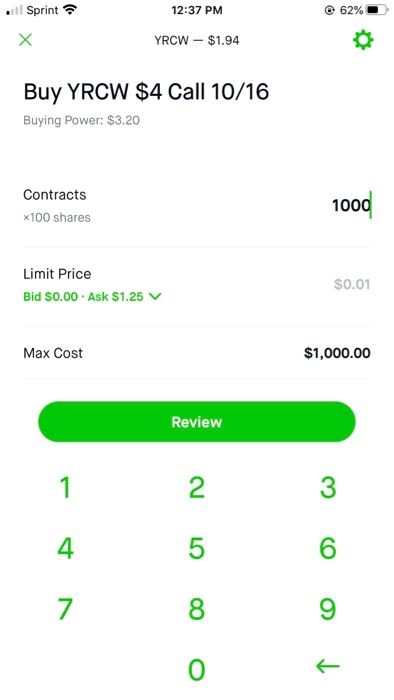

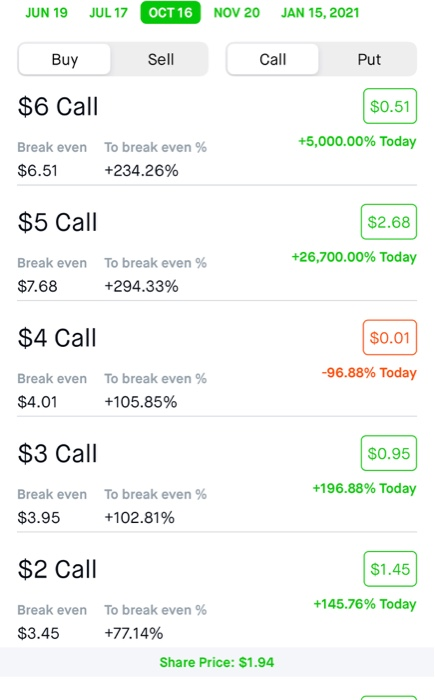

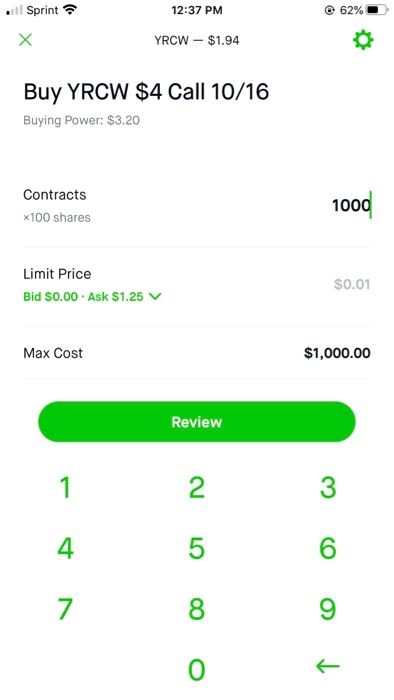

Company X trades at a current share price of $1.94 and Billy wants to buy a October 16 call option for $4 with a premium of $.01 (as shown in picture)

JUN 19 JUL 17 OCT 16 NOV 20 JAN 15, 2021 Buy Sell Call Put $6 Call $0.51 +5,000.00% Today Break even to break even % $6.51 +234.26% $5 Call $2.68 +26,700.00% Today Break even to break even % $7.68 +294.33% $4 Call $0.01 -96.88% Today Break even to break even % $4.01 +105.85% $3 Call $0.95 +196.88% Today Break even to break even % $3.95 +102.81% $2 Call $1.45 +145.76% Today Break even to break even % $3.45 +77.14% Share Price: $1.94 I Sprint 12:37 PM @ 62% YRCW - $1.94 Buy YRCW $4 Call 10/16 Buying Power: $3.20 Contracts *100 shares 1000 Limit Price Bid $0.00. Ask $1.25 V $0.01 Max Cost $1,000.00 Review 1 2 3 4. 5 6 7 8 9 0 QUESTIONS:

1) If Billy buys 1000 contracts x 100 shares for a October 16 call with a premium of $.01 for an inital investment of $1,000 how much money would he make if Company X went to:

a) $3.50

b) $4.15

c) $4.35

show all of your steps of how you obtained your answers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started