Question

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years. Their external borrowing opportunities are

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years. Their external borrowing opportunities are shown here:

| Fixed-Rate | Floating-Rate | |||

| Borrowing Cost | Borrowing Cost | |||

| Company X | 10% | LIBOR | ||

| Company Y | 12% | LIBOR + 1.5% | ||

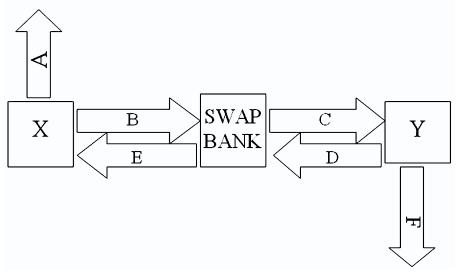

A swap bank is involved and quotes the following rates five-year dollar interest rate swaps at 10.05 percent−10.45 percent against LIBOR flat.

Assume both X and Y agree to the swap bank's terms. Fill in the values for A, B, C, D, E, & F on the diagram.

SWAP BANK C Y E A F

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Company X wants to pay floating rates It borrow money from outside at fixed rate Company Y wants to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Ethics for the Information Age

Authors: Michael J. Quinn

7th edition

134296540, 9780134296623 , 978-0134296548

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App