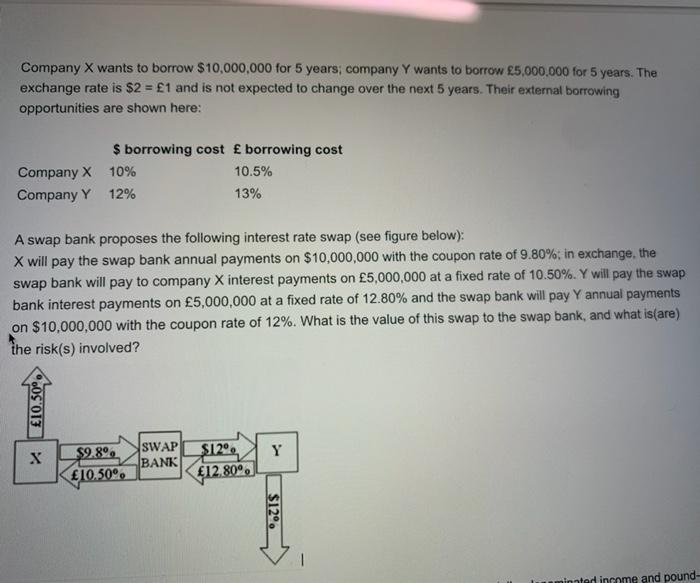

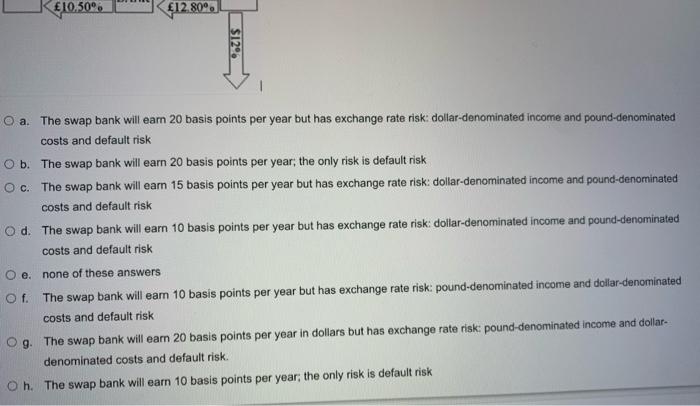

Company X wants to borrow $10,000,000 for 5 years, company Y wants to borrow 5,000,000 for 5 years. The exchange rate is $2 = 1 and is not expected to change over the next 5 years. Their external borrowing opportunities are shown here: $ borrowing cost borrowing cost Company X 10% 10.5% Company Y 12% 13% A swap bank proposes the following interest rate swap (see figure below) X will pay the swap bank annual payments on $10,000,000 with the coupon rate of 9.80%; in exchange, the swap bank will pay to company X interest payments on 5,000,000 at a fixed rate of 10.50%. Y will pay the swap bank interest payments on 5,000,000 at a fixed rate of 12.80% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of 12%. What is the value of this swap to the swap bank, and what is(are) the risk(s) involved? 10.50 S12 Y $9.89 SWAP BANK 10.50. 12.80 $12. minated income and pound- 10,50% 412 80 $12% O a. The swap bank will earn 20 basis points per year but has exchange rate risk: dollar-denominated income and pound-denominated costs and default risk O b. The swap bank will earn 20 basis points per year, the only risk is default risk O c. The swap bank will earn 15 basis points per year but has exchange rate risk: dollar-denominated income and pound-denominated costs and default risk O d. The swap bank will earn 10 basis points per year but has exchange rate risk: dollar-denominated income and pound-denominated costs and default risk Oo. none of these answers Of. The swap bank will eam 10 basis points per year but has exchange rate risk: pound-denominated income and dollar-denominated costs and default risk Og. The swap bank will earn 20 basis points per year in dollars but has exchange rate risk: pound-denominated income and dollar- denominated costs and default risk. Oh. The swap bank will earn 10 basis points per year, the only risk is default risk Company X wants to borrow $10,000,000 for 5 years, company Y wants to borrow 5,000,000 for 5 years. The exchange rate is $2 = 1 and is not expected to change over the next 5 years. Their external borrowing opportunities are shown here: $ borrowing cost borrowing cost Company X 10% 10.5% Company Y 12% 13% A swap bank proposes the following interest rate swap (see figure below) X will pay the swap bank annual payments on $10,000,000 with the coupon rate of 9.80%; in exchange, the swap bank will pay to company X interest payments on 5,000,000 at a fixed rate of 10.50%. Y will pay the swap bank interest payments on 5,000,000 at a fixed rate of 12.80% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of 12%. What is the value of this swap to the swap bank, and what is(are) the risk(s) involved? 10.50 S12 Y $9.89 SWAP BANK 10.50. 12.80 $12. minated income and pound- 10,50% 412 80 $12% O a. The swap bank will earn 20 basis points per year but has exchange rate risk: dollar-denominated income and pound-denominated costs and default risk O b. The swap bank will earn 20 basis points per year, the only risk is default risk O c. The swap bank will earn 15 basis points per year but has exchange rate risk: dollar-denominated income and pound-denominated costs and default risk O d. The swap bank will earn 10 basis points per year but has exchange rate risk: dollar-denominated income and pound-denominated costs and default risk Oo. none of these answers Of. The swap bank will eam 10 basis points per year but has exchange rate risk: pound-denominated income and dollar-denominated costs and default risk Og. The swap bank will earn 20 basis points per year in dollars but has exchange rate risk: pound-denominated income and dollar- denominated costs and default risk. Oh. The swap bank will earn 10 basis points per year, the only risk is default risk