Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a Company XYZ took a loan in 2019, and the amount was AED 2000,000 with 5% interest, and the net income before interest was

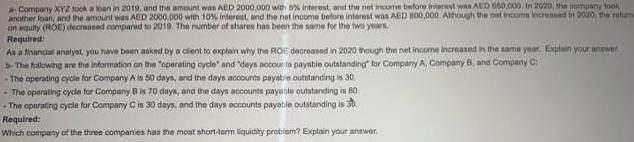

a Company XYZ took a loan in 2019, and the amount was AED 2000,000 with 5% interest, and the net income before interest was AED 650,000, In 2020, the company took another loan, and the amount was AED 2000,000 with 10% interest, and the net income before interest was AED 800,000. Athough the net income increased in 2020, the raten on equity (ROE) decreased compared to 2019. The number of shares has been the same for the two years. Required: As a financial analyst, you have been asked by a client to explain why the ROE decreased in 2020 though the net income increased in the same year. Explain your answer -The following are the information on the "operating cycle" and "days accounts payable outstanding for Company A, Company B, and Company C: -The operating cycle for Company A is 50 days, and the days accounts payable outstanding is 30. - The operating cycle for Company B is 70 days, and the days accounts payable outstanding is 80. The operating cycle for Company C is 30 days, and the days accounts payable outstanding is 30. Required: Which company of the three companies has the most short-term liquidity problem? Explain your answer.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer A As a financial analyst you have been asked by a client to explain why the ROE decreased in 2020 though the net income increased in the same y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started